- United States

- /

- Healthcare Services

- /

- NasdaqGS:PGNY

Did At-Home Semen Testing Integration Just Shift Progyny's (PGNY) Competitive Edge in Fertility Care?

Reviewed by Simply Wall St

- Earlier this month, Fellow Health announced it has joined Progyny's provider network to offer mail-in semen analysis as a covered benefit, giving eligible members access to clinically validated, at-home fertility testing.

- This collaboration is designed to remove barriers to male infertility evaluation, supporting more accessible and personalized fertility care for Progyny's members nationwide.

- We'll explore how expanding access to at-home male fertility testing may influence Progyny's growth outlook and competitive positioning.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Progyny Investment Narrative Recap

At its core, holding Progyny stock is a belief in the long-term expansion of fertility and family-building benefits, driven by sustained employer and member demand. The addition of Fellow Health’s mail-in semen analysis as a covered benefit could improve short-term member engagement, but is unlikely to materially alter the most significant near-term catalysts, ongoing client acquisition, and the chief risk of cost containment among employers prioritizing benefits.

The recent partnership with Amazon’s Health Benefits Connector stands out as particularly relevant. By simplifying access to Progyny’s offerings for new and existing clients, this collaboration is closely aligned with the ongoing catalyst of broadening the client base, which remains key to revenue growth as coverage and availability of fertility care becomes more seamless for employees.

Yet, in contrast, investors should remain alert to the elevated risk that employer-driven cost containment and benefit reprioritization could cap member growth or limit service adoption...

Read the full narrative on Progyny (it's free!)

Progyny's narrative projects $1.6 billion in revenue and $112.9 million in earnings by 2028. This requires 8.9% yearly revenue growth and a $59.8 million earnings increase from the current earnings of $53.1 million.

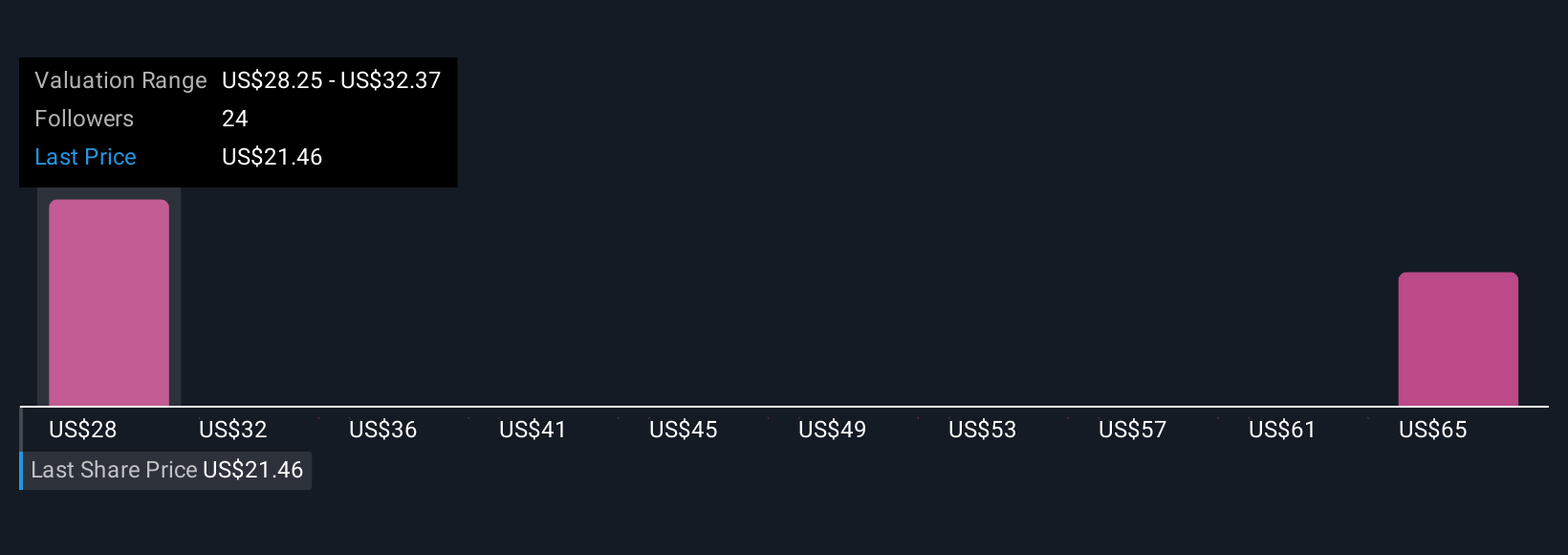

Uncover how Progyny's forecasts yield a $28.25 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span from US$28.25 to US$69.42 per share, illustrating how sentiment around Progyny’s future can vary substantially. Against this backdrop, the outlook for further client acquisition remains a central focus as you consider how market participation and competition could shape results over time.

Explore 3 other fair value estimates on Progyny - why the stock might be worth just $28.25!

Build Your Own Progyny Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Progyny research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Progyny research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Progyny's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PGNY

Progyny

A benefits management company, provides fertility, family building, and women’s health benefits solutions in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives