- United States

- /

- Healthtech

- /

- NasdaqGS:WAY

Should Waystar’s (WAY) Lower Loan Costs and Expanded Debt for Iodine Deal Prompt Investor Attention?

Reviewed by Simply Wall St

- On August 12, 2025, Waystar Holding Corp. announced it had refinanced and repriced its first lien term loan, reducing the interest rate and receiving strong demand from new and existing lenders, while also adding US$250 million of incremental term loans to help fund its pending acquisition of Iodine Software.

- The transaction was supported by reaffirmed debt ratings and a stable outlook from major credit agencies, highlighting lender confidence in Waystar’s balance sheet and future cash flow generation as it advances its acquisition-driven growth strategy.

- We’ll explore how the improved borrowing terms and expanded debt facility may impact Waystar’s investment narrative and financial outlook.

Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Waystar Holding Investment Narrative Recap

The core idea investors need to believe in with Waystar is that expanding through acquisitions and leveraging advanced AI solutions can drive long-term margin expansion and revenue growth despite inherent healthcare sector risks. The recent refinancing and repricing news directly supports the Iodine Software acquisition, the top near-term catalyst, by reducing interest costs and improving funding certainty, but it doesn't materially reduce the biggest risk of elevated post-deal leverage if synergies or new sales underperform.

Closely connected to this event, Waystar’s July 30 term loan repricing further signaled strong lender backing for the balance sheet and acquisition plan, while also improving the company’s ability to manage costs as it integrates Iodine. Collectively, these actions help address funding and short-term earnings impacts, yet investors should remain aware that the real test will be executing on expected cost and revenue gains as the enlarged business comes together.

But, if anticipated cost synergies or cross-sell opportunities do not materialize after the Iodine acquisition, investors should be aware that ...

Read the full narrative on Waystar Holding (it's free!)

Waystar Holding's outlook anticipates $1.3 billion in revenue and $248.3 million in earnings by 2028. This scenario is based on an annual revenue growth rate of 9.3% and a $162.4 million increase in earnings from current earnings of $85.9 million.

Uncover how Waystar Holding's forecasts yield a $50.38 fair value, a 40% upside to its current price.

Exploring Other Perspectives

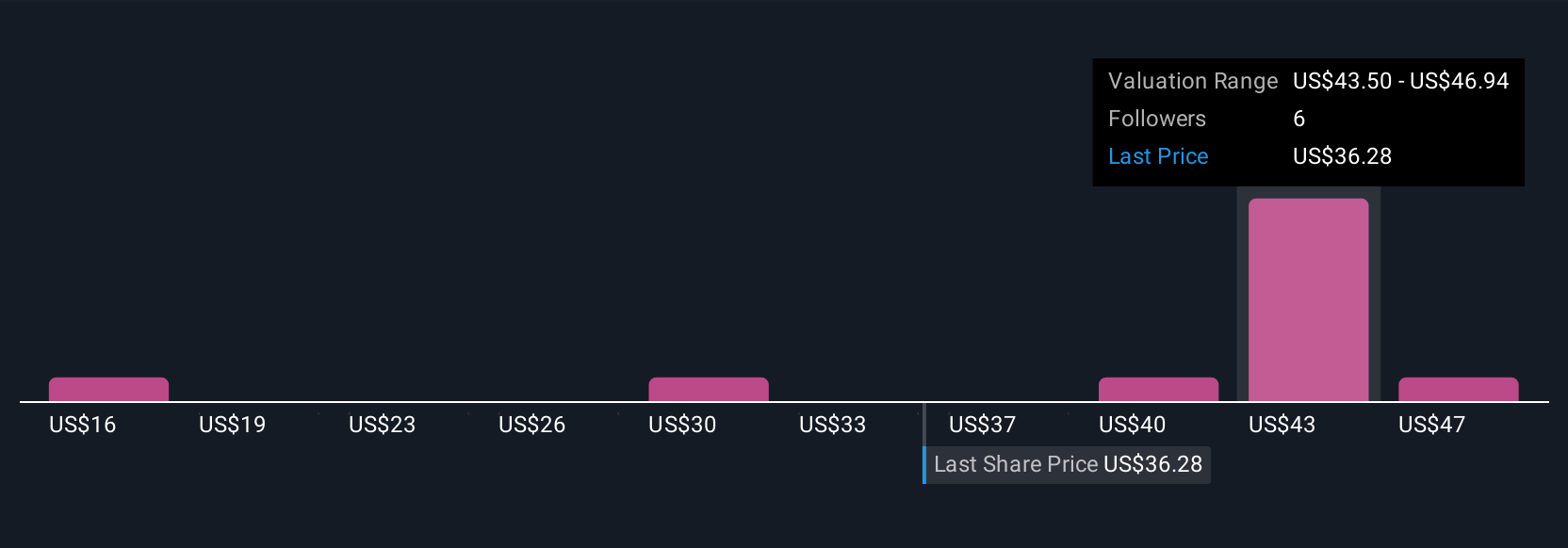

Five members of the Simply Wall St Community estimate Waystar’s fair value in a wide span from US$15.96 to US$50.38. With integration risk heightened by the Iodine acquisition, these varied outlooks show just how differently performance potential can be assessed, explore how your view matches up.

Explore 5 other fair value estimates on Waystar Holding - why the stock might be worth less than half the current price!

Build Your Own Waystar Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Waystar Holding research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Waystar Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Waystar Holding's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Waystar Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WAY

Waystar Holding

Develops a cloud-based software solution for healthcare payments.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives