- United States

- /

- Medical Equipment

- /

- NasdaqGM:TNDM

Could Tandem Diabetes Care’s (TNDM) Risk Profile Shift After Device Malfunction and New FDA Clearance?

Reviewed by Sasha Jovanovic

- In September 2025, Tandem Diabetes Care announced that its t:slim X2 insulin pump with Control-IQ+ technology received clearance for use with Eli Lilly’s Lyumjev ultra-rapid acting insulin in the United States, following a successful 13-week multicenter study showing high patient satisfaction and quality of life benefits.

- Alongside this advancement, Tandem faced heightened legal and operational risks after disclosing a device malfunction in certain t:slim X2 pumps, prompting legal investigations into potential federal securities law violations.

- We’ll explore how the recent device malfunction disclosure and ensuing legal scrutiny could reshape Tandem’s investment case going forward.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Tandem Diabetes Care Investment Narrative Recap

To be a shareholder in Tandem Diabetes Care, you need to believe in the company’s ability to drive new insulin pump adoption and expand into broader patient segments, even as it faces strong competition and execution risks. The recent device malfunction disclosure and legal investigations may amplify short-term uncertainty, but are unlikely to materially derail the most important near-term catalyst: broader pump eligibility and adoption due to policy changes. The main risk right now remains whether flat or declining renewals can be offset by new patient growth.

One of the most relevant announcements to highlight is the FDA clearance of Tandem’s t:slim X2 pump for use with Eli Lilly’s Lyumjev ultra-rapid insulin, supported by strong patient satisfaction data. This step could reinforce the company’s push to attract more new users and cement its position in automated insulin delivery, directly feeding into the company’s key growth catalysts tied to broader market access and expanded pump compatibility.

Yet, against these positive developments, investors should be aware of the increased legal and operational risk following the recent device malfunction disclosure, as this could...

Read the full narrative on Tandem Diabetes Care (it's free!)

Tandem Diabetes Care is projected to reach $1.2 billion in revenue and $14.4 million in earnings by 2028. This outlook assumes an annual revenue growth rate of 7.5% and an earnings increase of $219.9 million from current earnings of -$205.5 million.

Uncover how Tandem Diabetes Care's forecasts yield a $20.76 fair value, a 35% upside to its current price.

Exploring Other Perspectives

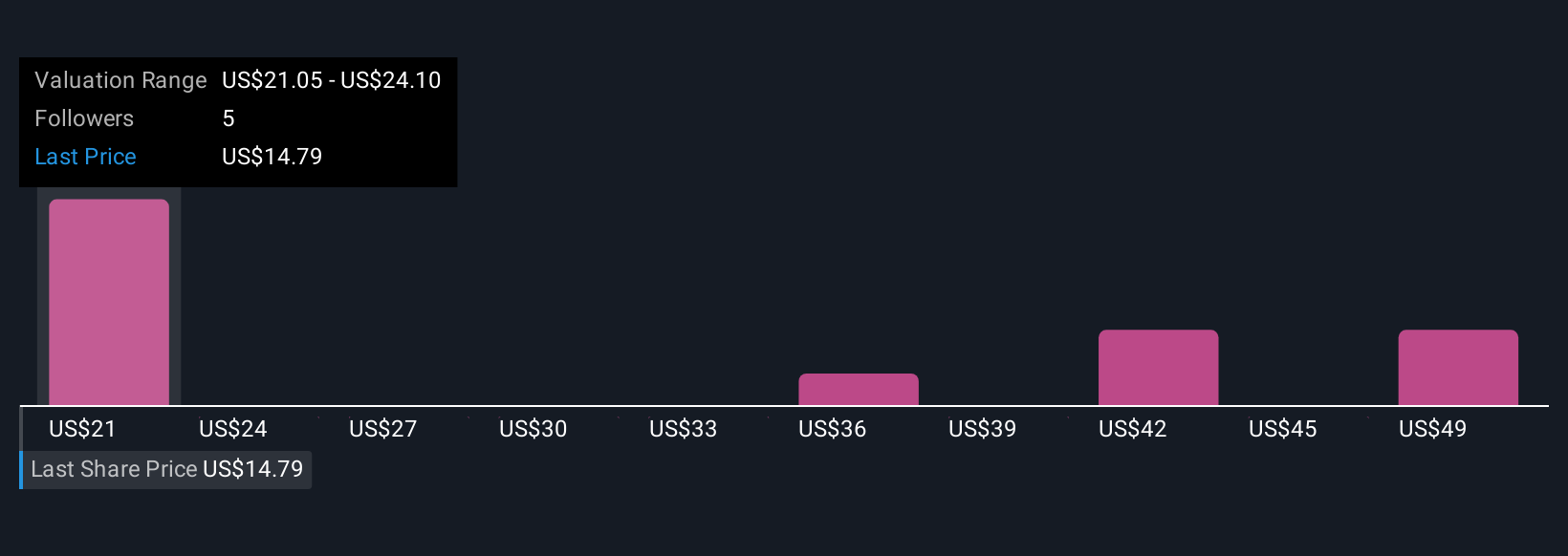

Fair value estimates from the Simply Wall St Community span US$20.76 to US$51.58, sourced from 5 independent viewpoints. Despite this wide range, concerns about new pump starts amid rising competition could weigh on future sales and margin expectations.

Explore 5 other fair value estimates on Tandem Diabetes Care - why the stock might be worth over 3x more than the current price!

Build Your Own Tandem Diabetes Care Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tandem Diabetes Care research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tandem Diabetes Care research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tandem Diabetes Care's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tandem Diabetes Care might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TNDM

Tandem Diabetes Care

Designs, develops, and commercializes technology solutions for people living with diabetes in the United States and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives