- United States

- /

- Healthcare Services

- /

- NasdaqGS:OMDA

Omada Health (OMDA): Assessing Valuation as Shares Gain Momentum

Reviewed by Kshitija Bhandaru

See our latest analysis for Omada Health.

Omada Health’s share price has gained real momentum lately, with the 7-day and 30-day share price returns both landing around 9% and the 90-day return topping 36%. While broader gains are less dramatic, investors are starting to notice the company’s improving revenue growth and respond with fresh interest. This suggests sentiment is shifting toward cautious optimism.

If you’re interested in what other healthcare names are catching investor attention, here’s your invitation to explore See the full list for free.

The key question now is whether Omada Health shares remain undervalued given the company's growth trajectory. Alternatively, all of the anticipated progress may already be reflected in the current price, which could leave limited upside for new buyers.

Price-to-Sales Ratio of 6.6x: Is it justified?

Omada Health is currently trading at a price-to-sales (P/S) ratio of 6.6x, which is well above both the U.S. Healthcare industry average (1.4x) and its peer group (1.2x). This indicates that the market is already pricing in robust future growth or unique advantages for the company. The latest close is at $24.01 per share.

The price-to-sales metric provides a quick way to gauge how much investors are willing to pay for every dollar of the company’s revenues, especially when the business is unprofitable. For Omada Health, this higher-than-average P/S ratio suggests that investors expect sustained growth in the top line, potentially beyond what is typical for other healthcare firms at this stage.

Compared to both the industry and its peers, Omada Health appears significantly more expensive on this measure. The substantial premium reflects high market expectations for revenue growth or future profitability. However, there is insufficient data to determine what a fair price-to-sales ratio should be for the company, so this premium may not be fully justified if growth does not materialize as expected.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 6.6x (OVERVALUED)

However, risks remain if Omada Health's revenue growth slows or if continued net losses persist longer than investors anticipate, which could potentially pressure the share price.

Find out about the key risks to this Omada Health narrative.

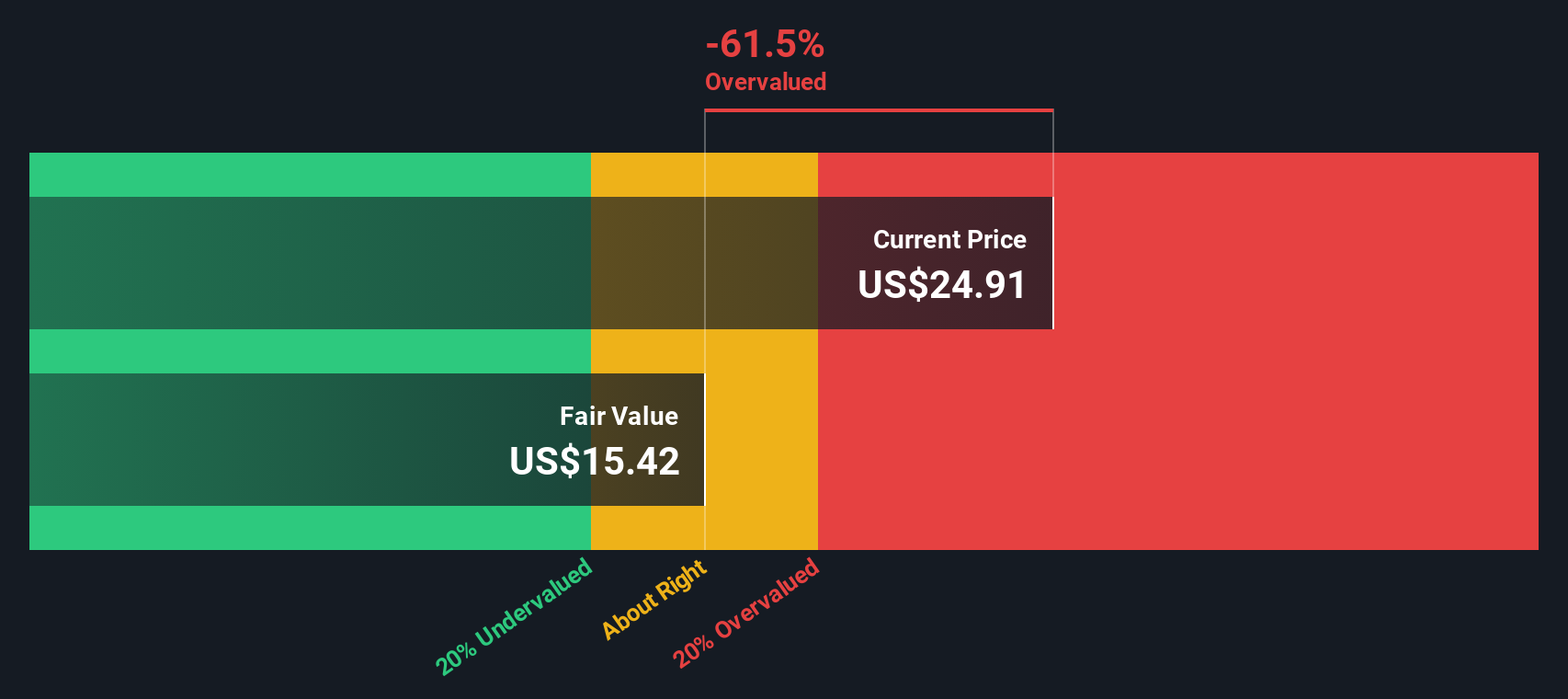

Another View: SWS DCF Model Suggests Overvaluation

Looking at Omada Health from a different angle, our DCF model places its fair value at $15.42, which is well below the current price of $24.01. This suggests the shares could be overvalued based on future cash flows. Does this mean the optimism in the sales multiple is misplaced? Alternatively, is the market seeing something that the DCF model does not capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Omada Health for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Omada Health Narrative

If you have a different perspective or want to look deeper into the numbers yourself, building your personal view is quick and straightforward. It takes just a few minutes. Do it your way

A great starting point for your Omada Health research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t limit your search to just one option. There’s a world of opportunities out there for smart investors ready to act today.

- Tap into steady income potential with these 19 dividend stocks with yields > 3% that offer regular payouts backed by strong fundamentals.

- Accelerate your portfolio’s growth with these 24 AI penny stocks pushing the boundaries of artificial intelligence and disruptive innovation.

- Position yourself at the forefront of tomorrow’s breakthroughs by checking out these 26 quantum computing stocks revolutionizing the tech landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OMDA

Omada Health

Provides a range of virtual care programs in the United States.

Adequate balance sheet with concerning outlook.

Similar Companies

Market Insights

Community Narratives