- United States

- /

- Medical Equipment

- /

- NasdaqCM:SRTS

Insufficient Growth At Sensus Healthcare, Inc. (NASDAQ:SRTS) Hampers Share Price

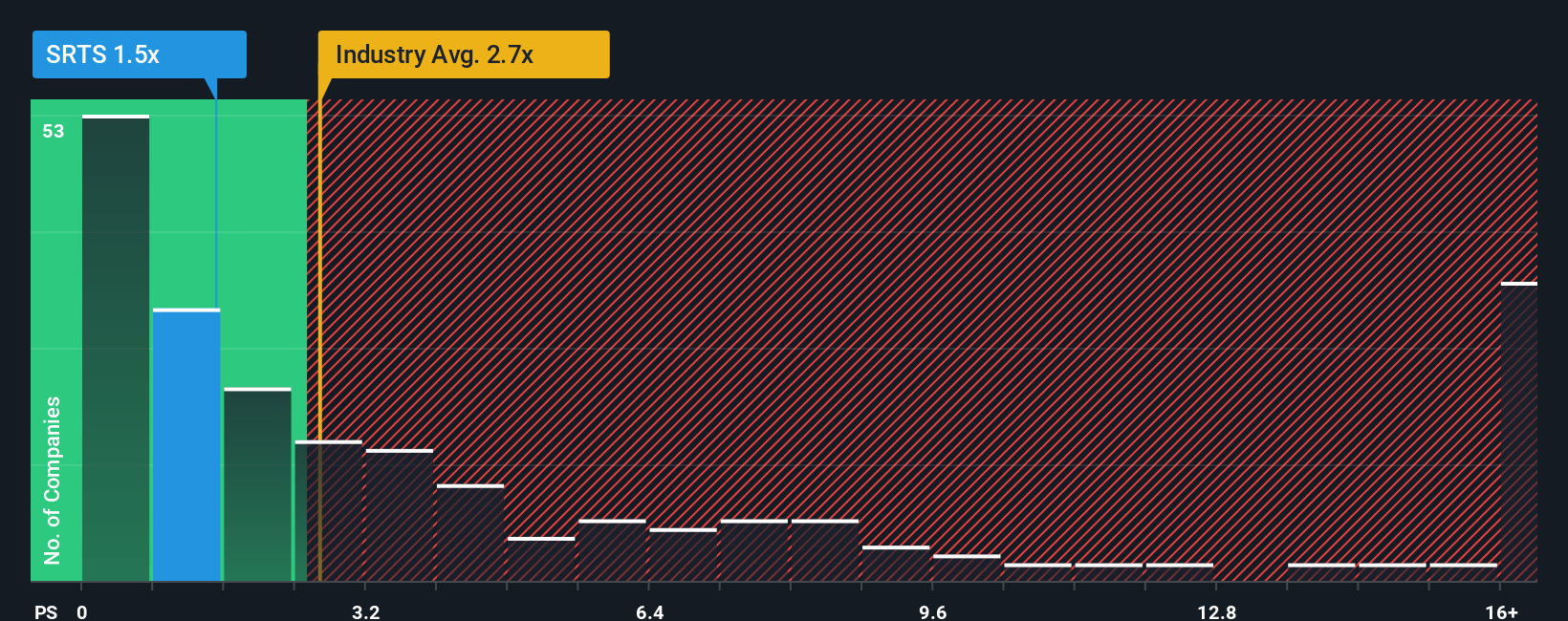

You may think that with a price-to-sales (or "P/S") ratio of 1.5x Sensus Healthcare, Inc. (NASDAQ:SRTS) is a stock worth checking out, seeing as almost half of all the Medical Equipment companies in the United States have P/S ratios greater than 2.7x and even P/S higher than 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Sensus Healthcare

How Has Sensus Healthcare Performed Recently?

With revenue growth that's inferior to most other companies of late, Sensus Healthcare has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Sensus Healthcare will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Sensus Healthcare's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 3.3% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 8.3% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 1.3% during the coming year according to the four analysts following the company. With the industry predicted to deliver 9.8% growth, the company is positioned for a weaker revenue result.

With this information, we can see why Sensus Healthcare is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Sensus Healthcare's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Sensus Healthcare's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

It is also worth noting that we have found 2 warning signs for Sensus Healthcare that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SRTS

Sensus Healthcare

Operates as a medical device company that manufactures and sells radiation therapy devices to healthcare providers worldwide.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.