- United States

- /

- Medical Equipment

- /

- NasdaqGS:OMCL

Does Omnicell’s (OMCL) Expanded Gastro Network Signal a Shift in Its Specialty Pharmacy Strategy?

Reviewed by Simply Wall St

- In late August 2025, Evoke Pharma and EVERSANA announced the addition of Omnicell as a key specialty pharmacy partner, aiming to expand GIMOTI nasal spray access across leading gastroenterology networks and nearly double the number of specialty pharmacies available for distribution.

- This collaboration not only broadens Omnicell’s presence in specialty pharmacy fulfillment but also aligns the company more closely with major physician organizations and insurance channels in the gastrointestinal space.

- We'll explore how Omnicell’s enhanced specialty pharmacy network presence could shape its investment narrative going forward.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Omnicell Investment Narrative Recap

To support Omnicell’s investment case, you need conviction in the ongoing shift toward cloud-based, recurring revenue solutions, as health systems seek more efficient medication management amid tight budgets and rising healthcare complexity. The recent pharmacy partnership with Evoke Pharma adds incremental exposure to the specialty pharmacy channel; however, it does not fundamentally shift the short-term catalyst, which remains the continued adoption of Omnicell’s OmniSphere platform. Key risks, particularly supply chain and tariff-related cost pressures, still warrant close investor attention.

Among recent company announcements, the appointment of Baird Radford as Chief Financial Officer stands out. Bringing deep healthcare finance experience, Radford may enhance Omnicell’s financial leadership as the company addresses both margin pressures from tariffs and the push for more resilient recurring revenues, core elements shaping near-term catalysts and risk management alike.

Yet, in contrast to the innovation-driven momentum, investors should be aware that ongoing tariff and supply chain cost increases could...

Read the full narrative on Omnicell (it's free!)

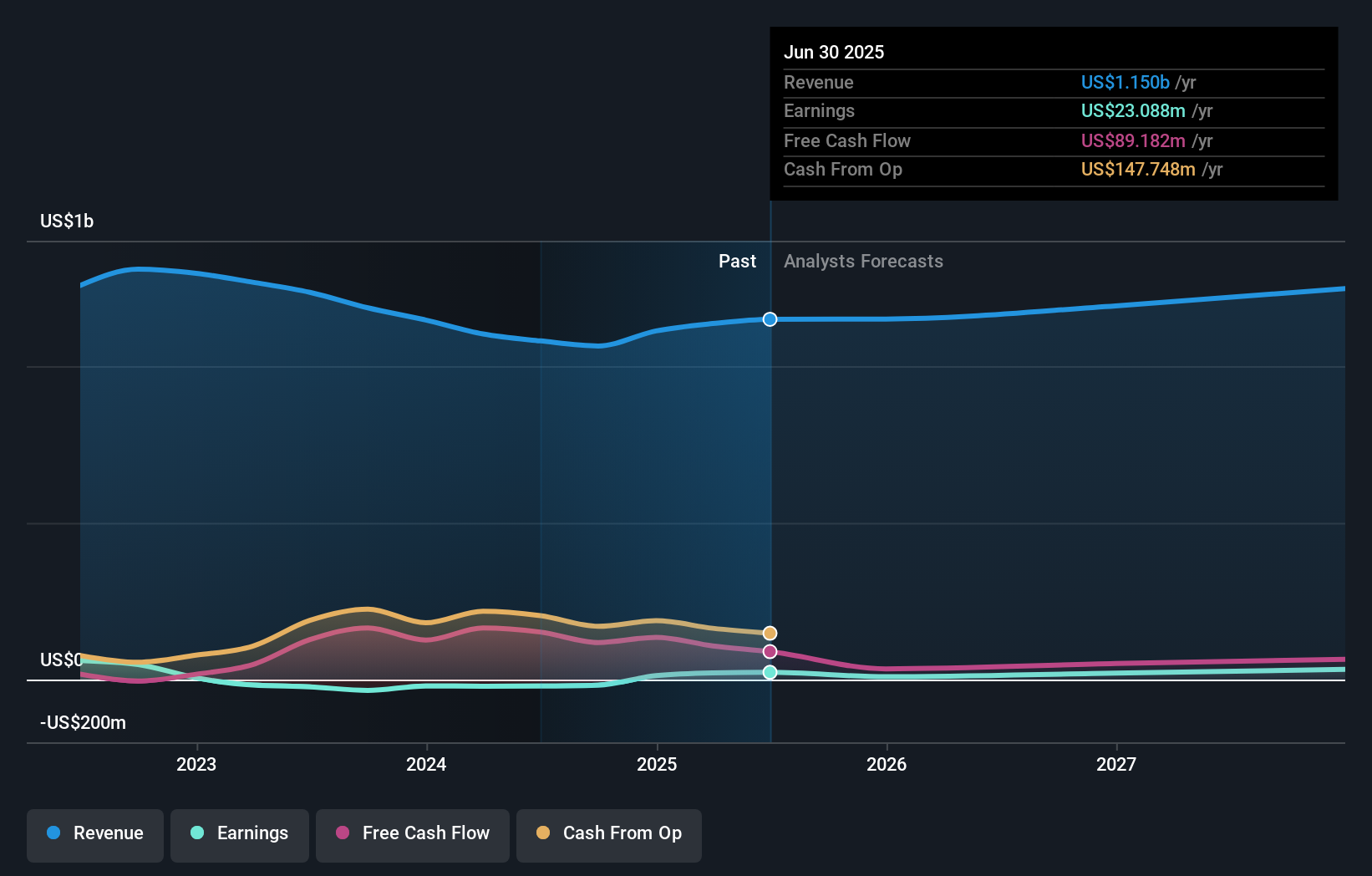

Omnicell's outlook suggests revenues will reach $1.3 billion and earnings will rise to $30.4 million by 2028. This scenario is based on a 3.0% annual revenue growth rate and a $7.3 million increase in earnings from the current $23.1 million.

Uncover how Omnicell's forecasts yield a $44.00 fair value, a 37% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community estimates Omnicell’s fair value at a single point, US$44.00, reflecting just one perspective so far. While you may see continued product innovation, persistent supply chain and tariff risks could still impact margins, consider comparing a range of views to assess the risk-reward balance.

Explore another fair value estimate on Omnicell - why the stock might be worth as much as 37% more than the current price!

Build Your Own Omnicell Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Omnicell research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Omnicell research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Omnicell's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OMCL

Omnicell

Provides medication management solutions and adherence tools for healthcare systems and pharmacies the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives