- United States

- /

- Healthcare Services

- /

- NasdaqGS:SGRY

Even after rising 3.1% this past week, Surgery Partners (NASDAQ:SGRY) shareholders are still down 56% over the past three years

If you love investing in stocks you're bound to buy some losers. Long term Surgery Partners, Inc. (NASDAQ:SGRY) shareholders know that all too well, since the share price is down considerably over three years. So they might be feeling emotional about the 56% share price collapse, in that time. And over the last year the share price fell 35%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 34% in the last 90 days.

On a more encouraging note the company has added US$80m to its market cap in just the last 7 days, so let's see if we can determine what's driven the three-year loss for shareholders.

Check out our latest analysis for Surgery Partners

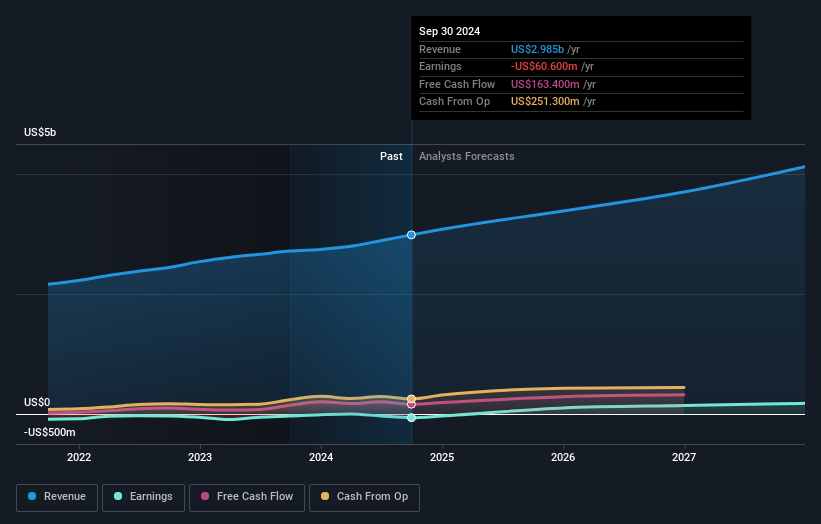

Because Surgery Partners made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over three years, Surgery Partners grew revenue at 10% per year. That's a fairly respectable growth rate. So some shareholders would be frustrated with the compound loss of 16% per year. The market must have had really high expectations to be disappointed with this progress. So this is one stock that might be worth investigating further, or even adding to your watchlist.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Surgery Partners is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Surgery Partners will earn in the future (free analyst consensus estimates)

A Different Perspective

Surgery Partners shareholders are down 35% for the year, but the market itself is up 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 3%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SGRY

Surgery Partners

Owns and operates a network of surgical facilities and ancillary services in the United States.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives