- United States

- /

- Medical Equipment

- /

- NasdaqGS:PODD

How Investors May Respond To Insulet (PODD) Raising Guidance After Omnipod-Driven Q3 Sales Surge

Reviewed by Sasha Jovanovic

- Insulet Corporation recently reported its third quarter results, posted US$706.2 million in sales, US$87.6 million in net income, and raised its revenue guidance for the fourth quarter and full year 2025, citing increased demand for its Omnipod system.

- A key insight from the announcement is the company’s upward revision in revenue expectations, which reflects higher management confidence in ongoing Omnipod adoption and market momentum.

- With revenue guidance raised for both the fourth quarter and full year, we’ll explore what this means for Insulet’s long-term growth outlook.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Insulet Investment Narrative Recap

To be a shareholder in Insulet today, you need to believe in the long-term adoption and expansion of the Omnipod platform as the core driver of growth. The latest news, strong sales momentum and higher revenue guidance, reinforces optimism around Omnipod’s market position, but it does not materially reduce the near-term risk of technological disruption or competitive advances, which could still threaten Insulet's earnings if market preferences shift.

Of the recent announcements, Insulet’s raised revenue guidance for both the fourth quarter and full year closely ties in with the company’s most immediate growth catalyst: broadening adoption of Omnipod 5 in existing and new international markets. This momentum is critical while the company continues to invest in manufacturing and launches, and underscores why investors are watching near-term adoption trends closely.

But on the other hand, investors should be mindful of the continued risk from emerging diabetes technologies that could rapidly alter market share if...

Read the full narrative on Insulet (it's free!)

Insulet's outlook projects $3.9 billion in revenue and $542.3 million in earnings by 2028. This scenario assumes 17.8% annual revenue growth and a $306 million increase in earnings from the current level of $236.1 million.

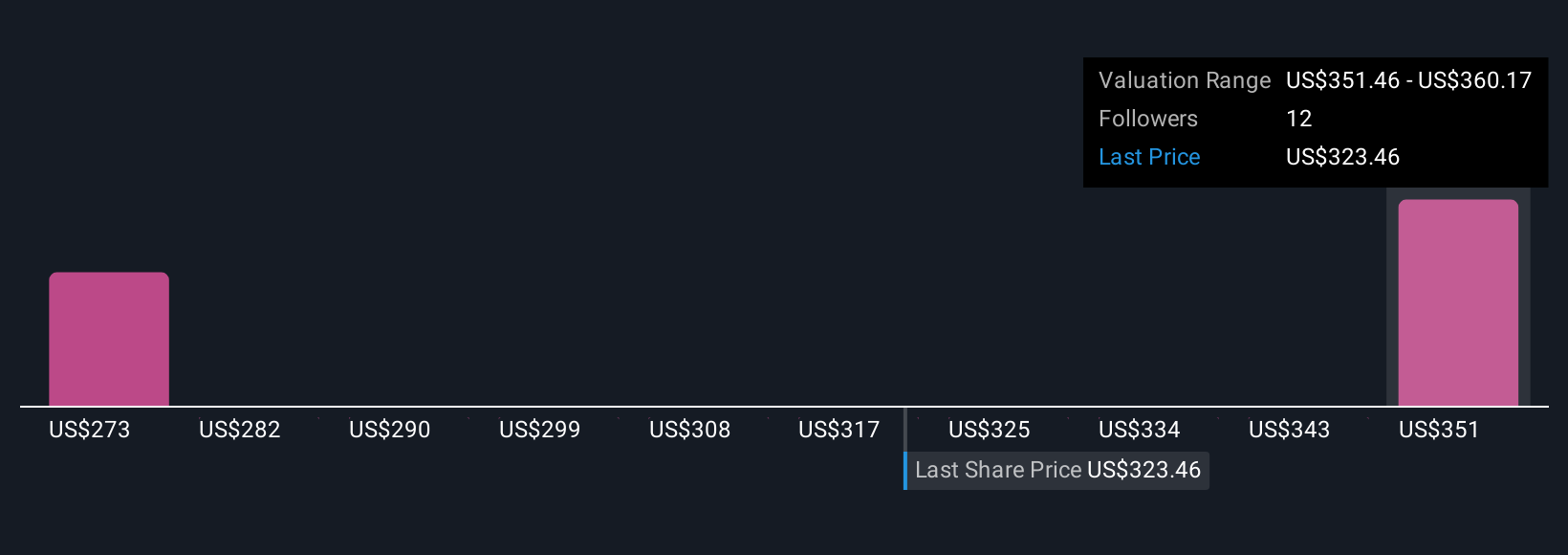

Uncover how Insulet's forecasts yield a $365.96 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range from US$298.38 to US$365.96, reflecting just two different approaches to Insulet's growth outlook. While opinions certainly vary, the company's continuing reliance on Omnipod highlights why broader innovation trends may play a decisive role in shaping future performance.

Explore 2 other fair value estimates on Insulet - why the stock might be worth 10% less than the current price!

Build Your Own Insulet Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Insulet research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Insulet research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Insulet's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PODD

Insulet

Develops, manufactures, and sells insulin delivery systems for people with insulin-dependent diabetes in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives