- United States

- /

- Healthcare Services

- /

- NasdaqCM:TALK

Talkspace (TALK): Gauging Valuation After CEO Reveals New AI Safety Initiative for At-Risk Teens

Reviewed by Kshitija Bhandaru

Talkspace (TALK) drew renewed attention after CEO Jon Cohen discussed the dangers of at-risk teens turning to generic AI tools for mental health support. He also revealed plans to release a purpose-built AI agent to address these concerns.

See our latest analysis for Talkspace.

Talkspace’s recent move to spotlight its AI-driven safety tools comes as momentum builds in its stock. After a stretch of strong news, the share price has climbed 18% over the past month and 14% in the last quarter. The one-year total shareholder return now tops 23%. Longer-term holders have seen a remarkable 258% three-year total return, even if the gains have kicked in more recently.

If the intersection of healthcare and technology has you curious, consider exploring See the full list for free.

With the stock still trading at a notable discount to analyst price targets, the big question now is whether Talkspace is poised for further upside, or if the market has already factored in all the growth ahead.

Most Popular Narrative: 37.1% Undervalued

Talkspace's most widely followed narrative sees a fair value substantially above its last close price of $3.02, suggesting notable potential upside if the stated assumptions bear out. Market optimism is running high, but for this scenario to play out, the company must deliver on several ambitious growth levers that are closely tied to its core business model.

Ongoing expansion into large commercial insurance networks, Medicare, and military populations has greatly increased Talkspace's addressable market and resulted in accelerating active user and payer session growth. With nearly two-thirds of the U.S. population now covered, this sets a strong foundation for sustained revenue growth. (Financial impact: topline revenue growth and greater revenue visibility)

Want to know what’s driving this bullish price target? One key metric behind the narrative’s fair value hinges on sustained top-line expansion and sharply climbing profit margins. Which set of bold financial projections are analysts betting on for Talkspace? Discover the full details and chart the path from today’s price to the narrative’s valuation.

Result: Fair Value of $4.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tighter regulations surrounding AI in mental health or rising competition could challenge Talkspace’s growth assumptions and potentially alter the bullish outlook.

Find out about the key risks to this Talkspace narrative.

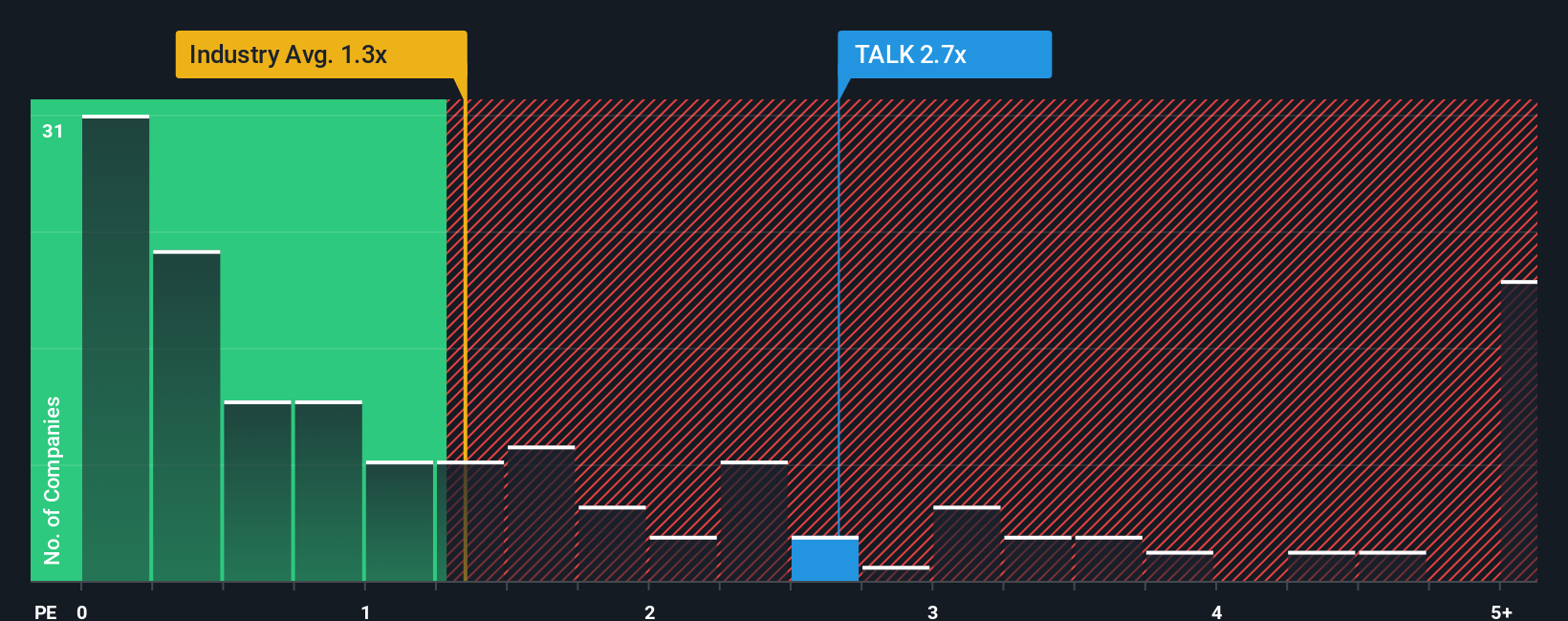

Another View: Multiples Tell a Different Story

While analysts say Talkspace looks undervalued based on future earnings forecasts, the current price-to-sales ratio of 2.5 times stands out as expensive compared to both the US Healthcare industry average and peer average, each at 1.4 times. The fair ratio estimate is just 1.5 times. This suggests the market could see further price adjustments. Are investors too optimistic, or could the business grow into this higher valuation?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Talkspace Narrative

If you’re inclined to dig into the facts and come to your own conclusions, it only takes a few minutes to map out your perspective. Do it your way

A great starting point for your Talkspace research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Maximize your opportunity by searching beyond just one stock. The smartest investors stay ahead by regularly finding new themes and untapped growth stories.

- Uncover unique technology trends and access the innovators at the forefront of artificial intelligence by checking out these 24 AI penny stocks.

- Capture steady income and financial resilience through these 19 dividend stocks with yields > 3%, featuring companies offering impressive yields above 3%.

- Tap into the world of digital assets and blockchain breakthroughs with these 79 cryptocurrency and blockchain stocks, where tomorrow’s leaders are shaping how we transact and invest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Talkspace might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:TALK

Talkspace

Operates as a virtual behavioral healthcare company that connects patients with licensed mental health providers in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)