- United States

- /

- Medical Equipment

- /

- NasdaqCM:LFWD

Investors Who Bought ReWalk Robotics (NASDAQ:RWLK) Shares Three Years Ago Are Now Down 97%

It's not possible to invest over long periods without making some bad investments. But you want to avoid the really big losses like the plague. So take a moment to sympathize with the long term shareholders of ReWalk Robotics Ltd. (NASDAQ:RWLK), who have seen the share price tank a massive 97% over a three year period. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. The more recent news is of little comfort, with the share price down 79% in a year. On top of that, the share price has dropped a further 27% in a month.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

View our latest analysis for ReWalk Robotics

Because ReWalk Robotics is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last three years, ReWalk Robotics saw its revenue grow by 13% per year, compound. That's a fairly respectable growth rate. So it's hard to believe the share price decline of 70% per year is due to the revenue. More likely, the market was spooked by the cost of that revenue. This is exactly why investors need to diversify - even when a loss making company grows revenue, it can fail to deliver for shareholders.

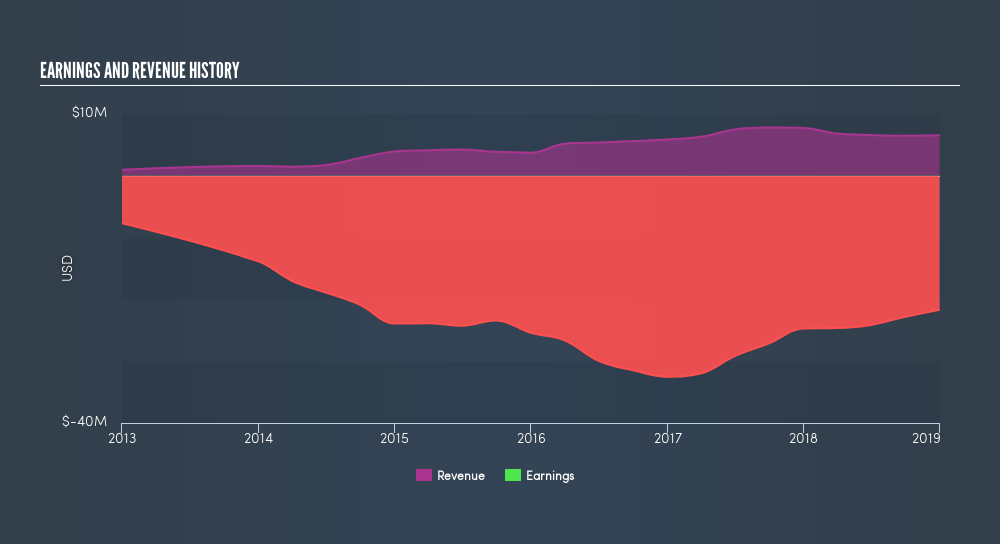

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for ReWalk Robotics in this interactivegraph of future profit estimates.

A Different Perspective

ReWalk Robotics shareholders are down 79% for the year, but the broader market is up 5.6%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Shareholders have lost 70% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. Although Warren Buffett famously said he likes to 'buy when there is blood on the streets', he also focusses on high quality stocks with solid prospects. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

If you like to buy stocks alongside management, then you might just love this freelist of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:LFWD

Lifeward

A medical device company, designs, develops, and commercializes technologies that enable mobility and wellness in rehabilitation and daily life for individuals with physical and neurological conditions in the United States, Europe, the Asia-Pacific, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives