- United States

- /

- Healthtech

- /

- NasdaqCM:STRM

There's Reason For Concern Over Streamline Health Solutions, Inc.'s (NASDAQ:STRM) Price

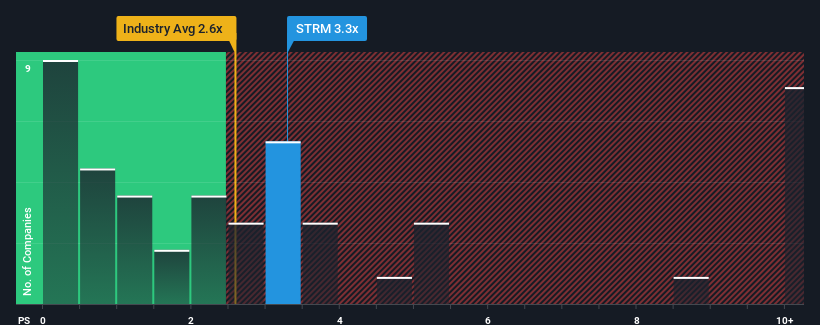

Streamline Health Solutions, Inc.'s (NASDAQ:STRM) price-to-sales (or "P/S") ratio of 3.3x may not look like an appealing investment opportunity when you consider close to half the companies in the Healthcare Services industry in the United States have P/S ratios below 2.6x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Streamline Health Solutions

How Streamline Health Solutions Has Been Performing

Streamline Health Solutions certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Streamline Health Solutions.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Streamline Health Solutions' is when the company's growth is on track to outshine the industry.

Taking a look back first, we see that the company grew revenue by an impressive 19% last year. The strong recent performance means it was also able to grow revenue by 111% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 17% per year over the next three years. That's shaping up to be similar to the 18% each year growth forecast for the broader industry.

In light of this, it's curious that Streamline Health Solutions' P/S sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of revenue growth is likely to weigh down the share price eventually.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Given Streamline Health Solutions' future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 4 warning signs for Streamline Health Solutions (1 is a bit concerning!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:STRM

Streamline Health Solutions

Provides health information technology solutions and associated services for hospitals and health systems in North America.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives