- United States

- /

- Medical Equipment

- /

- NasdaqGS:SRDX

Shareholders May Be Wary Of Increasing Surmodics, Inc.'s (NASDAQ:SRDX) CEO Compensation Package

The results at Surmodics, Inc. (NASDAQ:SRDX) have been quite disappointing recently and CEO Gary Maharaj bears some responsibility for this. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 09 February 2023. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. We present the case why we think CEO compensation is out of sync with company performance.

Check out our latest analysis for Surmodics

Comparing Surmodics, Inc.'s CEO Compensation With The Industry

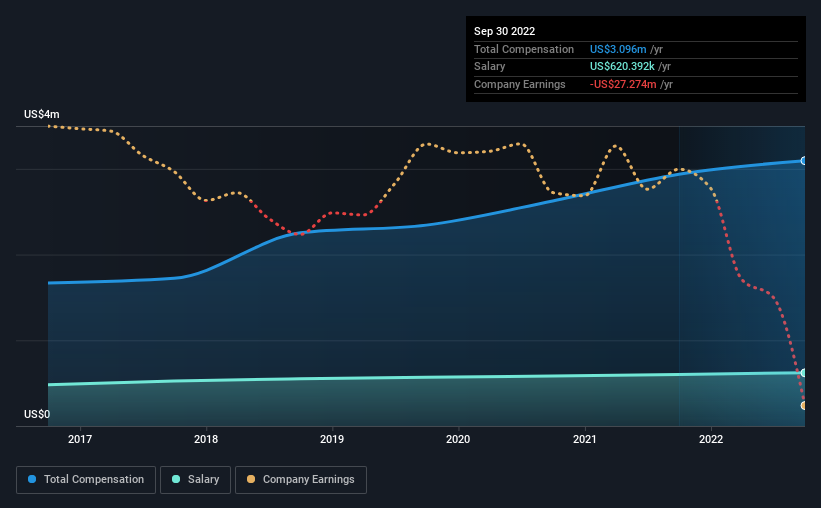

At the time of writing, our data shows that Surmodics, Inc. has a market capitalization of US$421m, and reported total annual CEO compensation of US$3.1m for the year to September 2022. That's a fairly small increase of 5.4% over the previous year. While we always look at total compensation first, our analysis shows that the salary component is less, at US$620k.

For comparison, other companies in the American Medical Equipment industry with market capitalizations ranging between US$200m and US$800m had a median total CEO compensation of US$4.4m. This suggests that Surmodics remunerates its CEO largely in line with the industry average. Furthermore, Gary Maharaj directly owns US$5.2m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | US$620k | US$602k | 20% |

| Other | US$2.5m | US$2.3m | 80% |

| Total Compensation | US$3.1m | US$2.9m | 100% |

Speaking on an industry level, nearly 19% of total compensation represents salary, while the remainder of 81% is other remuneration. Surmodics is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Surmodics, Inc.'s Growth

Over the last three years, Surmodics, Inc. has shrunk its earnings per share by 115% per year. It saw its revenue drop 4.9% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Surmodics, Inc. Been A Good Investment?

Given the total shareholder loss of 26% over three years, many shareholders in Surmodics, Inc. are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

Shareholders may want to check for free if Surmodics insiders are buying or selling shares.

Switching gears from Surmodics, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SRDX

Surmodics

Provides performance coating technologies for intravascular medical devices, and chemical and biological components for in vitro diagnostic immunoassay tests and microarrays in the United States and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives