- United States

- /

- Medical Equipment

- /

- NasdaqGM:TCMD

Tactile Systems Technology, Inc.'s (NASDAQ:TCMD) Shares Leap 28% Yet They're Still Not Telling The Full Story

Despite an already strong run, Tactile Systems Technology, Inc. (NASDAQ:TCMD) shares have been powering on, with a gain of 28% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 2.7% in the last twelve months.

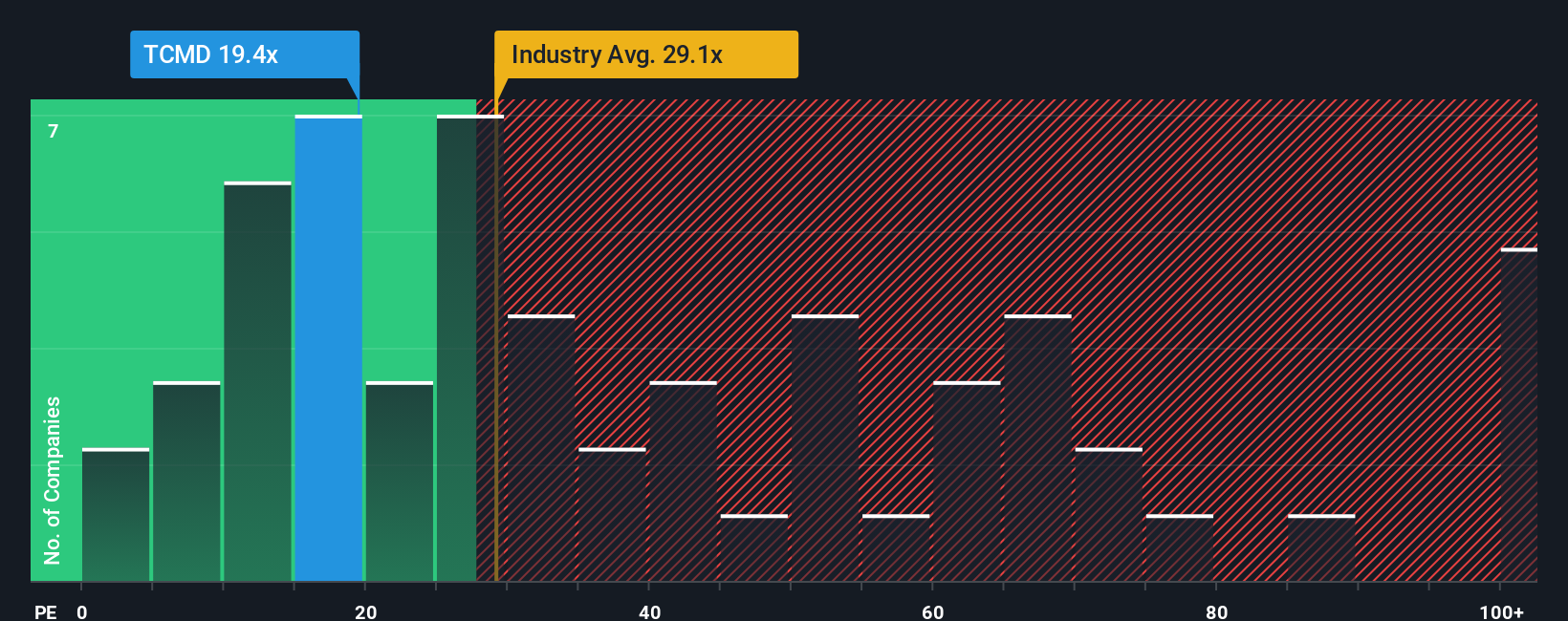

In spite of the firm bounce in price, it's still not a stretch to say that Tactile Systems Technology's price-to-earnings (or "P/E") ratio of 19.4x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 19x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Tactile Systems Technology hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

See our latest analysis for Tactile Systems Technology

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Tactile Systems Technology's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 54%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 35% each year as estimated by the five analysts watching the company. With the market only predicted to deliver 11% each year, the company is positioned for a stronger earnings result.

In light of this, it's curious that Tactile Systems Technology's P/E sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Tactile Systems Technology's P/E?

Tactile Systems Technology's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Tactile Systems Technology's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Having said that, be aware Tactile Systems Technology is showing 2 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Tactile Systems Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Tactile Systems Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TCMD

Tactile Systems Technology

A medical technology company, develops and provides medical devices to treat underserved chronic diseases in the United States.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives