- United States

- /

- Healthcare Services

- /

- NasdaqGM:PRE

Prenetics Global Limited (NASDAQ:PRE) Looks Just Right With A 29% Price Jump

Prenetics Global Limited (NASDAQ:PRE) shareholders would be excited to see that the share price has had a great month, posting a 29% gain and recovering from prior weakness. But the last month did very little to improve the 54% share price decline over the last year.

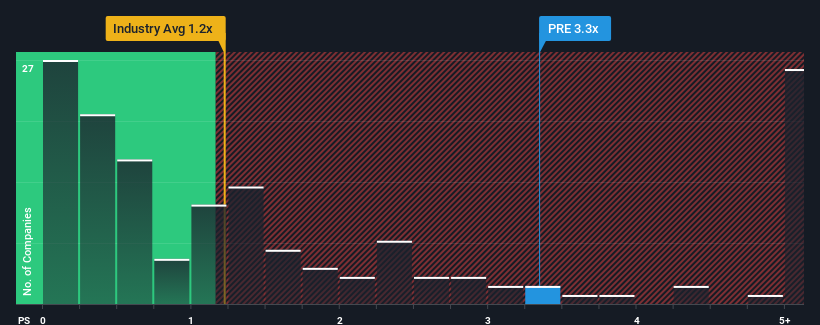

Following the firm bounce in price, given around half the companies in the United States' Healthcare industry have price-to-sales ratios (or "P/S") below 1.2x, you may consider Prenetics Global as a stock to avoid entirely with its 3.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Prenetics Global

How Has Prenetics Global Performed Recently?

Recent times have been advantageous for Prenetics Global as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Prenetics Global's future stacks up against the industry? In that case, our free report is a great place to start.How Is Prenetics Global's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Prenetics Global's is when the company's growth is on track to outshine the industry decidedly.

If we review the last year of revenue growth, the company posted a terrific increase of 65%. Still, revenue has fallen 67% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 62% over the next year. That's shaping up to be materially higher than the 7.4% growth forecast for the broader industry.

With this information, we can see why Prenetics Global is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Prenetics Global's P/S?

The strong share price surge has lead to Prenetics Global's P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look into Prenetics Global shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Prenetics Global (1 is a bit unpleasant!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Prenetics Global, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:PRE

Prenetics Global

A health sciences company, focuses on advancing consumer and clinical health.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives