- United States

- /

- Medical Equipment

- /

- NasdaqGS:NUVA

The NuVasive (NASDAQ:NUVA) Share Price Is Up 41% And Shareholders Are Holding On

If you want to compound wealth in the stock market, you can do so by buying an index fund. But you can do a lot better than that by buying good quality businesses for attractive prices. For example, the NuVasive, Inc. (NASDAQ:NUVA) share price is up 41% in the last five years, slightly above the market return. Also positive is the 5.8% share price rise over the last year.

Check out our latest analysis for NuVasive

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

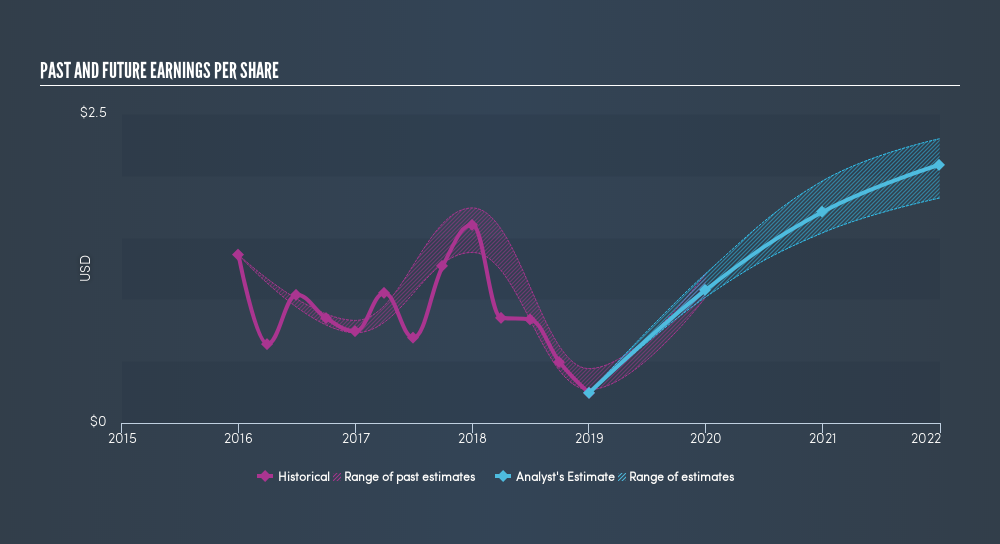

Over half a decade, NuVasive managed to grow its earnings per share at 6.4% a year. This EPS growth is reasonably close to the 7.2% average annual increase in the share price. This indicates that investor sentiment towards the company has not changed a great deal. Indeed, it would appear the share price is reacting to the EPS.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our freereport on NuVasive's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that NuVasive shareholders have received a total shareholder return of 5.8% over the last year. Having said that, the five-year TSR of 7.2% a year, is even better. You could get a better understanding of NuVasive's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

We will like NuVasive better if we see some big insider buys. While we wait, check out this freelist of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:NUVA

NuVasive

NuVasive, Inc., a medical technology company, develops, manufactures, and sells procedural solutions for spine surgery.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives