- United States

- /

- Healthcare Services

- /

- NasdaqCM:WGRX

Why Wellgistics Health (WGRX) Is Up 139.6% After AI and Blockchain Prescription Tracking Deal Announcement

Reviewed by Sasha Jovanovic

- On October 22, 2025, DataVault AI, Inc. and Wellgistics Health, Inc. announced a non-binding letter of intent to integrate manufacturer-to-patient blockchain-enabled smart contracts into Wellgistics' prescription drug infrastructure, aiming to fully digitize tracking from script to fulfillment across more than 6,500 pharmacies nationwide.

- A unique aspect of this partnership is its focus on leveraging AI agents and digital routing tools to optimize prescription drug services while enhancing safety compliance and patient outcomes.

- We'll examine how the digitization of prescription drug tracking with AI and blockchain integration reshapes Wellgistics Health's investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Wellgistics Health's Investment Narrative?

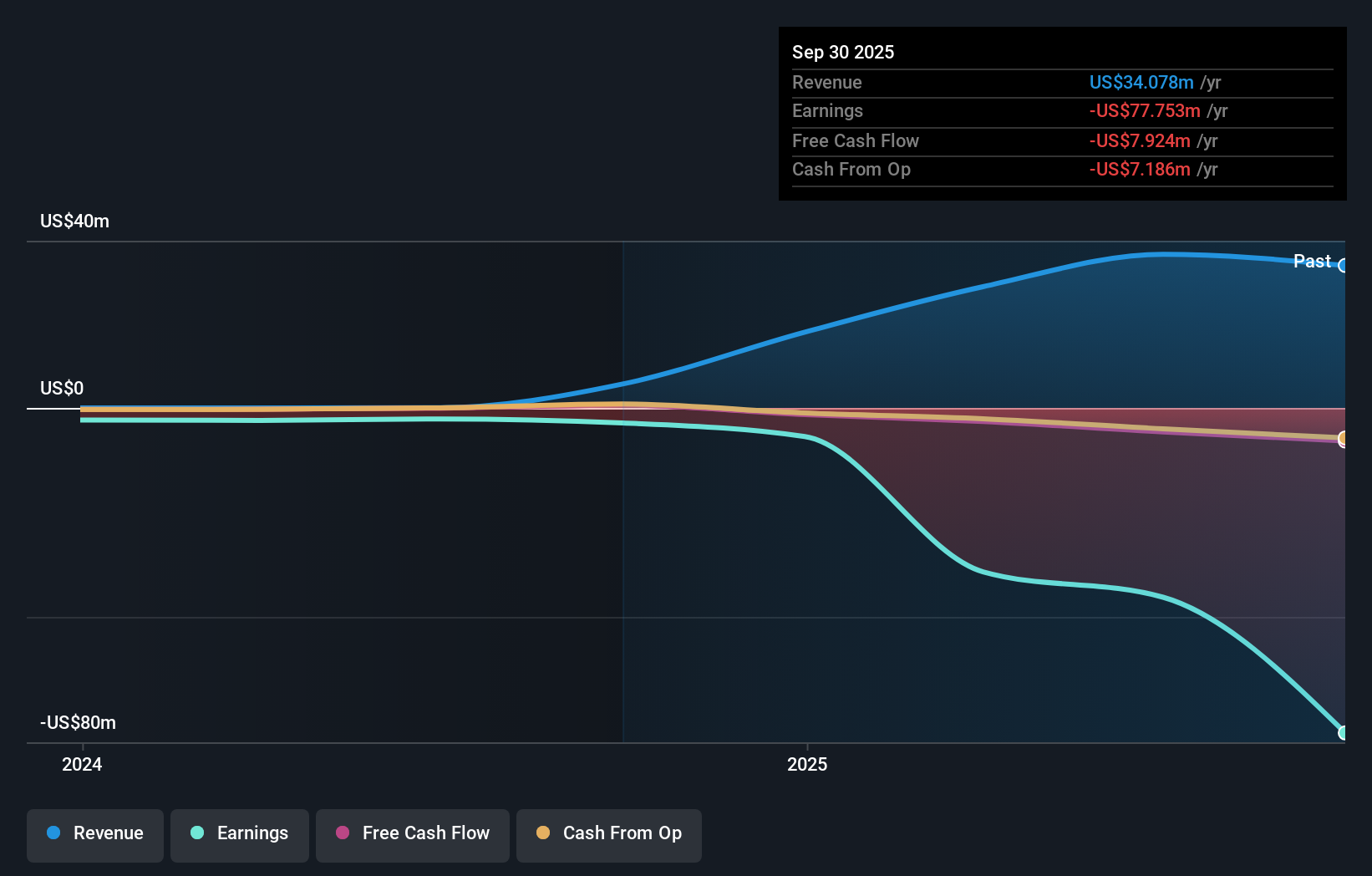

For anyone considering Wellgistics Health as an investment, the real story now is whether all the recent moves, chiefly, the proposed AI and blockchain partnership with DataVault AI, can meaningfully alter the company’s underlying catalysts and risks. Previously, the big focus centered on Wellgistics’ push to digitize pharmacy transactions and support a sprawling 6,500-strong network of independent pharmacies, but tough headwinds like continued net losses, executive turnover, delayed financial filings, and an uncertain board background kept the profile risky. The October 22 AI blockchain news adds a new potential catalyst: if this initiative moves from intent to execution, it could help address operational compliance and tracking challenges, possibly enhancing the value proposition for both Wellgistics and its pharmacy partners in the short term. Still, it remains early, and given recent leadership changes and continued questions about profitability and going concern warnings, this news, while promising, does not yet substantially shift the main risks or short-term outlook.

However, executive churn and past auditor comments on sustainability are crucial topics not to overlook.

Exploring Other Perspectives

Explore another fair value estimate on Wellgistics Health - why the stock might be worth less than half the current price!

Build Your Own Wellgistics Health Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wellgistics Health research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Wellgistics Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wellgistics Health's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wellgistics Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:WGRX

Wellgistics Health

Engages in the wholesale and distribution of pharmaceutical products to pharmaceutical manufacturers and independent retail pharmacies in the United States.

Low risk and overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)