- United States

- /

- Medical Equipment

- /

- NasdaqCM:SSKN

STRATA Skin Sciences, Inc. (NASDAQ:SSKN) Stock Rockets 26% But Many Are Still Ignoring The Company

STRATA Skin Sciences, Inc. (NASDAQ:SSKN) shareholders have had their patience rewarded with a 26% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 26% in the last twelve months.

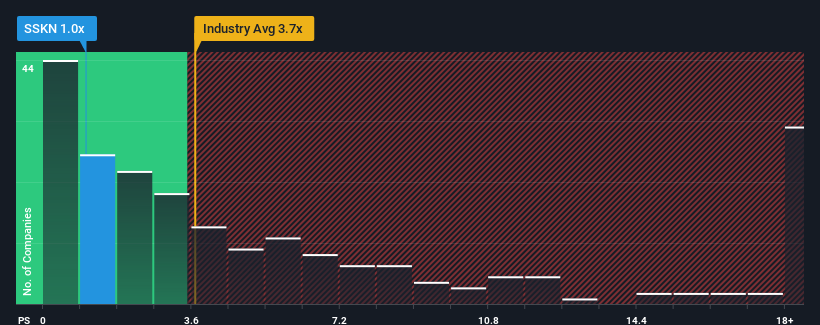

Even after such a large jump in price, STRATA Skin Sciences may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1x, since almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.7x and even P/S higher than 9x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for STRATA Skin Sciences

How Has STRATA Skin Sciences Performed Recently?

With revenue growth that's superior to most other companies of late, STRATA Skin Sciences has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on STRATA Skin Sciences.Do Revenue Forecasts Match The Low P/S Ratio?

STRATA Skin Sciences' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 21% last year. As a result, it also grew revenue by 14% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 17% per year as estimated by the dual analysts watching the company. With the industry only predicted to deliver 8.9% per annum, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that STRATA Skin Sciences' P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does STRATA Skin Sciences' P/S Mean For Investors?

Even after such a strong price move, STRATA Skin Sciences' P/S still trails the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at STRATA Skin Sciences' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with STRATA Skin Sciences (at least 1 which is concerning), and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SSKN

STRATA Skin Sciences

A medical technology company, develops, commercializes, and markets products for the treatment of dermatologic conditions in the United States, China, Europe, the Middle East, Asia, Australia, South Africa, and Central and South America.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives