- United States

- /

- Healthcare Services

- /

- NasdaqGS:SGRY

Leadership Change and Reaffirmed Guidance Might Change the Case for Investing in Surgery Partners (SGRY)

Reviewed by Simply Wall St

- Earlier this month, Surgery Partners reported second-quarter 2025 results with sales rising to US$826.2 million and a significantly lower net loss compared to the previous year, while reaffirming its full-year revenue guidance of US$3.3 billion to US$3.45 billion; the company also announced Wayne S. DeVeydt’s immediate resignation as Executive Chairman and director, appointing Blair E. Hendrix as the new Board Chairman and reducing the Board size to 10 directors.

- Despite the leadership change, the company’s ability to deliver both revenue growth and improved net loss figures, together with its confirmed annual outlook, provides insights into its operational strength and management’s confidence in near-term performance.

- To assess how Surgery Partners’ reaffirmed guidance amid executive transition shapes its outlook, we'll now discuss the impact on the company's investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Surgery Partners Investment Narrative Recap

To believe in Surgery Partners as a shareholder today, one must be confident in its ability to drive recurring revenue growth from a shifting mix of higher-acuity, outpatient procedures and successfully execute on physician and facility network expansion. The recent executive resignation and board changes, while significant, do not materially alter the near-term catalyst: management's reaffirmed 2025 revenue outlook and improved quarterly loss metrics. The main risk remains the pace of acquisitions and associated incremental EBITDA growth, which could affect delivery on stated guidance.

Of all recent announcements, the company's reconfirmation of its 2025 revenue guidance between US$3.3 billion and US$3.45 billion stands out as the most relevant. This steady outlook, delivered alongside leadership changes, speaks directly to the ongoing path of recovery and the company's ongoing effort to meet targets despite disruption at the board level. As current year performance relies on timely deal execution and facility contributions, guidance stability offers a near-term confidence anchor.

However, even as the company maintains its guidance, investors should not overlook the effect that lagging acquisitions may have on...

Read the full narrative on Surgery Partners (it's free!)

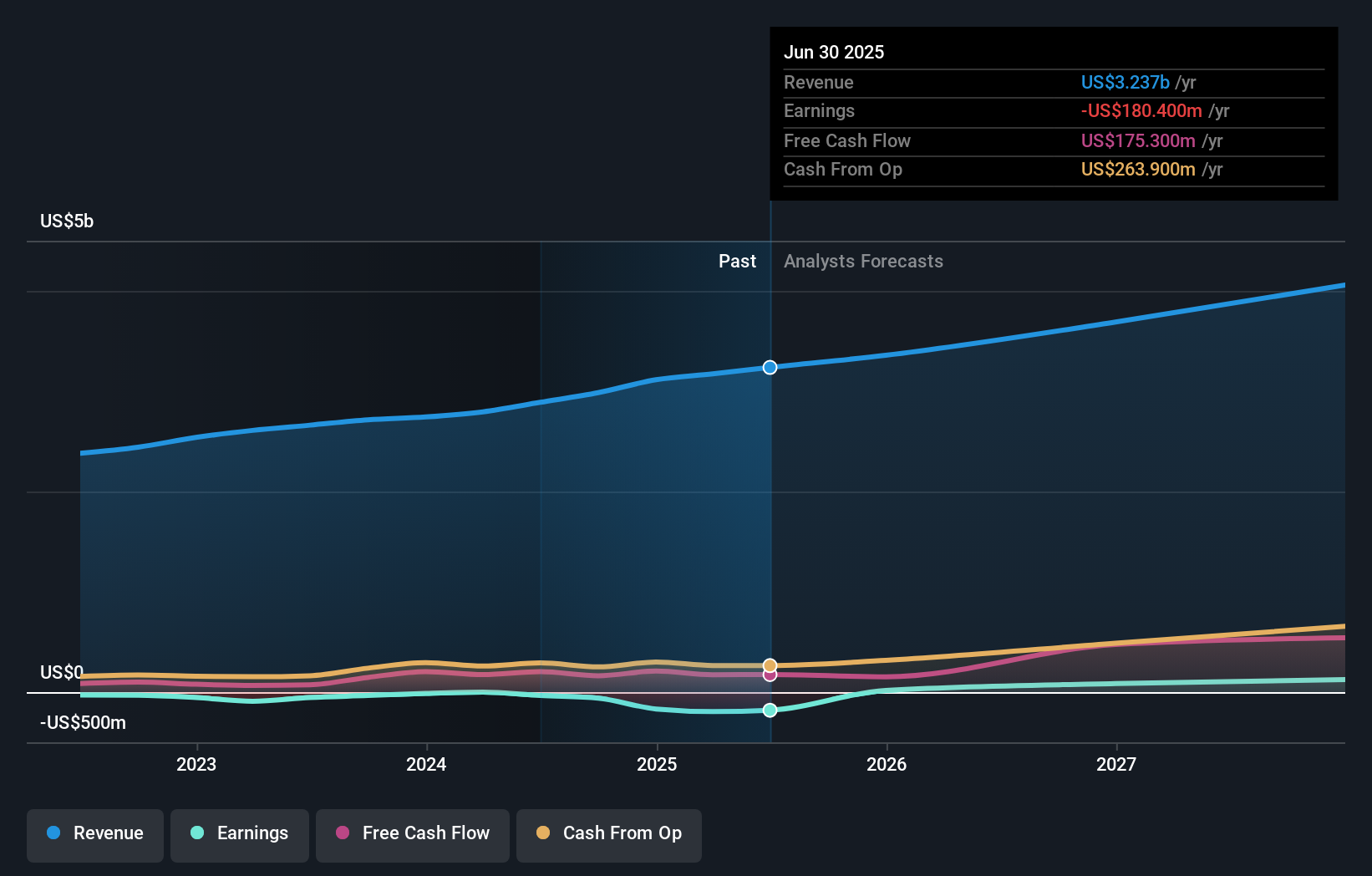

Surgery Partners' narrative projects $4.3 billion in revenue and $168.4 million in earnings by 2028. This requires 9.9% yearly revenue growth and a $348.8 million increase in earnings from the current -$180.4 million.

Uncover how Surgery Partners' forecasts yield a $31.00 fair value, a 36% upside to its current price.

Exploring Other Perspectives

With only two fair value estimates from the Simply Wall St Community ranging from US$31 to US$105.80, investor opinions strongly diverge. As revenue guidance remains unchanged, contrasting views may reflect ongoing uncertainty about the company’s ability to accelerate acquisition pace and deliver on earnings growth, so consider several perspectives before forming your outlook.

Explore 2 other fair value estimates on Surgery Partners - why the stock might be worth over 4x more than the current price!

Build Your Own Surgery Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Surgery Partners research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Surgery Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Surgery Partners' overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SGRY

Surgery Partners

Owns and operates a network of surgical facilities and ancillary services in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives