- United States

- /

- Healthtech

- /

- NasdaqGS:SLP

Simulations Plus, Inc.'s (NASDAQ:SLP) Stock On An Uptrend: Could Fundamentals Be Driving The Momentum?

Most readers would already be aware that Simulations Plus' (NASDAQ:SLP) stock increased significantly by 8.8% over the past week. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to study its financial indicators more closely to see if they had a hand to play in the recent price move. Specifically, we decided to study Simulations Plus' ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Simulations Plus

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Simulations Plus is:

5.9% = US$11m ÷ US$180m (Based on the trailing twelve months to November 2022).

The 'return' refers to a company's earnings over the last year. Another way to think of that is that for every $1 worth of equity, the company was able to earn $0.06 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Simulations Plus' Earnings Growth And 5.9% ROE

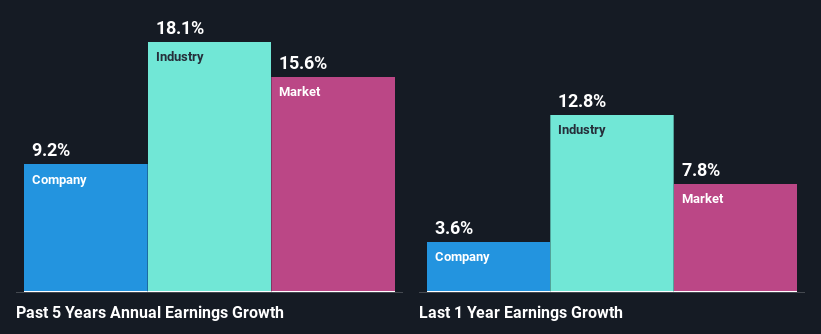

On the face of it, Simulations Plus' ROE is not much to talk about. However, its ROE is similar to the industry average of 6.4%, so we won't completely dismiss the company. Even so, Simulations Plus has shown a fairly decent growth in its net income which grew at a rate of 9.2%. Given the slightly low ROE, it is likely that there could be some other aspects that are driving this growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

Next, on comparing with the industry net income growth, we found that Simulations Plus' reported growth was lower than the industry growth of 18% in the same period, which is not something we like to see.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Is Simulations Plus fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Simulations Plus Making Efficient Use Of Its Profits?

Simulations Plus has a three-year median payout ratio of 45%, which implies that it retains the remaining 55% of its profits. This suggests that its dividend is well covered, and given the decent growth seen by the company, it looks like management is reinvesting its earnings efficiently.

Besides, Simulations Plus has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders.

Summary

In total, it does look like Simulations Plus has some positive aspects to its business. That is, a decent growth in earnings backed by a high rate of reinvestment. However, we do feel that that earnings growth could have been higher if the business were to improve on the low ROE rate. Especially given how the company is reinvesting a huge chunk of its profits. With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SLP

Simulations Plus

Develops drug discovery and development software for modeling and simulation, and prediction of molecular properties utilizing artificial intelligence and machine learning based technology worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.