- United States

- /

- Healthtech

- /

- NasdaqGS:SLP

Why Investors Shouldn't Be Surprised By Simulations Plus, Inc.'s (NASDAQ:SLP) 29% Share Price Surge

Simulations Plus, Inc. (NASDAQ:SLP) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 13% in the last twelve months.

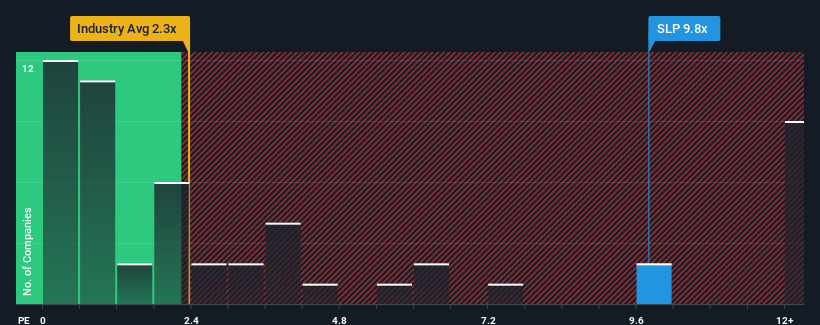

Following the firm bounce in price, you could be forgiven for thinking Simulations Plus is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 9.8x, considering almost half the companies in the United States' Healthcare Services industry have P/S ratios below 2.4x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Simulations Plus

How Has Simulations Plus Performed Recently?

Simulations Plus certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Simulations Plus.How Is Simulations Plus' Revenue Growth Trending?

In order to justify its P/S ratio, Simulations Plus would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 20% gain to the company's top line. The latest three year period has also seen an excellent 54% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 17% each year during the coming three years according to the seven analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 11% each year, which is noticeably less attractive.

With this information, we can see why Simulations Plus is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does Simulations Plus' P/S Mean For Investors?

Simulations Plus' P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Simulations Plus shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 1 warning sign for Simulations Plus that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SLP

Simulations Plus

Develops drug discovery and development software for modeling and simulation, and prediction of molecular properties utilizing artificial intelligence and machine learning based technology worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success