- United States

- /

- Healthcare Services

- /

- NasdaqGS:SGRY

Should Investors Revisit Surgery Partners After 31% One Year Decline?

Reviewed by Simply Wall St

Thinking about what to do with your Surgery Partners stock right now? You are not alone. Whether you have been riding out the recent downturn or are eyeing an entry point, it is hard to ignore just how much the stock has swung over the last year. In the past week, shares dipped by 1.0%, capping off a tough 30 days that saw a 4.1% slide. Zooming out, the year-to-date gain of 2.7% hardly matches the bruising 31.4% loss over the last twelve months. It is a mixed picture, with the five-year return sitting just above water at 1.5% and the three-year mark still in the red. This rollercoaster performance partly reflects changing investor perceptions around risk in the sector, as market-wide dynamics keep shifting in the healthcare services space. Yet for patient investors, each dip has also stoked talk of potential upside ahead.

But is the stock truly undervalued, or are these price moves just the market's way of saying "proceed with caution"? When we put Surgery Partners to the test using six widely respected valuation checks, the company comes in with a score of 6 out of 6. That puts it in rare company for stocks considered undervalued across every key metric. Up next, I will walk you through these valuation approaches one by one. Stick around, because there is an even more useful way to look at what the market might be missing, coming later in the article.

Why Surgery Partners is lagging behind its peersApproach 1: Surgery Partners Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular tool for estimating a company's intrinsic value. It works by forecasting the company’s future free cash flows and discounting them back to their present value. This provides a sense of what the business is worth today based on its long-term earning potential.

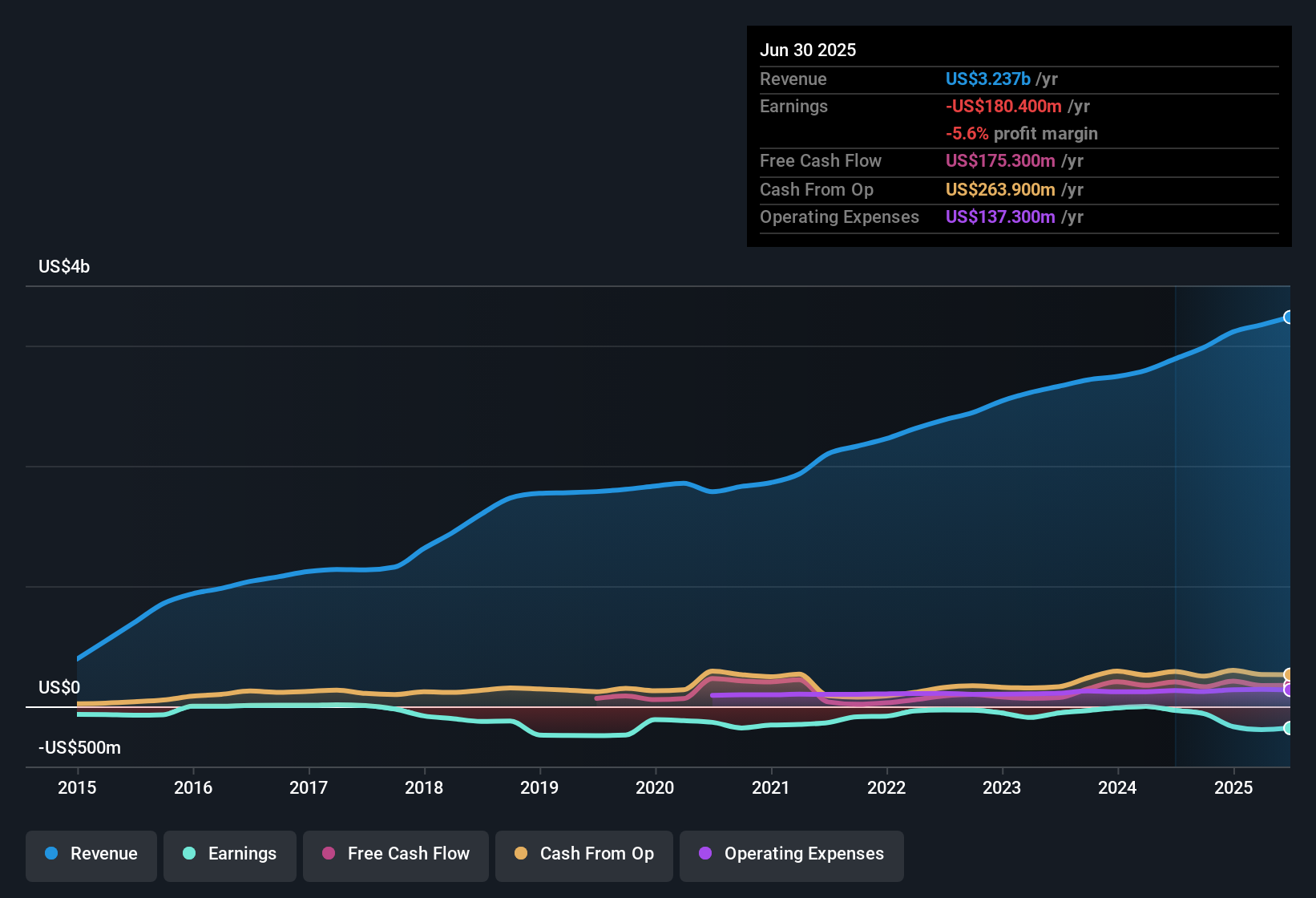

Surgery Partners, according to this DCF model, currently generates free cash flow of $166 million. Analyst estimates cover up to 2027, with projections showing free cash flow rising to $416 million by that year. For longer-term forecasts, Simply Wall St extrapolates these trends over the next decade, with free cash flow expected to surpass $677 million by 2035, supported by steady annual growth rates. All these projections are in USD, aligning with Surgery Partners’ reporting currency.

Based on these assumptions, the DCF valuation places the fair value of Surgery Partners at $81.37 per share. This suggests a 73.1% discount to the company’s current trading price. If the future cash flows occur as projected, the stock is trading well below its intrinsic value and may appeal to patient, value-oriented investors.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Surgery Partners.

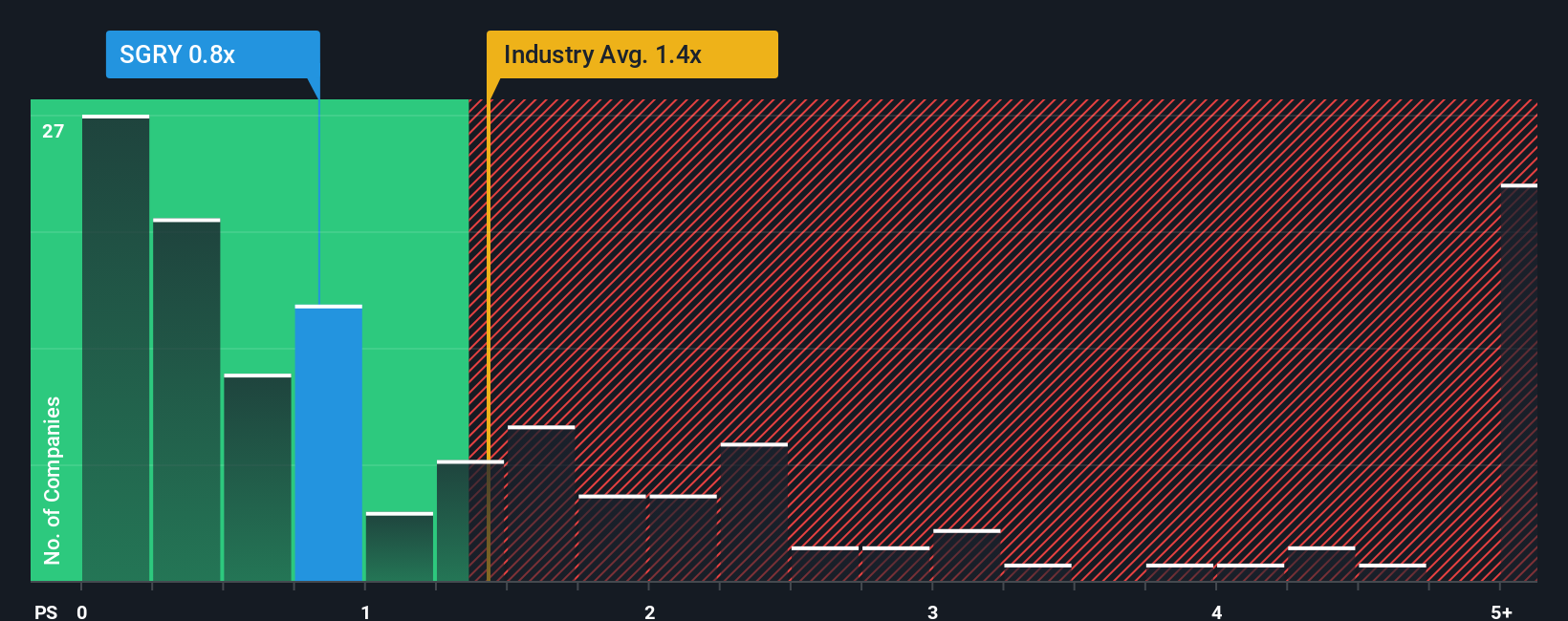

Approach 2: Surgery Partners Price vs Sales

The Price-to-Sales (P/S) ratio is a useful valuation tool, especially for companies like Surgery Partners that may not consistently report profits but generate substantial revenues. For healthcare providers operating in highly competitive, growth-oriented sectors, the P/S ratio offers a direct way to assess how much the market is willing to pay for each dollar of sales. This makes it a fair barometer when earnings are volatile or negative.

Growth prospects and risk play pivotal roles in determining whether a company's P/S ratio is justified. Higher expected sales growth or improved operating efficiency often earns a premium, while higher risk or weaker growth should result in a discount. Surgery Partners currently trades at a P/S ratio of 0.86x, which is below both the healthcare industry average of 1.32x and the peer average of 0.96x. This suggests the market is pricing the stock more conservatively than many of its competitors.

To go beyond basic benchmarks, Simply Wall St calculates a “Fair Ratio.” This proprietary metric factors in the company’s sales growth, profit margins, risk profile, industry dynamics, and market capitalization. This offers a much more tailored perspective than a one-size-fits-all industry average. For Surgery Partners, this Fair Ratio comes in at 0.96x. Since its actual P/S ratio of 0.86x is just below the Fair Ratio, the stock appears attractively valued on a sales basis, but not dramatically so.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Surgery Partners Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. In simple terms, a Narrative is your story about a company, capturing your view of its future, from big-picture business drivers to your estimates for revenue, margins, and what you think is a fair value per share.

Narratives are powerful because they connect what is happening in the real world to financial forecasts and fair value, helping you see how a company’s journey could play out in numbers. On Simply Wall St’s Community page, you can easily build and share your own Narrative using the same simple, visual tools trusted by millions of investors worldwide.

This approach helps you make clear buy or sell choices by comparing the fair value in your Narrative to today’s share price. Since Narratives automatically update when new news or earnings arrive, your outlook always stays relevant. For example, some Surgery Partners Narratives see a fair value as high as $36.00, betting on strong outpatient procedure growth and regulatory support, while others land as low as $24.00, focused on debt pressures and margin risk. Narratives let you back your decision with your research and assumptions, not just market noise.

Do you think there's more to the story for Surgery Partners? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SGRY

Surgery Partners

Owns and operates a network of surgical facilities and ancillary services in the United States.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives