- United States

- /

- Healthcare Services

- /

- NasdaqGM:RDNT

RadNet (RDNT): Valuation Perspective After Record Q3 Results and Upgraded 2025 Guidance

Reviewed by Simply Wall St

RadNet (RDNT) delivered a standout third quarter, announcing record revenue and adjusted EBITDA. This performance was driven by impressive gains in advanced imaging and digital health, especially from its recent AI-focused acquisitions. The company also raised its 2025 guidance, highlighting a strong outlook.

See our latest analysis for RadNet.

RadNet’s recent string of upbeat earnings, new AI-driven partnerships, and raised guidance has been accompanied by a steadily climbing share price, up 11.4% over the past three months despite a slightly negative 1-year total shareholder return. While long-term investors have seen dramatic gains—RadNet’s three-year total shareholder return stands at an impressive 351%—momentum is notably building again as digital health and imaging growth stories pick up steam.

If RadNet’s tech-fueled rebound has you curious, now’s a great time to discover fast-growing companies with high insider ownership and see which ones are making waves through fast growing stocks with high insider ownership.

But with RadNet hitting record highs and lifting its guidance, investors are left to wonder: Is the stock still undervalued after its rapid run, or has the market already priced in the next leg of growth?

Most Popular Narrative: 13% Undervalued

With RadNet’s fair value pegged at $86.67 by the most widely followed narrative and a recent close of $75.15, analysts see considerable upside even as the stock’s advance continues. Investors are tuning into why this difference in valuation exists, especially with fresh guidance and stronger market positioning in play.

Ongoing investments in AI-powered imaging solutions (e.g., DeepHealth, See-Mode, iCAD) are materially increasing center throughput, boosting capacity utilization, and driving more high-margin advanced procedures. This is directly enhancing both revenue growth and EBITDA margins as adoption scales through 2026.

Want to know the secret sauce behind this bullish narrative? The valuation hinges on ambitious profit margin expansion and bold growth forecasts. These are numbers that could reshape expectations for years to come. If you’re curious which financial leaps are baked into this upside, the full narrative breaks down every high-conviction projection fueling the target price.

Result: Fair Value of $86.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including heavy ongoing investments in AI and potential reimbursement headwinds. These factors could limit margin expansion if demand softens.

Find out about the key risks to this RadNet narrative.

Another View: Peer Comparisons Suggest a Premium

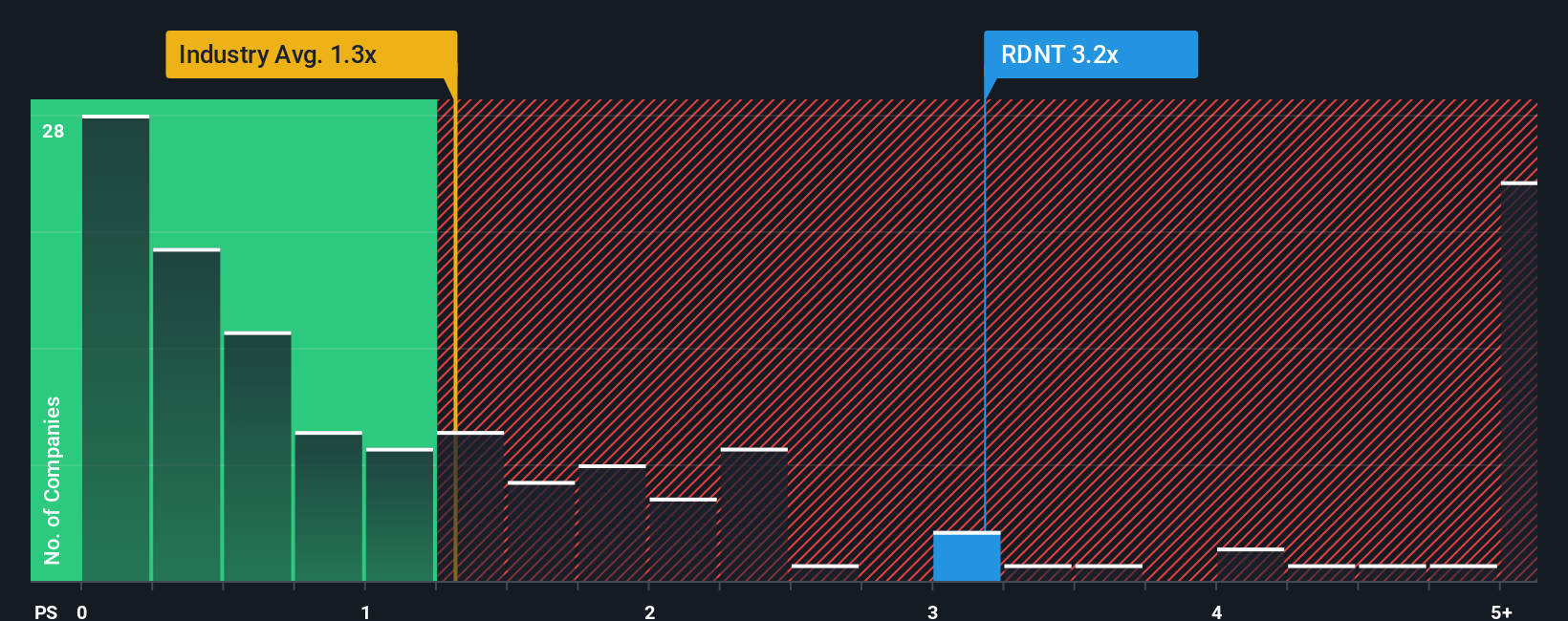

Looking at valuation through the lens of sales, RadNet trades at 2.9 times its revenue. This is significantly higher than both its peers (2.0x) and the broader US Healthcare sector (1.3x). The market is asking for a premium, which raises questions about valuation risk if expectations cool. Could this premium persist as growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RadNet Narrative

If you want to dig deeper and put your own spin on the numbers, you can easily craft your take in just minutes. Do it your way.

A great starting point for your RadNet research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Make your next smart move and tap into strategies you might be overlooking. Access hidden opportunities that could outpace the crowd, with just a few clicks.

- Start building a stream of passive income by checking out these 16 dividend stocks with yields > 3%, featuring established companies with yields topping 3%.

- Tap into artificial intelligence breakthroughs by finding the latest standouts through these 25 AI penny stocks, which showcases stocks at the forefront of this megatrend.

- Unlock potential bargains that others might miss with these 879 undervalued stocks based on cash flows, which spotlights stocks trading below their cash flow-based value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RDNT

RadNet

Provides outpatient diagnostic imaging services in the United States and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives