- United States

- /

- Medical Equipment

- /

- NasdaqGM:TNDM

Lacklustre Performance Is Driving Tandem Diabetes Care, Inc.'s (NASDAQ:TNDM) 27% Price Drop

Tandem Diabetes Care, Inc. (NASDAQ:TNDM) shares have had a horrible month, losing 27% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 68% share price decline.

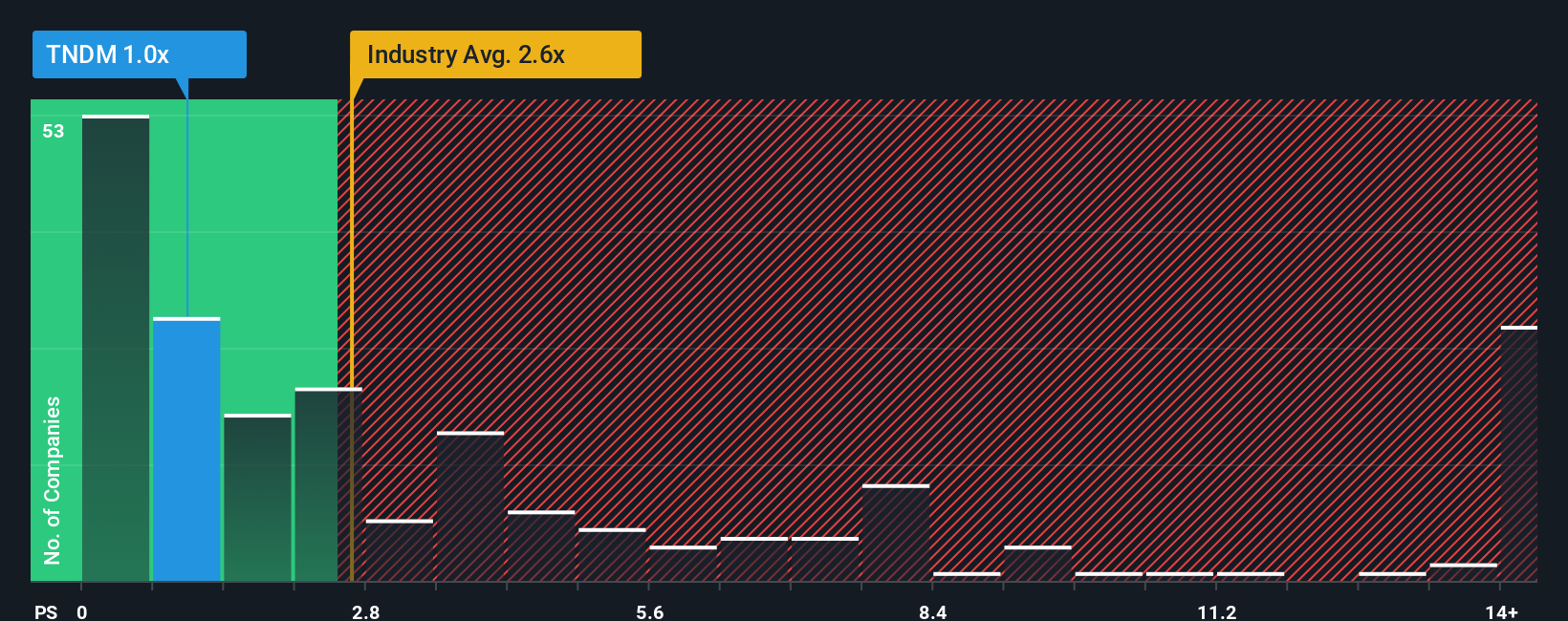

After such a large drop in price, Tandem Diabetes Care's price-to-sales (or "P/S") ratio of 1x might make it look like a buy right now compared to the Medical Equipment industry in the United States, where around half of the companies have P/S ratios above 2.6x and even P/S above 7x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Tandem Diabetes Care

What Does Tandem Diabetes Care's P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Tandem Diabetes Care has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tandem Diabetes Care.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as Tandem Diabetes Care's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company grew revenue by an impressive 28% last year. The latest three year period has also seen an excellent 33% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 7.8% each year as estimated by the analysts watching the company. With the industry predicted to deliver 9.9% growth per annum, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Tandem Diabetes Care's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

The southerly movements of Tandem Diabetes Care's shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Tandem Diabetes Care's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Tandem Diabetes Care with six simple checks on some of these key factors.

If you're unsure about the strength of Tandem Diabetes Care's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Tandem Diabetes Care might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TNDM

Tandem Diabetes Care

Designs, develops, and commercializes technology solutions for people living with diabetes in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives