- United States

- /

- Healthcare Services

- /

- NasdaqGS:WGS

GeneDx Holdings (WGS): Assessing Valuation After Board Addition of Leading AI Expert Dr. Thomas Fuchs

Reviewed by Kshitija Bhandaru

Most Popular Narrative: 4.9% Overvalued

According to the most widely followed narrative, GeneDx Holdings appears moderately overvalued compared to its intrinsic fair value as assessed by analysts using forward-looking earnings and revenue growth estimates.

"Analysts expect earnings to reach $117.1 million (and earnings per share of $4.56) by about September 2028, up from $1.4 million today. In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.3x on those 2028 earnings. This compares to a current PE ratio of 2599.3x. This future PE is greater than the current PE for the US Healthcare industry at 20.9x."

Curious why analysts think these ambitious multi-year forecasts may already be reflected in today’s share price? The narrative’s credibility hinges on rapid gains in profitability and valuation multiples that are rarely seen outside the fastest-growing sectors. If you want to uncover what drives these bold assumptions and whether the story stands up to scrutiny, don’t miss the full narrative and what it could reveal about GeneDx’s next move.

Result: Fair Value of $123.75 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, reimbursement pressures or slower than expected adoption in pediatric and rare disease markets could quickly challenge the growth narrative for GeneDx Holdings.

Find out about the key risks to this GeneDx Holdings narrative.Another View: SWS DCF Model Points to Undervaluation

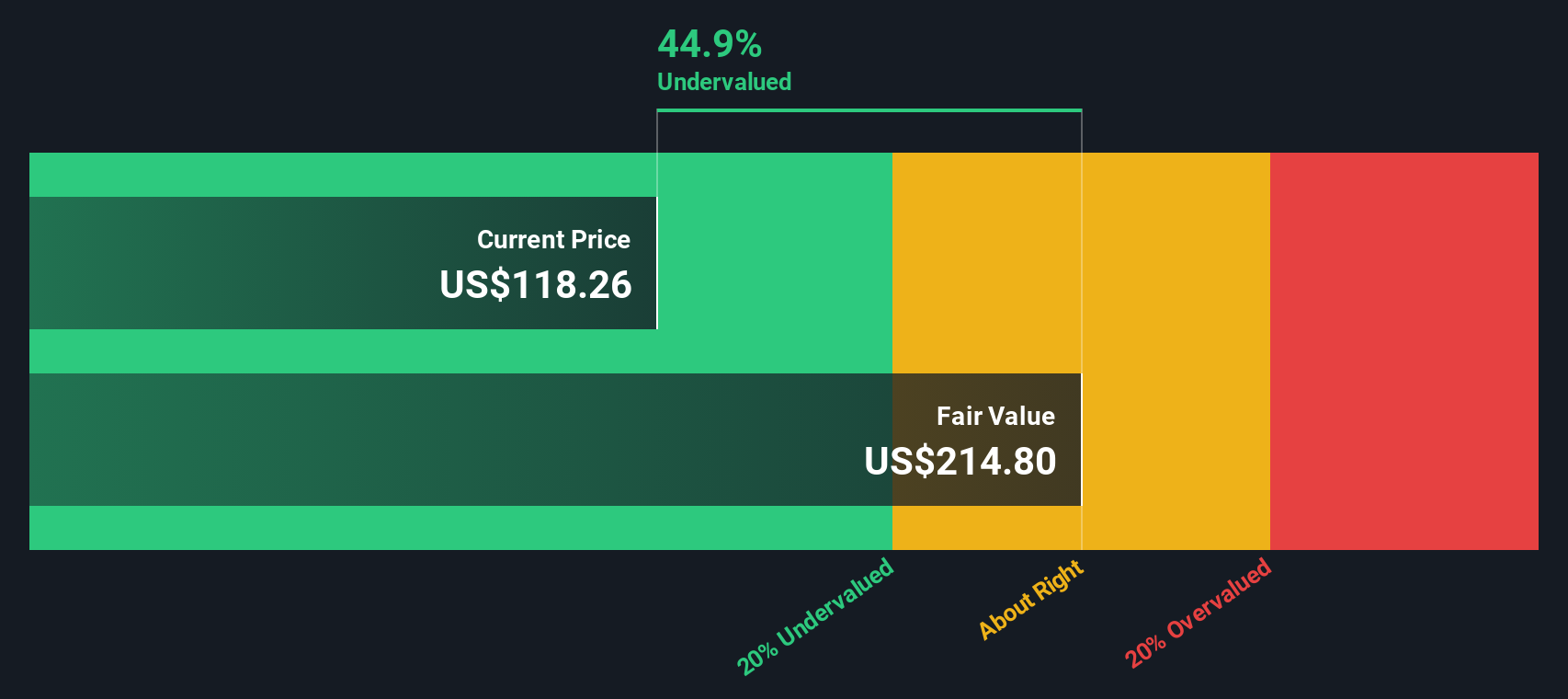

While analyst price targets suggest GeneDx Holdings may be overvalued, our SWS DCF model presents a different perspective. The model indicates the company's shares could actually be trading below their true worth. Could this hidden value be the opportunity investors are overlooking?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GeneDx Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GeneDx Holdings Narrative

If you have your own perspective or want to dig deeper into the numbers, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your GeneDx Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Why let opportunity pass you by? Use the Simply Wall Street Screener to spot companies breaking boundaries, tapping into major trends, and rewarding shareholders in unique ways. Sharpen your watchlist with these handpicked angles:

- Uncover undervalued stocks designed for strong cash flow by tracking companies that stand out through undervalued stocks based on cash flows.

- Expand your investment horizons by exploring artificial intelligence pioneers disrupting industries, featured in AI penny stocks.

- Find opportunities for long-term returns by identifying businesses with yields that stand above the rest through dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WGS

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives