- United States

- /

- Healthtech

- /

- NasdaqGS:WAY

Waystar Holding (WAY): Examining Valuation as Investor Interest Grows on Cloud Healthcare Payment Innovation

Reviewed by Simply Wall St

Waystar Holding (WAY) just closed a private placement transaction on October 10, 2025. This event comes as the company catches investor attention for its cloud-based healthcare payment technology and solid financial growth.

See our latest analysis for Waystar Holding.

Waystar Holding has steadily attracted market attention, with its latest private placement coming amid a year of double-digit business growth and growing optimism around healthcare tech. While the year-to-date share price return stands at 4.37%, it is the impressive one-year total shareholder return of 35.35% that really signals momentum may be building, reflecting both business execution and broader enthusiasm for digital healthcare solutions.

If this wave of innovation piques your interest, check out other healthcare companies making strides in the sector: See the full list for free.

With analysts projecting nearly 35 percent upside and robust financials, is Waystar Holding still flying under the market’s radar, or has enthusiasm for healthcare innovation already been priced in? Could this be a genuine buying opportunity?

Most Popular Narrative: 25.5% Undervalued

With Waystar Holding closing at $37.52 and the narrative fair value placed significantly higher, the latest consensus reveals long-term potential is far from fully priced in.

The acquisition of Iodine Software, a leading provider of AI-powered clinical intelligence, will expand Waystar's total addressable market by over 15%, accelerate its product roadmap, and immediately boost gross margins and adjusted EBITDA margins, setting up compounding, long-term revenue and earnings growth.

Curious what’s fueling this bullish view? A bold assumption lies at the heart of this narrative: future margin expansion and market reach most competitors can only dream of. Want to see how consensus transforms these ambitious forecasts into a strikingly higher valuation? Only the full narrative reveals what’s really driving the price target.

Result: Fair Value of $50.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy post-acquisition leverage or unexpected shifts in patient healthcare utilization could pose challenges to Waystar's growth and put future revenue forecasts at risk.

Find out about the key risks to this Waystar Holding narrative.

Another View: High Market Ratios Raise Questions

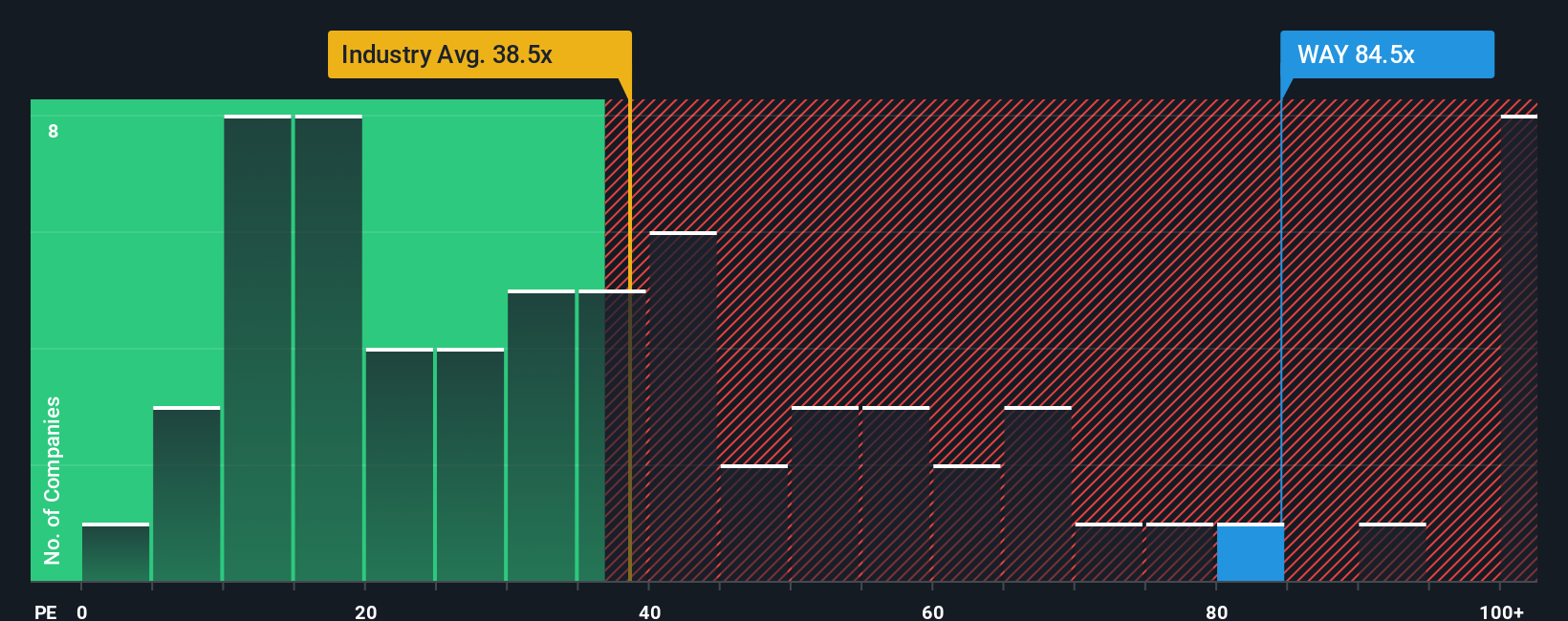

While the narrative suggests Waystar is undervalued, one widely followed metric paints a different picture. Waystar’s price-to-earnings ratio is 83.3x, which is more than double the global healthcare services average of 39.3x, higher than the peer average of 47.7x, and well above its fair ratio of 34.5x. Elevated multiples like these may signal growth optimism, but they also increase valuation risk if expectations slip. Is the market too far ahead of itself, or could rapid earnings growth still catch up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Waystar Holding Narrative

If our analysis inspires a different perspective or you want to investigate the numbers firsthand, crafting your own Waystar Holding narrative is quick and easy. Give it a try in under three minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Waystar Holding.

Looking for More Smart Investment Ideas?

Don’t let opportunity pass by while others seize the best stock picks. Get ahead and tap into themes that could power tomorrow’s top performers:

- Capture growth potential with AI-driven innovators by starting with these 25 AI penny stocks. These companies are reshaping industries and unlocking new possibilities through advanced machine learning.

- Supercharge your search for steady income by targeting these 17 dividend stocks with yields > 3%, which deliver market-beating yields above 3% and have strong fundamentals.

- Jump into the future of blockchain technology and access these 79 cryptocurrency and blockchain stocks, which are at the forefront of secure payments and digital asset transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waystar Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WAY

Waystar Holding

Develops a cloud-based software solution for healthcare payments.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives