- United States

- /

- Medical Equipment

- /

- NasdaqGM:TMDX

TransMedics Group (TMDX): Evaluating Valuation After Needham Upgrade Highlights Growing Analyst Confidence

Reviewed by Simply Wall St

TransMedics Group (TMDX) shares have been in focus after Needham shifted its rating on the company from Hold to Buy. This move, along with optimistic analyst sentiment, underscores rising confidence in the company's outlook.

See our latest analysis for TransMedics Group.

TransMedics Group’s share price has surged nearly 96% year-to-date, fueled by growing optimism following the recent Needham upgrade and excitement around the company’s innovations in organ transplant technology. While short-term momentum has clearly picked up, longer-term shareholders have also seen tremendous gains, with a total return of over 168% in three years and almost 990% in five years.

If breakthroughs in medical technology like this interest you, it is a great moment to see what other innovators are making waves in the sector with our curated See the full list for free.

With analysts raising price targets and the stock on a remarkable run, investors are left wondering if TransMedics Group remains undervalued or if these gains suggest the market has already priced in future success.

Most Popular Narrative: 6% Undervalued

With the current share price of $130.52 just below the most widely followed fair value estimate of $138.88, debate continues over how much upside remains. The narrative fueling this fair value hinges on surging demand and international expansion, setting the scene for potential sustained growth.

Ongoing healthcare modernization initiatives and increased recognition of organ transplantation as a cost-effective treatment are prompting both U.S. and international health systems to invest in advanced transplant infrastructure, which supports broader clinical adoption of the OCS system and should drive both domestic and international revenue acceleration.

Want to know the real engine pushing this target price? The answer lies in bold assumptions about future revenues, profit margins, and market footprint. Get the numbers and the logic powering the narrative. One key forecast could change how you see this company’s potential.

Result: Fair Value of $138.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory hurdles or a slowdown in international adoption could challenge this bullish narrative and affect TransMedics Group’s expected growth momentum.

Find out about the key risks to this TransMedics Group narrative.

Another View: Multiples Suggest a Price Premium

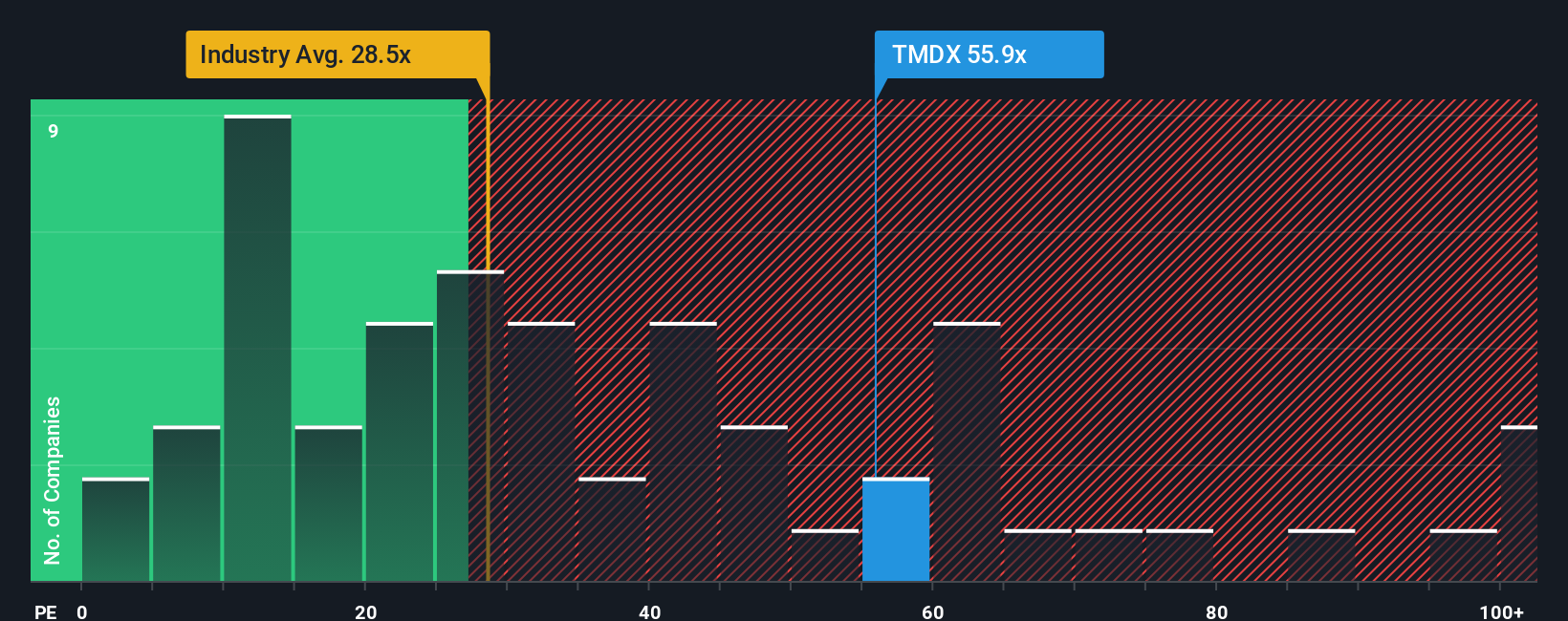

Taking a look at one of the most widely used market measures, TransMedics Group is trading at a price-to-earnings ratio of 62.1x. That is not only twice as expensive as the US Medical Equipment industry average of 29.7x, but it is also well above both its peer average of 39.7x and the calculated fair ratio of 38.2x.

This signals that, compared to similar companies, the shares command a notable premium. Investors should consider if momentum alone can justify this, or if a repricing could occur if growth slows. Is the market's optimism warranted, or is there an element of risk being overlooked?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TransMedics Group Narrative

If you want to dig deeper or reach your own conclusion about TransMedics Group, you can quickly analyze the data and build your personal thesis in under three minutes using Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding TransMedics Group.

Make Your Next Investing Move with These Standout Ideas

Opportunities do not wait around. Get ahead of the crowd by tapping into powerful trends and innovative companies that could help shape your portfolio’s future.

- Tap into the unstoppable surge of tech by reviewing these 27 AI penny stocks, which are driving artificial intelligence innovation and redefining industry standards.

- Strengthen your passive income strategy by checking out these 17 dividend stocks with yields > 3% with yields above 3% for those seeking reliable returns in any market.

- Position yourself for growth in tomorrow’s financial systems with these 80 cryptocurrency and blockchain stocks, focusing on blockchain breakthroughs and secure digital transactions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TransMedics Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TMDX

TransMedics Group

A commercial-stage medical technology company, engages in transforming organ transplant therapy for end-stage organ failure patients in the United States and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives