- United States

- /

- IT

- /

- NasdaqGM:MDB

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

As the U.S. market navigates a period of retreat from record highs, with tech stocks experiencing notable declines, investors are closely monitoring key indices like the S&P 500 and Dow Jones Industrial Average for signs of broader economic trends. Amidst this backdrop, identifying high growth tech stocks requires a keen eye on companies that demonstrate resilience and adaptability in an evolving economic landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ACADIA Pharmaceuticals | 10.87% | 25.66% | ★★★★★☆ |

| ADMA Biologics | 20.60% | 23.25% | ★★★★★☆ |

| Palantir Technologies | 25.17% | 31.57% | ★★★★★★ |

| Workday | 11.51% | 29.07% | ★★★★★☆ |

| OS Therapies | 57.14% | 70.11% | ★★★★★☆ |

| Circle Internet Group | 27.36% | 77.54% | ★★★★★☆ |

| RenovoRx | 65.52% | 68.63% | ★★★★★☆ |

| Gorilla Technology Group | 27.68% | 129.58% | ★★★★★☆ |

| Vanda Pharmaceuticals | 22.66% | 59.11% | ★★★★★☆ |

| Monopar Therapeutics | 76.01% | 54.38% | ★★★★★☆ |

Click here to see the full list of 71 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

MiMedx Group (MDXG)

Simply Wall St Growth Rating: ★★★★☆☆

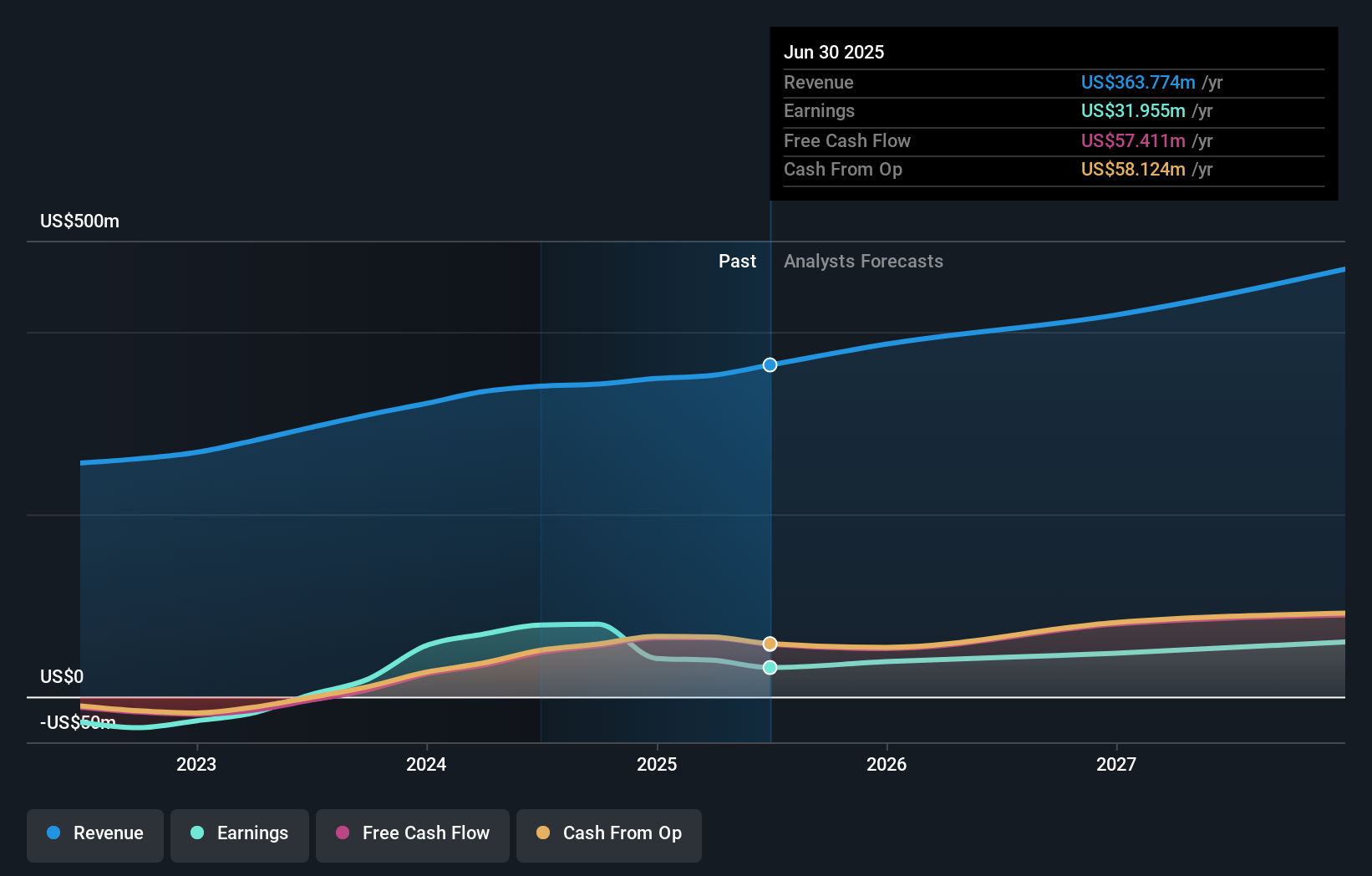

Overview: MiMedx Group, Inc. is a company that develops and distributes placental tissue allografts for various sectors of healthcare, with a market cap of $1.05 billion.

Operations: MiMedx Group focuses on the development and distribution of placental tissue allografts, primarily serving the biotechnology sector with a revenue of $363.77 million.

MiMedx Group, despite recent challenges, shows promising signs of recovery and strategic growth. With a revised full-year revenue outlook increasing to low double digits, the company is outpacing the average US market growth forecast of 9.3%. This adjustment follows a robust Q2 performance with sales rising to $98.61 million from $87.21 million in the previous year. Additionally, MiMedx's earnings are set to surge by 24.6% annually, significantly ahead of the US market's 15.1%, reflecting strong underlying business dynamics despite a drop in net profit margin from 23.1% last year to 8.8%. The strategic alliance with Vaporox not only diversifies its wound care portfolio but also enhances its competitive edge by integrating advanced therapies like VHT with its products, potentially setting new standards in treatment efficacy and boosting future revenue streams.

- Click here and access our complete health analysis report to understand the dynamics of MiMedx Group.

Assess MiMedx Group's past performance with our detailed historical performance reports.

MongoDB (MDB)

Simply Wall St Growth Rating: ★★★★☆☆

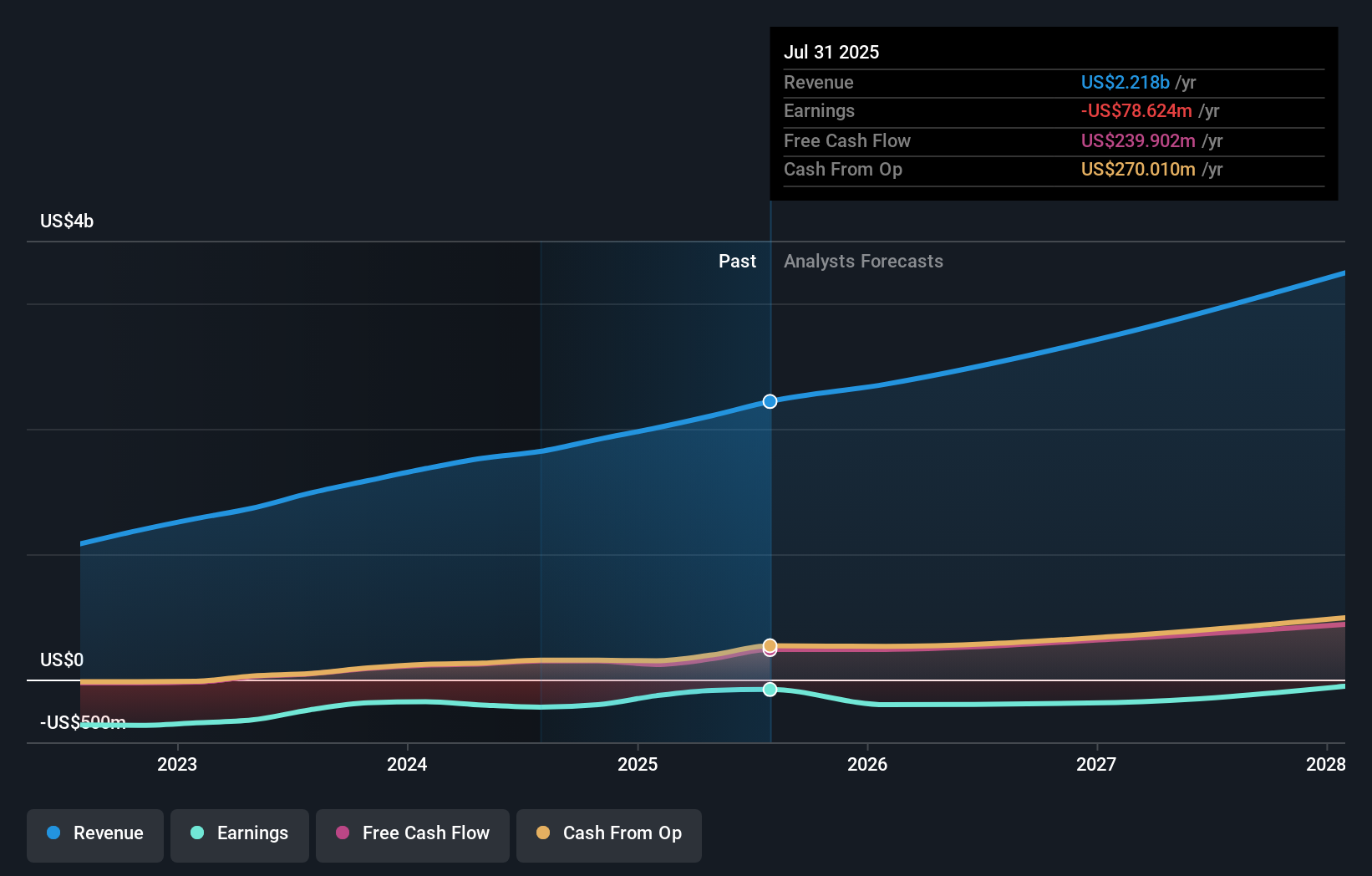

Overview: MongoDB, Inc. provides a general-purpose database platform globally and has a market cap of approximately $25.68 billion.

Operations: The company generates revenue primarily through its data processing segment, which contributed $2.22 billion. Gross profit margin trends indicate a focus on efficient cost management within its operations.

MongoDB's recent financial performance and strategic initiatives underscore its evolving role in the tech landscape, particularly within AI and database management. In Q2 2026, MongoDB reported a revenue increase to $591.4 million from $478.11 million year-over-year, alongside a narrowed net loss of $47.05 million compared to last year's $54.53 million, reflecting efficiency improvements despite ongoing investments in innovation. The company has been proactive in expanding its AI capabilities as evidenced by new product launches and enhancements aimed at simplifying complex AI applications for developers at scale, which could enhance long-term growth prospects amid competitive pressures and technological advancements in the sector.

- Unlock comprehensive insights into our analysis of MongoDB stock in this health report.

Understand MongoDB's track record by examining our Past report.

Simulations Plus (SLP)

Simply Wall St Growth Rating: ★★★★☆☆

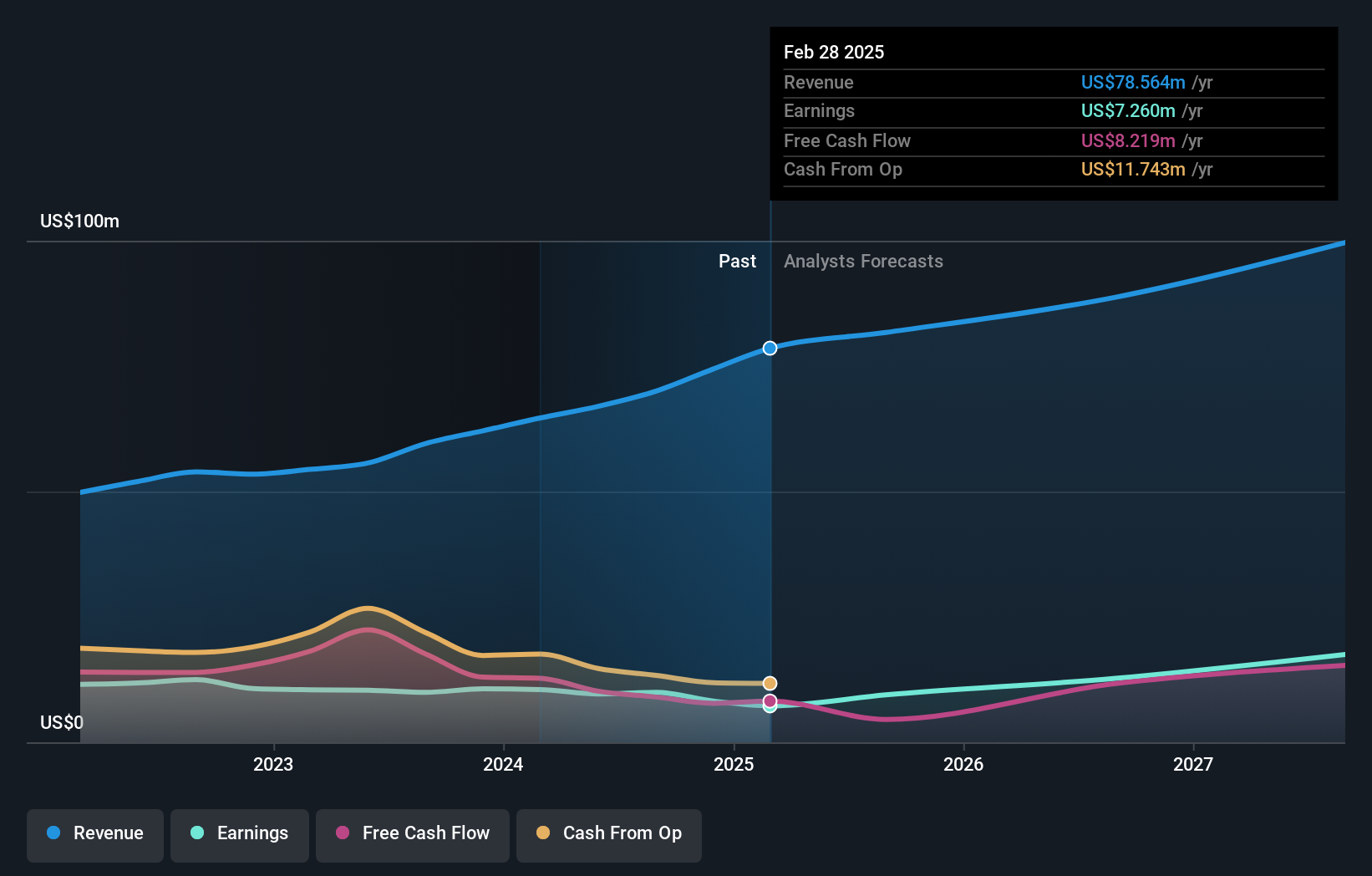

Overview: Simulations Plus, Inc. specializes in creating software for drug discovery and development that leverages artificial intelligence and machine learning technologies, with a market capitalization of $285.20 million.

Operations: SLP generates revenue through two primary segments: software sales, which contribute $46.73 million, and services, amounting to $33.66 million. The company focuses on developing advanced modeling and simulation tools for the pharmaceutical industry using AI and machine learning technologies.

Simulations Plus, Inc., a pioneer in artificial intelligence-driven drug design, recently showcased its innovative edge with the publication of its collaboration results on RORg/RORgT ligands. This development underlines the company's commitment to enhancing drug efficacy and safety through AI, as demonstrated by their ADMET Predictor 13 platform which integrates high-throughput simulations and advanced AI for smarter pharmaceutical R&D. Despite a challenging fiscal quarter with a reported net loss of $67.32 million from revenues of $20.36 million, Simulations Plus is optimistic about future growth, projecting annual revenue growth between 9% to 14%. This forward-looking stance is supported by strategic executive appointments aimed at bolstering its market position in the competitive tech-driven biopharma sector.

- Delve into the full analysis health report here for a deeper understanding of Simulations Plus.

Evaluate Simulations Plus' historical performance by accessing our past performance report.

Where To Now?

- Click through to start exploring the rest of the 68 US High Growth Tech and AI Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MDB

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives