- United States

- /

- Healthcare Services

- /

- NasdaqGS:PGNY

White House IVF Policy Proposal Could Be a Game Changer for Progyny (PGNY)

Reviewed by Sasha Jovanovic

- Earlier this week, the White House proposed a policy to make in vitro fertilization (IVF) more accessible, encouraging employers to offer IVF and infertility coverage as standalone benefits without federal funding or mandatory participation.

- This initiative could prompt employers to expand infertility treatment offerings and may serve as a catalyst for companies specializing in fertility benefits, such as Progyny, given their established presence and expertise in the sector.

- We'll look at how government efforts to broaden IVF access could reshape Progyny's growth prospects and overall investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Progyny Investment Narrative Recap

For anyone considering Progyny as an investment, the core thesis centers on persistent employer demand for fertility and family-building benefits, with the company aiming to deepen its reach as these offerings move into the mainstream. The White House’s new IVF proposal could act as a tailwind if it accelerates employer adoption, but broad-based cost containment efforts by companies remain the most important near-term risk, offsetting the catalyst by limiting spend even as policies encourage broader coverage. If employer belt tightening outweighs regulatory momentum, revenue growth expectations could face pressure.

Among recent announcements, the partnership with Amazon's Health Benefits Connector stands out as most directly relevant, streamlining Progyny’s access to new clients and aligning with potential increases in benefit adoption signaled by the latest policy proposal. This move not only widens distribution but also strengthens Progyny’s position if more employers seek simple, plug-and-play fertility coverage amid a shifting regulatory landscape.

Yet, despite the optimism surrounding expanded IVF access, investors should weigh how periods of employer caution could mean that...

Read the full narrative on Progyny (it's free!)

Progyny's narrative projects $1.6 billion in revenue and $112.9 million in earnings by 2028. This requires 8.9% yearly revenue growth and a $59.8 million increase in earnings from the current $53.1 million.

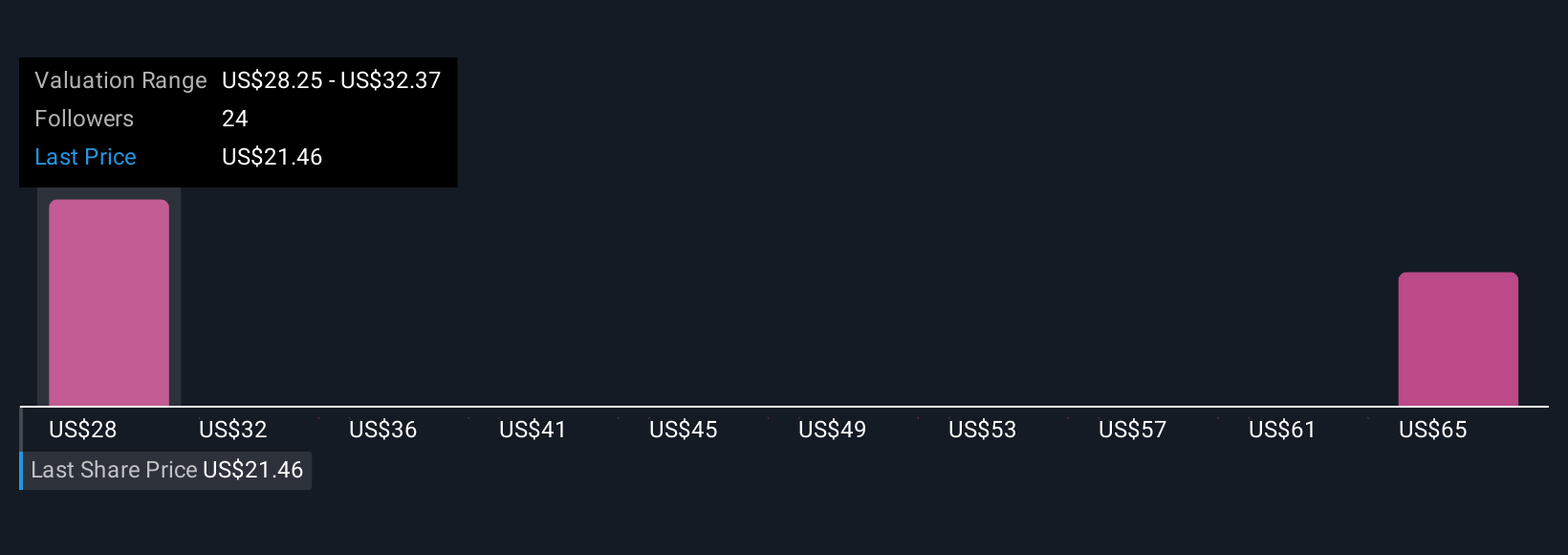

Uncover how Progyny's forecasts yield a $28.25 fair value, a 46% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community range widely from US$21.00 to US$69.42 per share. As employer spending habits can change in response to economic or policy shifts, it pays to see how your expectations measure up against this spectrum of views.

Explore 4 other fair value estimates on Progyny - why the stock might be worth just $21.00!

Build Your Own Progyny Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Progyny research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Progyny research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Progyny's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PGNY

Progyny

A benefits management company, provides fertility, family building, and women’s health benefits solutions in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives