- United States

- /

- Medical Equipment

- /

- NasdaqGS:SWAV

Shockwave Medical, Inc.'s (NASDAQ:SWAV) 28% Jump Shows Its Popularity With Investors

Shockwave Medical, Inc. (NASDAQ:SWAV) shares have continued their recent momentum with a 28% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 46%.

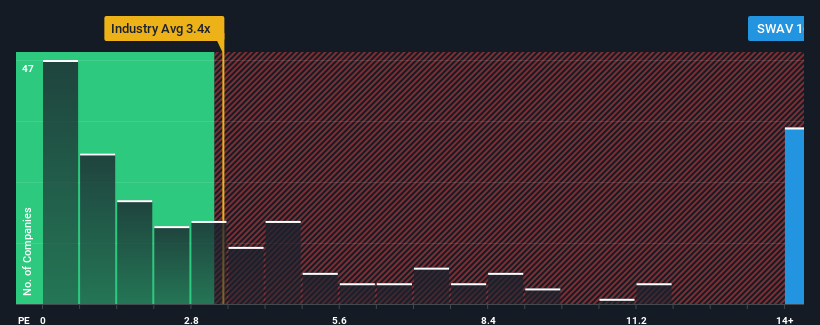

Following the firm bounce in price, given around half the companies in the United States' Medical Equipment industry have price-to-sales ratios (or "P/S") below 3.4x, you may consider Shockwave Medical as a stock to avoid entirely with its 16.8x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Shockwave Medical

How Shockwave Medical Has Been Performing

Recent times have been advantageous for Shockwave Medical as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shockwave Medical.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, Shockwave Medical would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 49% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 23% per year over the next three years. With the industry only predicted to deliver 10% per year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Shockwave Medical's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Shockwave Medical's P/S Mean For Investors?

Shares in Shockwave Medical have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Shockwave Medical shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 3 warning signs for Shockwave Medical that we have uncovered.

If these risks are making you reconsider your opinion on Shockwave Medical, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SWAV

Shockwave Medical

A medical device company, develops and commercializes intravascular lithotripsy (IVL) technology for the treatment of calcified plaque in patients with peripheral and coronary vascular, and heart valve diseases in the United States and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives