- United States

- /

- Medical Equipment

- /

- NasdaqCM:UFPT

UFP Technologies (UFPT): Analyst Confidence Renews Focus on Valuation and Growth Outlook

Reviewed by Simply Wall St

UFP Technologies (UFPT) is in the spotlight after analysts reiterated their buy ratings and pointed to the company’s strong revenue growth, innovative approach in medical devices, and emphasis on reinvestment within a challenging healthcare sector.

See our latest analysis for UFP Technologies.

UFP Technologies’ share price has seen some recovery in recent weeks, climbing nearly 4% over the past month after a difficult first half of the year. Even as the healthcare sector navigates inventory headwinds and regulatory hurdles, long-term investors are still up nearly 442% in total shareholder returns over five years. This underscores the company’s growth potential despite short-term setbacks.

If you’re looking for other innovative healthcare names with momentum or turnaround potential, consider exploring the space using our curated screener: See the full list for free.

With the stock trading well below analyst targets and outperforming over time, the real question is whether UFP Technologies is trading at a discount, or if the current price already reflects all of its future potential.

Most Popular Narrative: 39% Undervalued

With UFP Technologies closing at $200.99 and the most popular narrative setting fair value near $329.50, there is a significant valuation gap. The latest analysis puts a spotlight on whether current operations and future projections truly warrant such a bold price target.

The expansion of manufacturing capacity and product development centers in the Dominican Republic, along with new program launches for robotic-assisted surgery customers, sets the stage for sustained revenue growth tied to increased demand for sophisticated medical device components and packaging solutions.

Want to know the high-stakes assumptions powering this valuation? The narrative is banking on a sharp rise in earnings and margins, insider industry demand, and a potential multiplier that could set a new benchmark for medtech stocks. Unlock the full narrative to see which projections are making analysts so bullish on UFP Technologies.

Result: Fair Value of $329.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, UFP Technologies’ heavy reliance on a handful of large customers and operational hiccups at key sites could quickly challenge these bullish forecasts.

Find out about the key risks to this UFP Technologies narrative.

Another View: What Do Market Ratios Reveal?

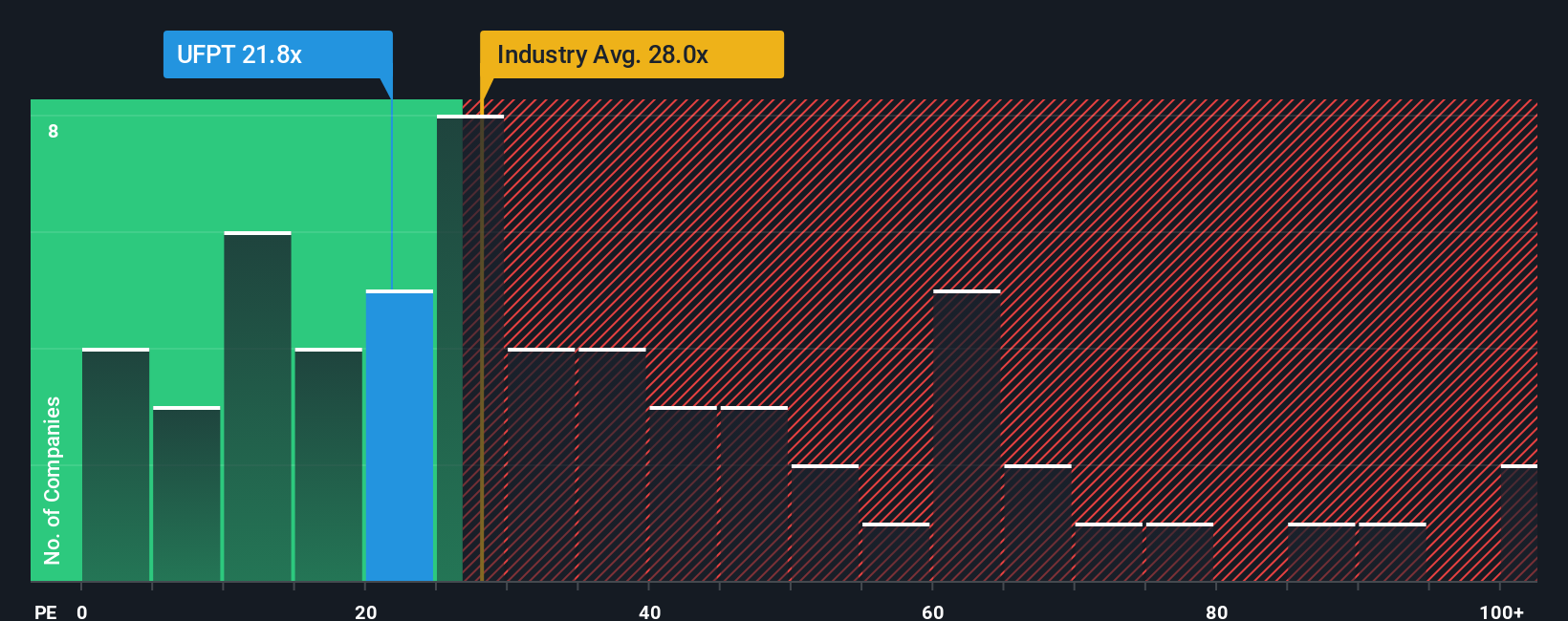

Taking a closer look at valuation ratios, UFP Technologies sports a 23.1x earnings multiple, which is higher than peer averages of 20.1x and above its fair ratio of 22.3x. However, it remains cheaper than the broader US Medical Equipment industry at 30.3x. This suggests the stock may not offer an obvious bargain and could be pricier than its closest competitors. Are investors justified in paying this premium, or does it add valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UFP Technologies Narrative

If you see the story differently or want to dig into the numbers yourself, you can build your own UFP Technologies narrative in just a few minutes with our interactive tools. Do it your way.

A great starting point for your UFP Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the curve and seize new opportunities in the market by checking out stocks handpicked from top-performing themes. Smart investors keep their options open, so don’t miss out on what’s next.

- Uncover untapped potential and value by reviewing these 872 undervalued stocks based on cash flows, revealing companies whose share prices may lag behind intrinsic worth and future prospects.

- Tap into long-term growth and stability with these 17 dividend stocks with yields > 3%, where strong yields and consistent payouts help power your portfolio through various market cycles.

- Ride the wave of cutting-edge industry trends by hunting for breakout leaders among these 27 AI penny stocks, capitalizing on AI advancements reshaping global businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:UFPT

UFP Technologies

Designs and manufactures solutions for medical devices, sterile packaging, and other engineered custom products in the United States.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives