- United States

- /

- Medical Equipment

- /

- NasdaqCM:SMTI

Companies Like Sanara MedTech (NASDAQ:SMTI) Can Afford To Invest In Growth

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So should Sanara MedTech (NASDAQ:SMTI) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

See our latest analysis for Sanara MedTech

How Long Is Sanara MedTech's Cash Runway?

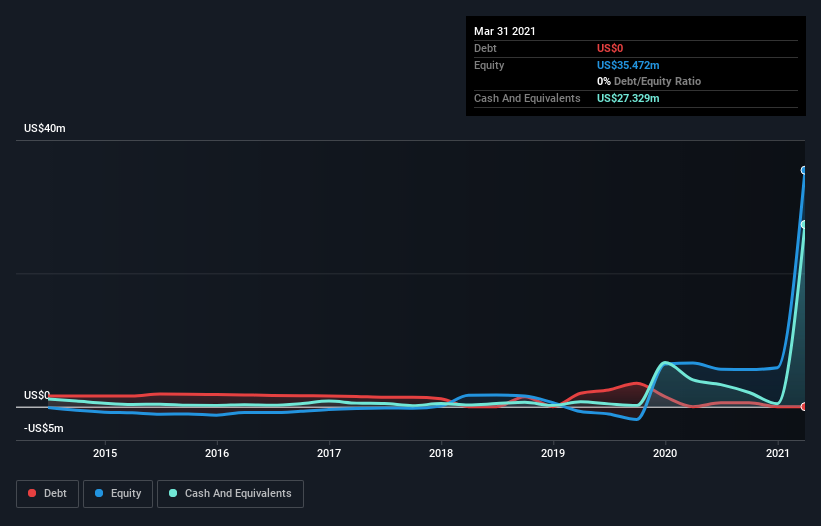

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In March 2021, Sanara MedTech had US$27m in cash, and was debt-free. In the last year, its cash burn was US$4.4m. So it had a cash runway of about 6.3 years from March 2021. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. The image below shows how its cash balance has been changing over the last few years.

How Well Is Sanara MedTech Growing?

It was fairly positive to see that Sanara MedTech reduced its cash burn by 28% during the last year. On top of that, operating revenue was up 33%, making for a heartening combination We think it is growing rather well, upon reflection. In reality, this article only makes a short study of the company's growth data. This graph of historic revenue growth shows how Sanara MedTech is building its business over time.

How Easily Can Sanara MedTech Raise Cash?

There's no doubt Sanara MedTech seems to be in a fairly good position, when it comes to managing its cash burn, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund growth. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Sanara MedTech's cash burn of US$4.4m is about 2.3% of its US$187m market capitalisation. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

How Risky Is Sanara MedTech's Cash Burn Situation?

As you can probably tell by now, we're not too worried about Sanara MedTech's cash burn. For example, we think its cash runway suggests that the company is on a good path. Its cash burn reduction wasn't quite as good, but was still rather encouraging! After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. Taking a deeper dive, we've spotted 3 warning signs for Sanara MedTech you should be aware of, and 1 of them makes us a bit uncomfortable.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

When trading Sanara MedTech or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:SMTI

Sanara MedTech

A medical technology company, develops, markets, and distributes surgical, wound, and skincare products and services to physicians, hospitals, clinics, and post-acute care settings in the United States.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives