- United States

- /

- Medical Equipment

- /

- NasdaqGM:TMDX

TransMedics Group (TMDX): Evaluating Valuation Following Strong Q3 Results and Raised 2025 Outlook

Reviewed by Simply Wall St

TransMedics Group (TMDX) drew investor focus after announcing third quarter results that far outpaced last year, with revenue and net income climbing sharply. The company also increased its full-year 2025 revenue outlook, indicating continued momentum.

See our latest analysis for TransMedics Group.

TransMedics Group’s upbeat earnings and upgraded revenue outlook grabbed headlines this week, but it’s the bigger picture that really stands out. The recent 1-day and 7-day share price dip hasn’t dulled the stock’s explosive year-to-date share price return of 79.2%. Even after short-term swings, the company’s 1-year total shareholder return of 38.6% and substantial 731.6% gain over five years highlight powerful momentum that has kept long-term investors well ahead.

If healthcare breakthroughs are on your radar, the logical next step is to explore other innovators. Check out See the full list for free..

But with analysts projecting a higher price target and shares still trading at a notable discount to intrinsic value, investors are left to wonder if TransMedics is a buy on future growth or if the market has already priced it in.

Most Popular Narrative: 16% Undervalued

With TransMedics closing at $119.17 and the narrative assigning it a fair value of $141.91, the story suggests there is still notable upside beyond the current price. The widely followed narrative is not limited to price targets; it builds a case backed by industry momentum and future potential.

Structural increases in organ transplant demand, driven by the aging population and higher rates of chronic disease globally, are expected to expand the addressable market for TransMedics' OCS platform. This positions the company for sustained revenue growth as transplant volumes rise.

Want the inside track on what could power this valuation? Analysts are considering a step-change in revenue growth, stickier profit margins, and larger-scale ambitions. What numbers did they use to justify such a bold price? Dive in to see what is driving the optimism behind this target.

Result: Fair Value of $141.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory hurdles or setbacks in new clinical trials could cast doubt on TransMedics’ ability to maintain its current growth trajectory.

Find out about the key risks to this TransMedics Group narrative.

Another View: Is the Market Reading Too Much Into Growth?

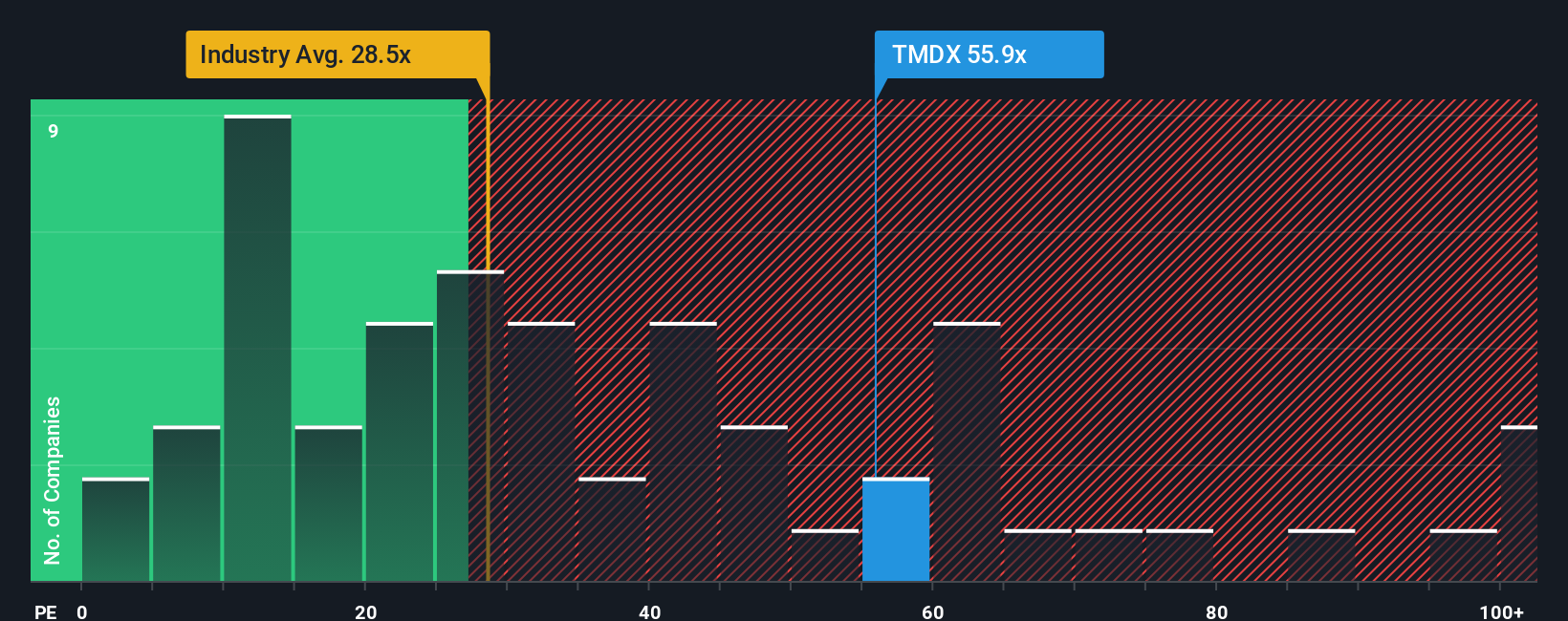

While the current price suggests TransMedics is undervalued based on future growth, a quick look at the price-to-earnings ratio tells a different story. At 44.4x, it is noticeably higher than both the US Medical Equipment industry average of 27.1x and the company’s fair ratio of 27.1x. This could mean investors are already pricing in a lot of optimism, so does this high valuation signal risk rather than opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TransMedics Group Narrative

If you have a different perspective or want to dig into the numbers yourself, you can shape your own TransMedics story in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding TransMedics Group.

Looking for More Smart Investment Ideas?

Don’t settle for just one hot stock when you could tap into a world of innovative opportunities designed to help your money work harder for you. Start now and unlock the next big winner; your future portfolio will thank you.

- Tap into high-growth potential by seizing opportunities among these 25 AI penny stocks that are pushing the boundaries of artificial intelligence and automation.

- Secure steady income streams by pursuing these 16 dividend stocks with yields > 3% offering robust yields and consistent returns for income-focused portfolios.

- Stay ahead of the curve by targeting these 876 undervalued stocks based on cash flows that the market has overlooked, putting you a step ahead of other investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransMedics Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TMDX

TransMedics Group

A commercial-stage medical technology company, engages in transforming organ transplant therapy for end-stage organ failure patients in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives