- United States

- /

- Medical Equipment

- /

- NasdaqGM:TNDM

Even With A 27% Surge, Cautious Investors Are Not Rewarding Tandem Diabetes Care, Inc.'s (NASDAQ:TNDM) Performance Completely

Tandem Diabetes Care, Inc. (NASDAQ:TNDM) shareholders have had their patience rewarded with a 27% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 21% in the last twelve months.

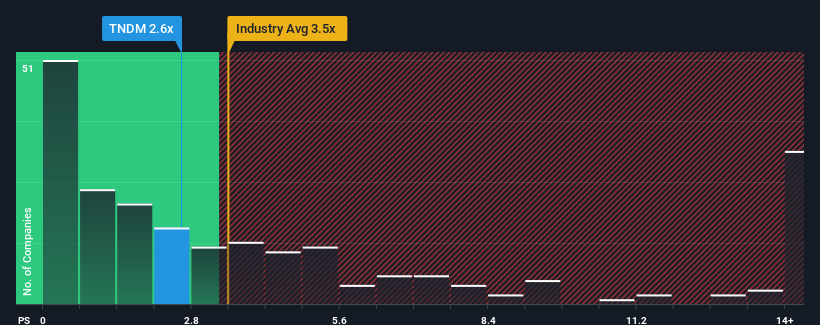

Even after such a large jump in price, Tandem Diabetes Care may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.6x, since almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.5x and even P/S higher than 8x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Tandem Diabetes Care

What Does Tandem Diabetes Care's P/S Mean For Shareholders?

Tandem Diabetes Care hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Tandem Diabetes Care will help you uncover what's on the horizon.How Is Tandem Diabetes Care's Revenue Growth Trending?

In order to justify its P/S ratio, Tandem Diabetes Care would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 6.7%. Even so, admirably revenue has lifted 50% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 11% each year over the next three years. With the industry predicted to deliver 9.5% growth per year, the company is positioned for a comparable revenue result.

With this information, we find it odd that Tandem Diabetes Care is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

Tandem Diabetes Care's stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It looks to us like the P/S figures for Tandem Diabetes Care remain low despite growth that is expected to be in line with other companies in the industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You always need to take note of risks, for example - Tandem Diabetes Care has 2 warning signs we think you should be aware of.

If you're unsure about the strength of Tandem Diabetes Care's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Tandem Diabetes Care might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TNDM

Tandem Diabetes Care

A medical device company, designs, develops, and commercializes technology solutions for people living with diabetes in the United States and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives