- United States

- /

- Medical Equipment

- /

- NasdaqCM:PDEX

Pro-Dex (PDEX): One-Off $2.1M Gain Drives Surge in Profit, Challenging Core Growth Narrative

Reviewed by Simply Wall St

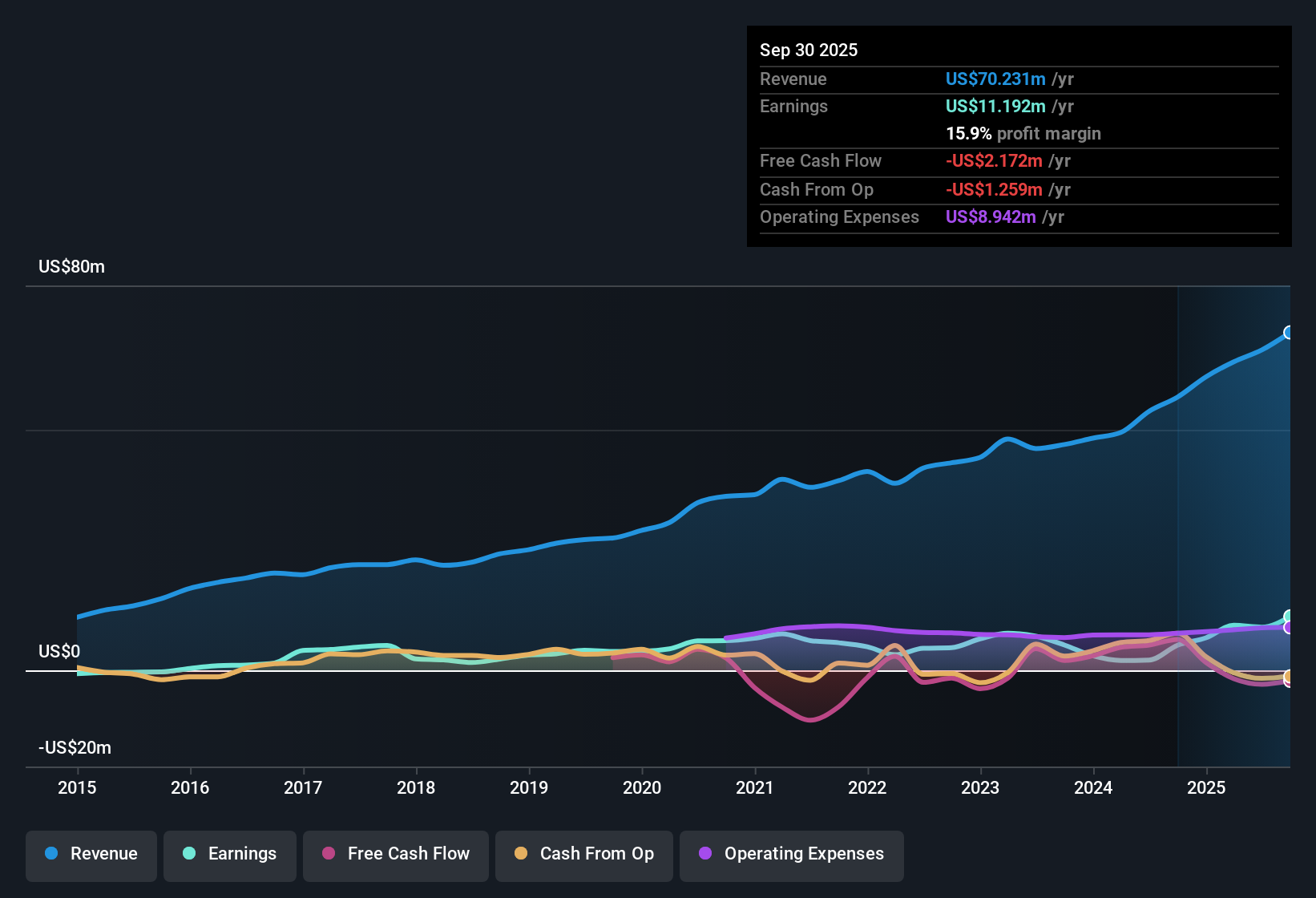

Pro-Dex (PDEX) booked a net profit margin of 13.5% for the most recent period, sharply higher than last year’s 4%. The big headline is a $2.1 million one-off gain, which fueled eye-catching earnings growth of 322.1% year-over-year. This dramatically outpaced the company’s 1% annualized earnings growth over the past five years. With the Price-to-Earnings Ratio at 13.2x, below both peer and industry averages, investors are left weighing a modest valuation against the reality that current profits are inflated by non-recurring items.

See our full analysis for Pro-Dex.Next, we will see how these numbers stack up against widely followed narratives and whether the recent surge in profits actually changes the story for Pro-Dex going forward.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gain Flattens Five-Year Growth Pace

- Pro-Dex’s $2.1 million non-recurring gain accounts for most of the 322.1% profit surge this year, a sizeable spike compared to its modest 1% average annual earnings growth over the last five years.

- Recent market analysis notes that sharp one-time boosts such as this can excite investors but also make it much harder to evaluate the business’s true profitability beneath the surface.

- What stands out is how the jump in net profit margin to 13.5% occurs while long-term annualized growth remains persistently low, challenging any assumption of a significant change in the company’s underlying trajectory.

- This keeps the focus on whether future results can sustain gains without the help of such infrequent items.

Profit Quality Flagged As a Risk

- Earnings quality is noted as a minor risk since profit growth was heavily shaped by the one-off gain rather than improvements in ongoing operations or core revenue streams.

- The prevailing narrative from market frameworks emphasizes that while investors often reward companies for headline profit jumps, caution is warranted when results are boosted by events that are not expected to recur.

- This becomes more relevant when long-term growth, at just 1% annualized, points to limited momentum once temporary boosts subside.

- Such situations frequently attract heightened scrutiny over whether subsequent quarters can meet investor expectations for continued improvement.

Valuation Discount Versus Industry

- Pro-Dex trades at a Price-to-Earnings ratio of 13.2x, which is below the US Medical Equipment industry average of 27.7x and the peer average of 17.1x. This highlights a clear valuation discount for investors at the current share price of $36.24.

- The current comparison to sector norms supports the idea that, even with short-term profit boosts, the market awaits more consistent evidence of durable earnings before awarding a valuation closer to industry multiples.

- While discounted pricing can appear attractive, it underscores how investors tend to approach such valuations carefully when underlying profit drivers rely on non-recurring events.

- This context positions the present multiple as a potential opportunity or simply a reflection of ongoing skepticism related to earnings quality.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Pro-Dex's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Pro-Dex’s reliance on a one-off gain and persistently modest long-term growth highlights a lack of steady and reliable earnings momentum.

If you want to focus on companies with a more reliable record, check out stable growth stocks screener (2103 results) and find businesses delivering consistent growth over time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PDEX

Pro-Dex

Designs, develops, manufactures, and sells powered surgical instruments for medical device original equipment manufacturers worldwide.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.