- United States

- /

- Medical Equipment

- /

- NasdaqGS:OMCL

Omnicell (OMCL) valuation check as new Titan XT automation platform targets healthcare growth

Reviewed by Simply Wall St

Omnicell (OMCL) just rolled out Titan XT, a new enterprise level automated dispensing system built on its OmniSphere cloud platform, and the launch is already reshaping how investors think about the stock.

See our latest analysis for Omnicell.

The launch of Titan XT coincides with Omnicell’s 30 day share price return of 30.11 percent and 90 day share price return of 51.10 percent, which signal rapidly building momentum. However, the 5 year total shareholder return of negative 60.02 percent indicates that long term holders are still waiting for a full turnaround.

If this kind of healthcare automation story has your attention, it could be worth scanning other promising healthcare stocks that might be flying under your radar.

With shares rebounding but still well below five year highs and trading only modestly under analyst targets, the key question now is whether Omnicell remains undervalued or if the market is already pricing in Titan powered growth.

Most Popular Narrative: 9% Undervalued

With Omnicell last closing at 46.84 dollars against a narrative fair value of 51.50 dollars, expectations are quietly running ahead of the current quote.

The continued rollout and adoption of the cloud native OmniSphere platform across Omnicell's customer base will simplify enterprise wide medication management, make adding new features and integrating advanced analytics much easier, and accelerate the company's transition to higher margin, recurring SaaS based revenues, supporting improved revenue predictability and net margins.

Want to see what kind of revenue runway and margin shift are baked into that optimism? The real surprise is how rich the future earnings multiple needs to be to keep this story intact. Curious which assumptions have to hold for that to work?

Result: Fair Value of $51.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, tariff driven cost pressure and slower than expected SaaS mix shift could quickly undermine the optimism embedded in Titan powered earnings assumptions.

Find out about the key risks to this Omnicell narrative.

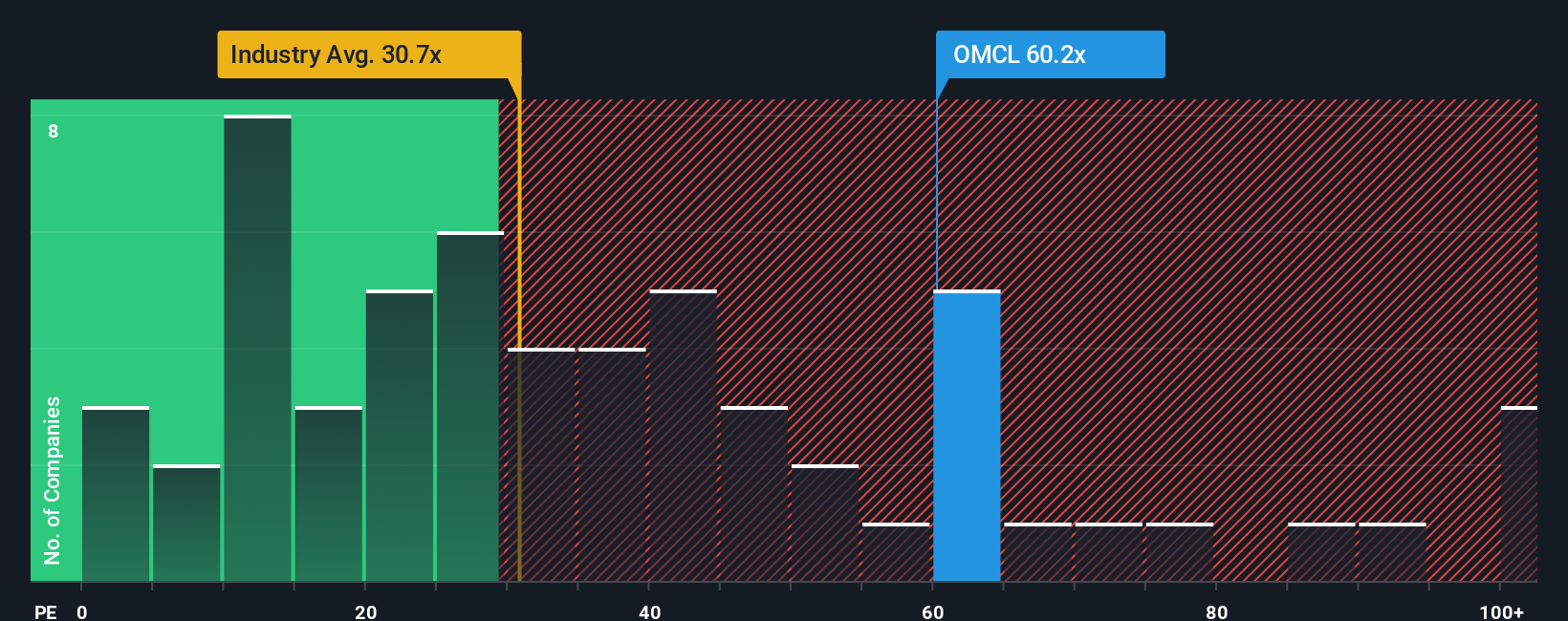

Another View: Multiples Flash a Caution Sign

While narrative fair value suggests modest upside, the current price implies a 105.5x earnings multiple. This is far richer than both the US Medical Equipment industry at 29.7x and peers at 23.3x, and well above a 34.9x fair ratio. Could sentiment be running ahead of fundamentals again?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Omnicell Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in just minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Omnicell.

Looking for your next smart move?

Before markets shift again, secure your edge by running fresh ideas through the Simply Wall Street Screener and lining up your next high conviction opportunities.

- Capture potential mispricings by running these 900 undervalued stocks based on cash flows and line up candidates where expectations still lag the underlying cash flows.

- Ride structural growth trends by targeting these 24 AI penny stocks positioned at the heart of machine learning and automation demand.

- Strengthen long term income potential by focusing on these 12 dividend stocks with yields > 3% that combine resilient cash generation with ongoing shareholder payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OMCL

Omnicell

Provides medication management solutions and adherence tools for healthcare systems and pharmacies the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion