- United States

- /

- Medical Equipment

- /

- NasdaqCM:PLSE

Pulse Biosciences (PLSE): Evaluating Valuation Following FDA Approval for Cardiac Surgery System Study

Reviewed by Kshitija Bhandaru

If you have been keeping an eye on Pulse Biosciences (PLSE) lately, the news of the company’s FDA approval to begin its nsPFA Cardiac Surgery System Study for atrial fibrillation is tough to ignore. This green light is more than just a technicality; it gives Pulse Biosciences the go-ahead to put its nonthermal ablation technology to the test in real-world cardiac surgeries across multiple sites. For investors, this step signals that the company’s preclinical and early clinical data have cleared a high regulatory bar, shifting the conversation from potential to progress.

Following this milestone, Pulse Biosciences’ stock has seen shifts that reflect changing investor sentiment about its long-term prospects. Over the past month, its shares are up around 3 percent, with a jump of 21 percent in the past week, suggesting that momentum has picked up as the market digests the clinical news. Still, looking at the past year, the price performance has lagged, and the stock has given up some ground overall. The recent announcement joins a steady stream of updates, including presentations at medical conferences that keep the company on the radar for both industry experts and investors.

This brings us to a key question: after the latest rally and landmark regulatory win, is Pulse Biosciences a bargain with more upside, or are investors already pricing in future breakthroughs?

Price-to-Book Ratio of 11.3x: Is it justified?

Pulse Biosciences is currently trading at a price-to-book ratio of 11.3 times, which is significantly higher than the US Medical Equipment industry average of 2.7 times. This makes the stock appear expensive relative to its peers in the sector.

The price-to-book (P/B) ratio measures a company's market value compared to its book value. For medical device companies, this metric is commonly used when earnings are negative or highly variable. It reflects the market's expectations for future asset growth or returns. Since Pulse Biosciences is not yet profitable, P/B offers a key lens for understanding investor sentiment.

This elevated multiple suggests the market is pricing in significant future growth or breakthrough potential. However, the company remains unprofitable and currently has minimal revenue. The high P/B ratio may be hard to justify in the near term unless Pulse Biosciences can rapidly translate its innovative technology and regulatory wins into sustainable revenue and profits.

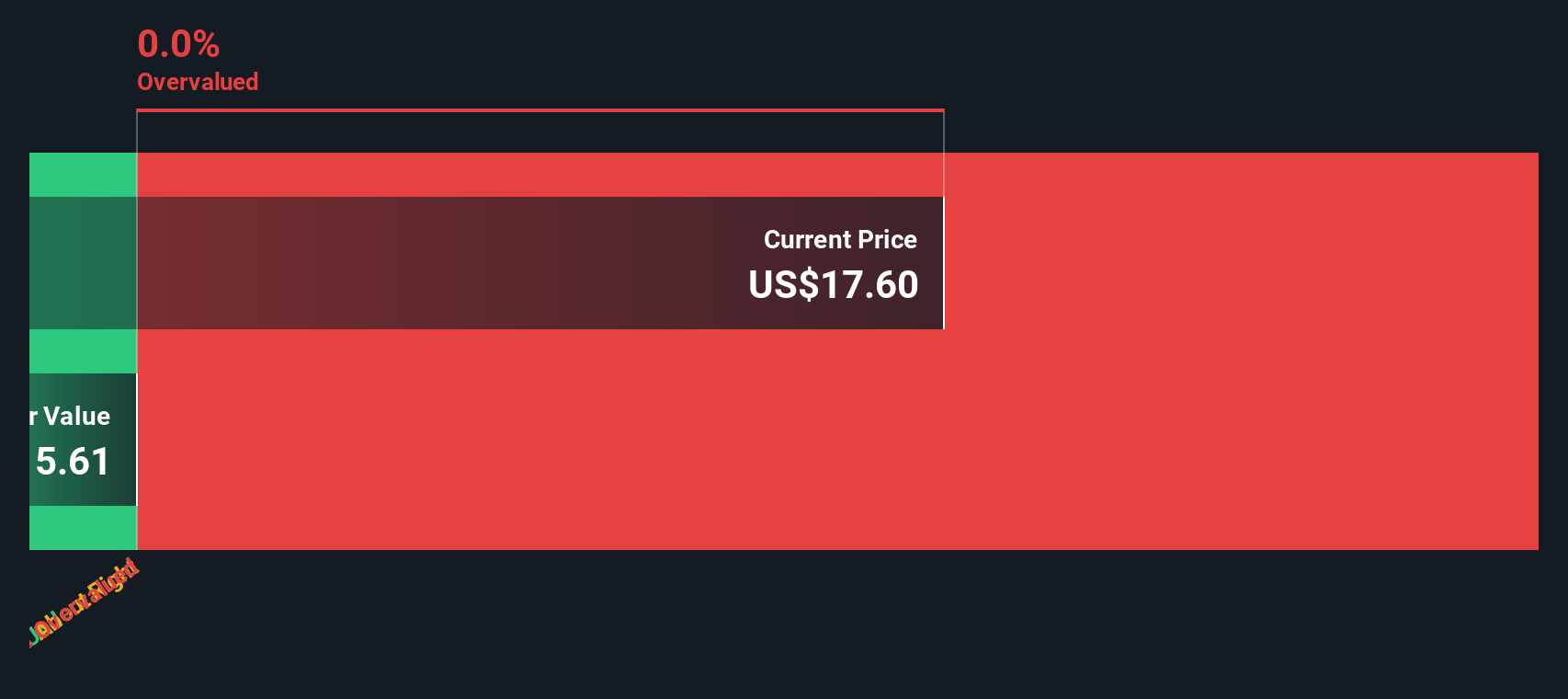

Result: Fair Value of $17.61 (OVERVALUED)

See our latest analysis for Pulse Biosciences.However, ongoing losses and zero revenue continue to cast doubt. Any setbacks in clinical progress could quickly temper recent investor optimism.

Find out about the key risks to this Pulse Biosciences narrative.Another View: Discounted Cash Flow Model Offers No Relief

A second perspective comes from our DCF model, which tries to estimate the long-term intrinsic value based on future cash flows. However, there is not enough data to calculate a fair value in this case, leaving investors with more questions than answers. Could this signal hidden upside, or is caution still warranted?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Pulse Biosciences Narrative

If you see the story differently or want to dive deeper into the numbers yourself, it’s easy to put together your own view in just a few minutes. Do it your way

A great starting point for your Pulse Biosciences research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Staying ahead means always searching for standout stocks. Simply Wall St’s smart screeners handpick opportunities others might miss. Don’t let the next hot trend or hidden gem slip by. Your future portfolio could thank you for checking out the latest ideas.

- Unlock the strongest dividend potential by seizing opportunities among dividend stocks with yields > 3%, where stable income meets reliable long-term performance.

- Catch the next wave in artificial intelligence by selecting innovators dominating AI penny stocks, poised to transform industries and outpace the competition.

- Spot high-value bargains early by targeting shares that are trading well below their intrinsic worth with undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PLSE

Flawless balance sheet with low risk.

Market Insights

Community Narratives