- United States

- /

- Medical Equipment

- /

- NasdaqGS:PODD

Insulet (NasdaqGS:PODD) Launches Omnipod 5 iPhone App With Dexcom G7 Compatibility

Reviewed by Simply Wall St

Insulet (NasdaqGS:PODD) recently announced that its Omnipod® 5 App for iPhone is now compatible with the Dexcom G7 Continuous Glucose Monitoring System, enhancing its Automated Insulin Delivery capabilities. Over the last quarter, the company's share price increased by 20%, reflecting investor enthusiasm likely spurred by product advancements and strategic moves, such as new executive leadership under CEO Ashley McEvoy. These developments, alongside optimistic revenue guidance and expanded marketing into Canada, likely bolstered the company’s stock performance in congruence with broader market optimism, evidenced by gains in major indices such as the S&P 500 and Nasdaq.

Buy, Hold or Sell Insulet? View our complete analysis and fair value estimate and you decide.

The recent announcement by Insulet regarding the compatibility of its Omnipod® 5 App with the Dexcom G7 system may further boost its market presence, as it enhances Automated Insulin Delivery capabilities. This innovation aligns with broader efforts to expand Omnipod 5's reach into the type 2 diabetes market, potentially impacting the company's revenue growth, which analysts expect to increase by 17% annually over the next three years. The extension of Omnipod 5 into new geographical markets, supported by FDA clearance, is expected to substantially broaden Insulet's addressable market and drive revenue increases.

Over the past five years, Insulet's total shareholder return was 62.45%, a robust performance reflecting investor confidence in its growth trajectory and innovative product offerings. This long-term appreciation dwarfs the 12.4% return of the US market and the 7% from the Medical Equipment industry over the past year. Such performance underscores the investor sentiment buoyed partly by strategic product enhancement and expansion.

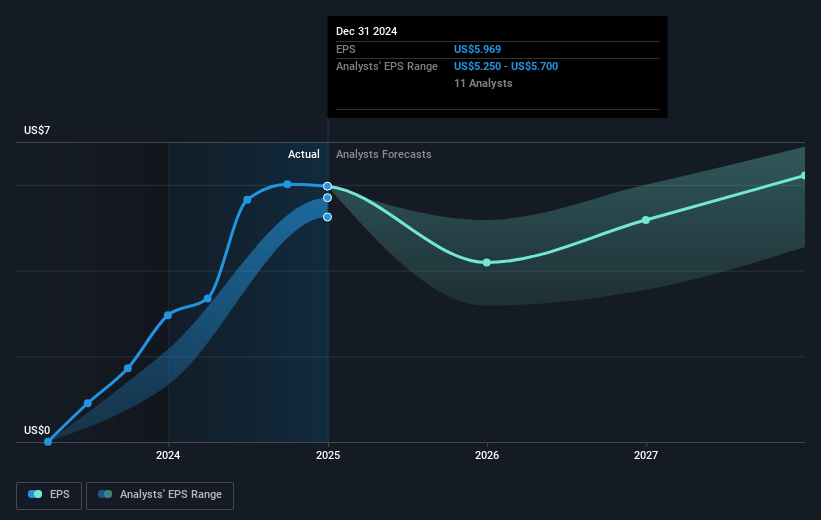

Despite recent share price gains of 20%, the stock still trades below the consensus analyst price target of US$313.60. This suggests that there remains potential upside for investors aligning with analyst expectations. However, future revenue and earnings projections indicate a possible compression of profit margins from 20.2% to 14.1% by 2028, necessitating careful monitoring of operational and financial efficiencies to achieve targets. As the share price movement progresses toward the price target, ongoing innovations and successful market expansion will be critical factors influencing analyst forecasts and investor sentiments.

Jump into the full analysis health report here for a deeper understanding of Insulet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PODD

Insulet

Develops, manufactures, and sells insulin delivery systems for people with insulin-dependent diabetes in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion