- United States

- /

- Medical Equipment

- /

- NasdaqGS:TMCI

Further Upside For Treace Medical Concepts, Inc. (NASDAQ:TMCI) Shares Could Introduce Price Risks After 84% Bounce

Treace Medical Concepts, Inc. (NASDAQ:TMCI) shares have had a really impressive month, gaining 84% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 6.8% over the last year.

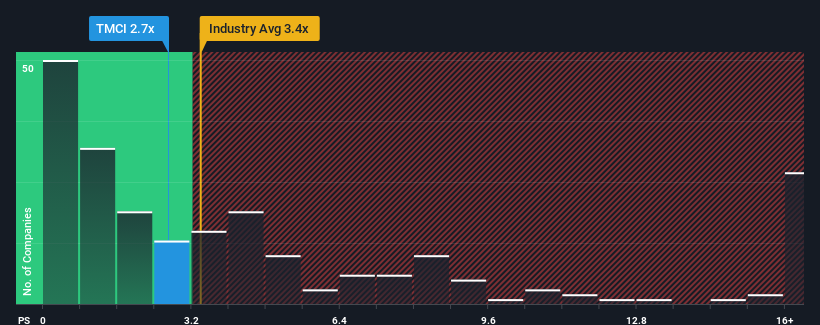

In spite of the firm bounce in price, Treace Medical Concepts may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.7x, since almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.4x and even P/S higher than 8x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Treace Medical Concepts

How Has Treace Medical Concepts Performed Recently?

With revenue growth that's superior to most other companies of late, Treace Medical Concepts has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Treace Medical Concepts' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Treace Medical Concepts' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 16% last year. Pleasingly, revenue has also lifted 138% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 8.1% per annum during the coming three years according to the six analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 9.2% per year, which is not materially different.

In light of this, it's peculiar that Treace Medical Concepts' P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Treace Medical Concepts' P/S?

Treace Medical Concepts' stock price has surged recently, but its but its P/S still remains modest. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Treace Medical Concepts' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Treace Medical Concepts you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Treace Medical Concepts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TMCI

Treace Medical Concepts

A medical technology company, designs, manufactures, and markets medical devices in the United States.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives