- United States

- /

- Medical Equipment

- /

- NasdaqGM:SIBN

The 15% return this week takes SI-BONE's (NASDAQ:SIBN) shareholders three-year gains to 25%

Low-cost index funds make it easy to achieve average market returns. But across the board there are plenty of stocks that underperform the market. For example, the SI-BONE, Inc. (NASDAQ:SIBN) share price return of 25% over three years lags the market return in the same period. In the last year the stock price gained, albeit only 4.9%.

Since the stock has added US$92m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

SI-BONE isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

SI-BONE's revenue trended up 22% each year over three years. That's well above most pre-profit companies. While long-term shareholders have made money, the 8% per year gain over three years isn't that great given the rising market. Generally, we would have hoped for a stronger share price, given the impressive revenue growth. If the business can trend towards profitability and fund its growth, then the market could present an opportunity. But you might want to take a closer look at this one.

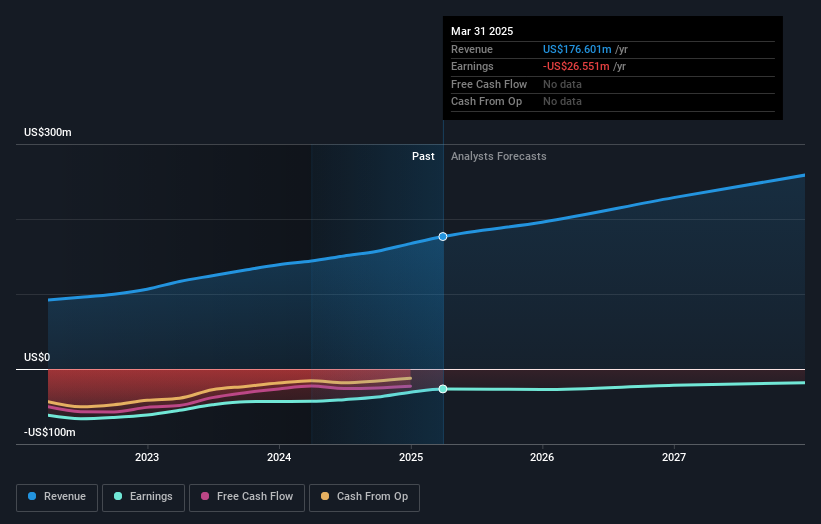

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at SI-BONE's financial health with this free report on its balance sheet.

A Different Perspective

SI-BONE shareholders are up 4.9% for the year. But that was short of the market average. The silver lining is that the gain was actually better than the average annual return of 1.0% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for SI-BONE that you should be aware of.

Of course SI-BONE may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:SIBN

SI-BONE

A medical device company, focuses on solving musculoskeletal disorders of the sacropelvic anatomy in the United States and internationally.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives