- United States

- /

- Medical Equipment

- /

- NasdaqGS:QDEL

QuidelOrtho Corporation's (NASDAQ:QDEL) 38% Dip In Price Shows Sentiment Is Matching Revenues

The QuidelOrtho Corporation (NASDAQ:QDEL) share price has fared very poorly over the last month, falling by a substantial 38%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 48% share price drop.

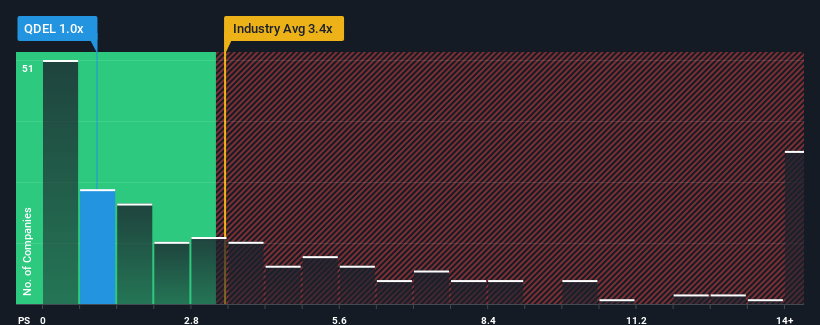

Since its price has dipped substantially, QuidelOrtho may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1x, considering almost half of all companies in the Medical Equipment industry in the United States have P/S ratios greater than 3.4x and even P/S higher than 8x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for QuidelOrtho

How QuidelOrtho Has Been Performing

While the industry has experienced revenue growth lately, QuidelOrtho's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on QuidelOrtho will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, QuidelOrtho would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a frustrating 8.1% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 80% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the seven analysts covering the company suggest revenue should grow by 1.4% each year over the next three years. That's shaping up to be materially lower than the 9.7% each year growth forecast for the broader industry.

With this information, we can see why QuidelOrtho is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From QuidelOrtho's P/S?

Shares in QuidelOrtho have plummeted and its P/S has followed suit. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of QuidelOrtho's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for QuidelOrtho (1 is concerning) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if QuidelOrtho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:QDEL

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives