- United States

- /

- Medical Equipment

- /

- NasdaqCM:UFPT

Should You Think About Buying UFP Technologies, Inc. (NASDAQ:UFPT) Now?

UFP Technologies, Inc. (NASDAQ:UFPT), is not the largest company out there, but it led the NASDAQCM gainers with a relatively large price hike in the past couple of weeks. As a small cap stock, hardly covered by any analysts, there is generally more of an opportunity for mispricing as there is less activity to push the stock closer to fair value. Is there still an opportunity here to buy? Let’s examine UFP Technologies’s valuation and outlook in more detail to determine if there’s still a bargain opportunity.

Check out our latest analysis for UFP Technologies

Is UFP Technologies Still Cheap?

Good news, investors! UFP Technologies is still a bargain right now according to my price multiple model, which compares the company's price-to-earnings ratio to the industry average. In this instance, I’ve used the price-to-earnings (PE) ratio given that there is not enough information to reliably forecast the stock’s cash flows. I find that UFP Technologies’s ratio of 27.99x is below its peer average of 37.33x, which indicates the stock is trading at a lower price compared to the Medical Equipment industry. UFP Technologies’s share price also seems relatively stable compared to the rest of the market, as indicated by its low beta. If you believe the share price should eventually reach its industry peers, a low beta could suggest it is unlikely to rapidly do so anytime soon, and once it’s there, it may be hard to fall back down into an attractive buying range.

What does the future of UFP Technologies look like?

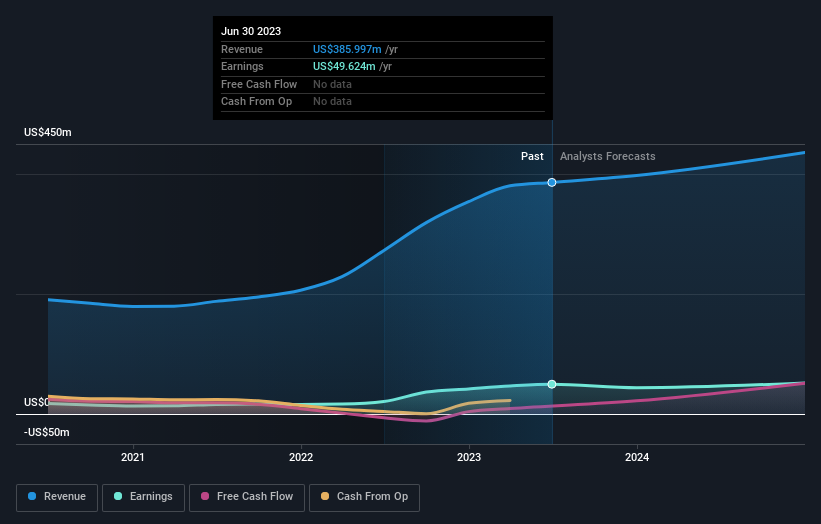

Investors looking for growth in their portfolio may want to consider the prospects of a company before buying its shares. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. Though in the case of UFP Technologies, it is expected to deliver a negative earnings growth of -3.6%, which doesn’t help build up its investment thesis. It appears that risk of future uncertainty is high, at least in the near term.

What This Means For You

Are you a shareholder? Although UFPT is currently trading below the industry PE ratio, the negative profit outlook does bring on some uncertainty, which equates to higher risk. I recommend you think about whether you want to increase your portfolio exposure to UFPT, or whether diversifying into another stock may be a better move for your total risk and return.

Are you a potential investor? If you’ve been keeping tabs on UFPT for some time, but hesitant on making the leap, I recommend you dig deeper into the stock. Given its current price multiple, now is a great time to make a decision. But keep in mind the risks that come with negative growth prospects in the future.

So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. Every company has risks, and we've spotted 1 warning sign for UFP Technologies you should know about.

If you are no longer interested in UFP Technologies, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:UFPT

UFP Technologies

Designs and manufactures solutions for medical devices, sterile packaging, and other engineered custom products in the United States.

Excellent balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.