- United States

- /

- Medical Equipment

- /

- NasdaqGS:PODD

Is Insulet Fairly Priced After Its Strong Run and High Earnings Multiple in 2025?

Reviewed by Bailey Pemberton

- If you are looking at Insulet and wondering whether the recent price makes it a buy, hold, or avoid, you are not alone. This stock often divides opinion among growth focused investors.

- After a strong run to around $289.62, the shares are still up 12.8% year to date and 10.0% over the last year, even though the stock has slipped 0.6% in the past week and 12.5% over the past month and remains roughly flat over 3 years while still compounding at 13.2% over 5 years.

- Recent attention has centred on Insulet's expanding role in diabetes care technology and how its flagship wearable insulin management systems are being adopted in key markets. Investors have been weighing that growth narrative against changing competitive dynamics and evolving expectations for the broader medical device space.

- On our metrics, Insulet only scores 1 out of 6 on the valuation checks, which suggests the market may already be pricing in a lot of optimism. Next we will unpack how different valuation approaches view the stock and finish by looking at a more robust way to interpret that valuation in context.

Insulet scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Insulet Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting its future cash flows and then discounting those cash flows back into current dollars.

For Insulet, the latest twelve month Free Cash Flow is about $366.6 million. Analyst and extrapolated projections see Free Cash Flow rising steadily, with estimates such as roughly $425.5 million in 2026 and $476.7 million in 2027, reaching around $1.34 billion by 2035. These figures are based on a 2 Stage Free Cash Flow to Equity model, where analyst forecasts inform the near term and Simply Wall St extrapolates further growth beyond that initial horizon.

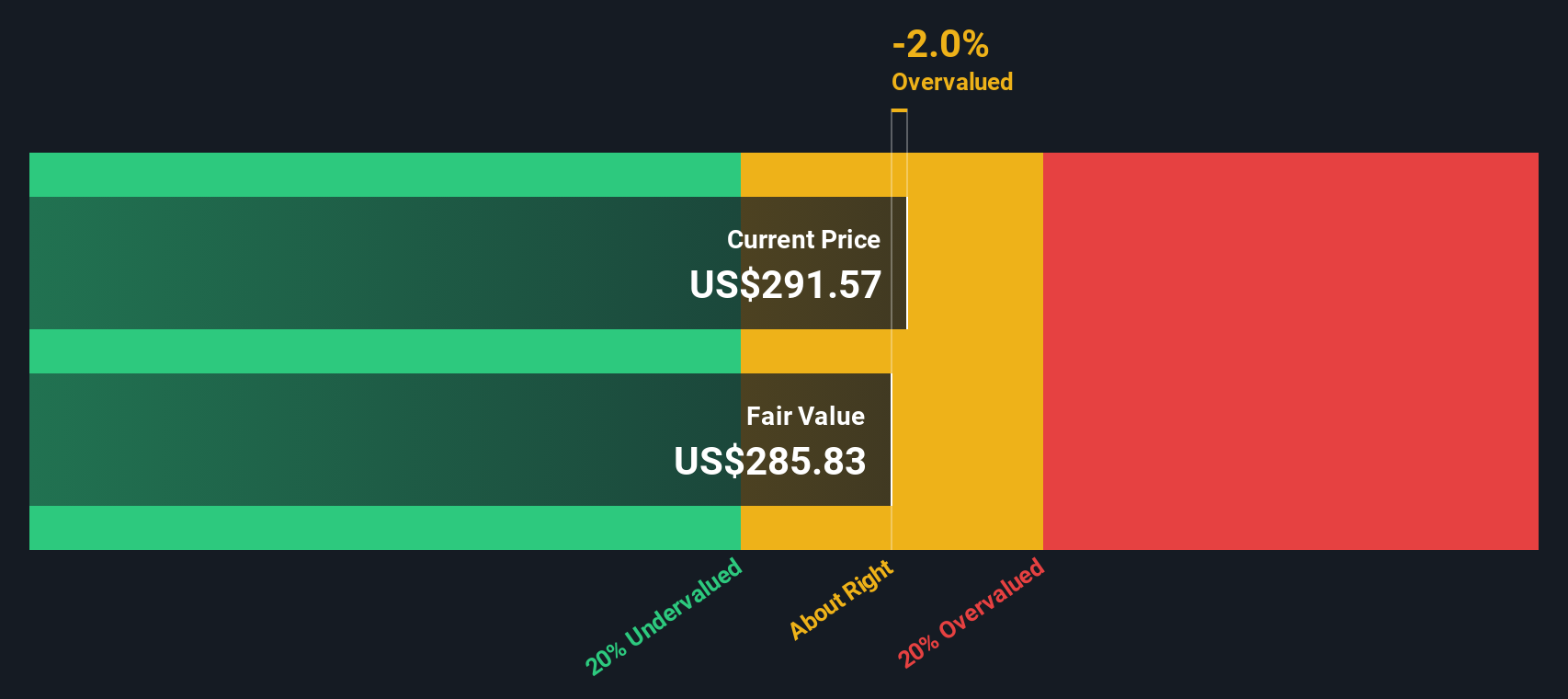

When all those projected cash flows are discounted back, the intrinsic value is about $285.83 per share. Compared with the recent market price around $289.62, the model suggests Insulet is roughly 1.3% overvalued. This is effectively in the fair value range rather than clearly cheap or expensive.

Result: ABOUT RIGHT

Insulet is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Insulet Price vs Earnings

For profitable companies like Insulet, the Price to Earnings ratio is a useful way to gauge valuation because it links what investors pay today to the profits the business is already generating. In general, higher growth and lower perceived risk can justify a higher PE ratio, while slower or more uncertain growth usually warrants a lower, more conservative multiple.

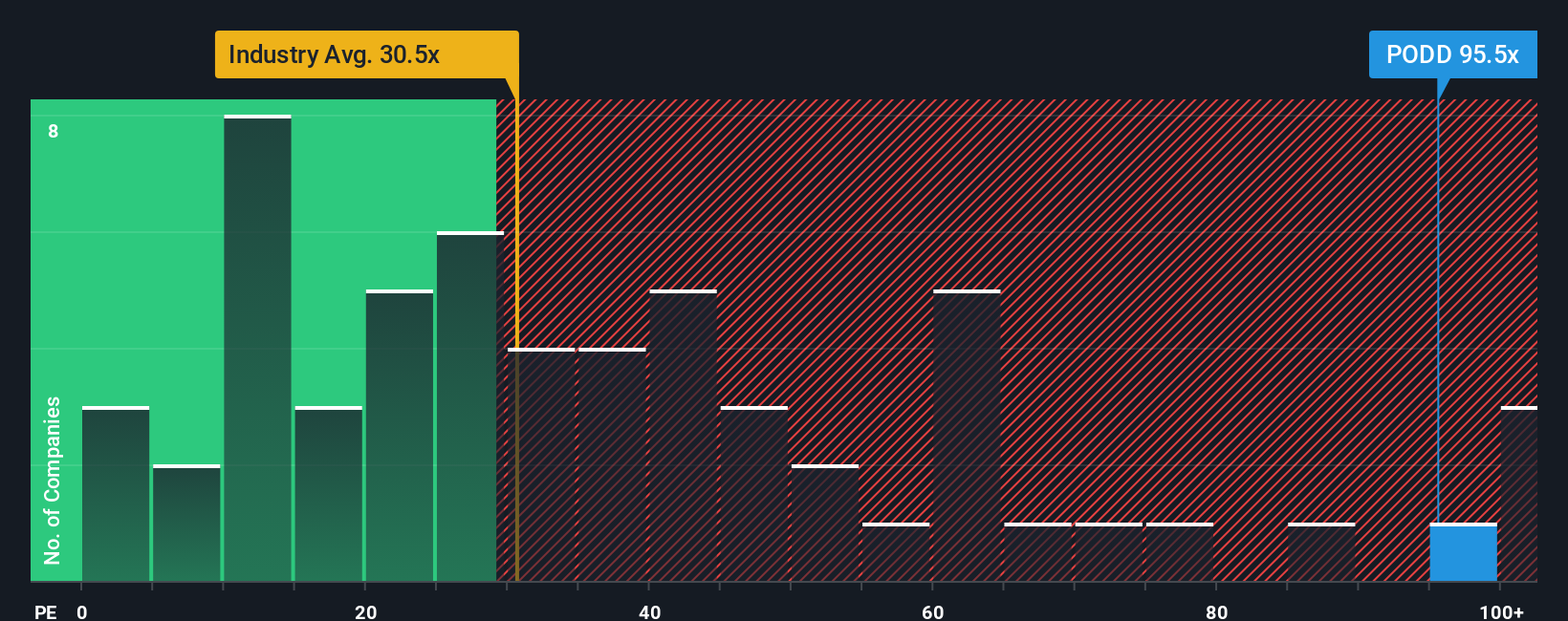

Insulet currently trades on about 82.8x earnings, which is well above the broader Medical Equipment industry average of roughly 29.7x and also ahead of the peer group average around 42.3x. Simply Wall St uses a proprietary Fair Ratio, which estimates what a more appropriate PE might be after accounting for Insulet’s earnings growth profile, margins, industry, market cap and risk factors. For Insulet, that Fair Ratio is about 37.3x, materially below the current market multiple.

Because the Fair Ratio incorporates company specific drivers rather than just comparing to peers or the sector, it offers a more tailored view of value. On this basis, Insulet’s current PE suggests the shares are trading at a premium to what its fundamentals justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1459 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Insulet Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you connect your view of Insulet’s story to a set of forecasts and a fair value estimate. You can then compare that fair value to the current share price to help decide whether to buy, sell, or hold. Your Narrative automatically updates as new earnings, news, or guidance arrive. For Insulet, you might see one investor building a bullish Narrative around rapid Type 2 diabetes expansion and assigning a fair value near the high end of recent targets around the low to mid $400s. Another investor might focus on product concentration risk and competitive pressure, landing closer to the low $300s. Narratives makes these different perspectives transparent and easy to explore so you can choose or refine the one that best matches your own expectations for revenue growth, margins, and the multiple the market will be willing to pay.

Do you think there's more to the story for Insulet? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PODD

Insulet

Develops, manufactures, and sells insulin delivery systems for people with insulin-dependent diabetes in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion