- United States

- /

- Healthcare Services

- /

- NasdaqGM:NAKA

A Look at Kindly MD (NAKA) Valuation After $30M Bitcoin-Linked Investment in Metaplanet Inc.

Reviewed by Simply Wall St

Kindly MD's Latest Move: Big Bet on Bitcoin and Global Expansion

If you follow Kindly MD (NAKA), you likely noticed the market buzz after their subsidiary, Nakamoto Holdings, unveiled its largest investment to date. Nakamoto is committing up to $30 million in Metaplanet Inc., a Japanese company well-known for its Bitcoin treasury strategy. For investors, this is a major signal. The combined entity is taking a bold step into international markets, especially in Asia, and doubling down on Bitcoin as a core asset. This announcement comes right on the heels of Kindly MD's recent merger with Nakamoto Holdings, hinting that the company’s ambitions go far beyond its healthcare roots.

The impact on the stock has been immediate. Kindly MD shares surged 77% in Tuesday’s regular session, closing sharply higher as excitement over this international Bitcoin play took hold. Over the past year, the stock has returned just 2.75%, with volatility increasing since the merger. Recent months had seen momentum fading, but this week’s announcement has clearly shaken things up, renewing debate about the company’s evolving strategy and risk profile.

After such a dramatic move, should investors see value at current prices, or is the market already pricing in big expectations for Bitcoin and global growth?

Price-to-Book of 201.3x: Is it justified?

Based on the preferred valuation multiple, Kindly MD (NAKA) appears to be trading at a significantly higher price than its peers, suggesting it is overvalued on this measure.

The price-to-book (P/B) ratio compares a company’s market value to its book value, serving as a common benchmark for asset-heavy sectors. In healthcare, a high P/B multiple typically signals anticipated growth or future profitability, but may also indicate excessive optimism if earnings and assets do not support the premium.

With NAKA’s P/B ratio standing at 201.3x, which is vastly higher than the healthcare industry average of 2.1x, the market appears to be pricing in very ambitious prospects. However, Kindly MD's lack of profitability and meaningful revenue raises questions about whether such a steep premium is warranted based solely on traditional financials.

Result: Fair Value of $4.80 (OVERVALUED)

See our latest analysis for Kindly MD.However, uncertainties remain around Kindly MD's lack of profit and ongoing revenue volatility, which could challenge the bullish outlook going forward.

Find out about the key risks to this Kindly MD narrative.Another View: What Does the SWS DCF Model Say?

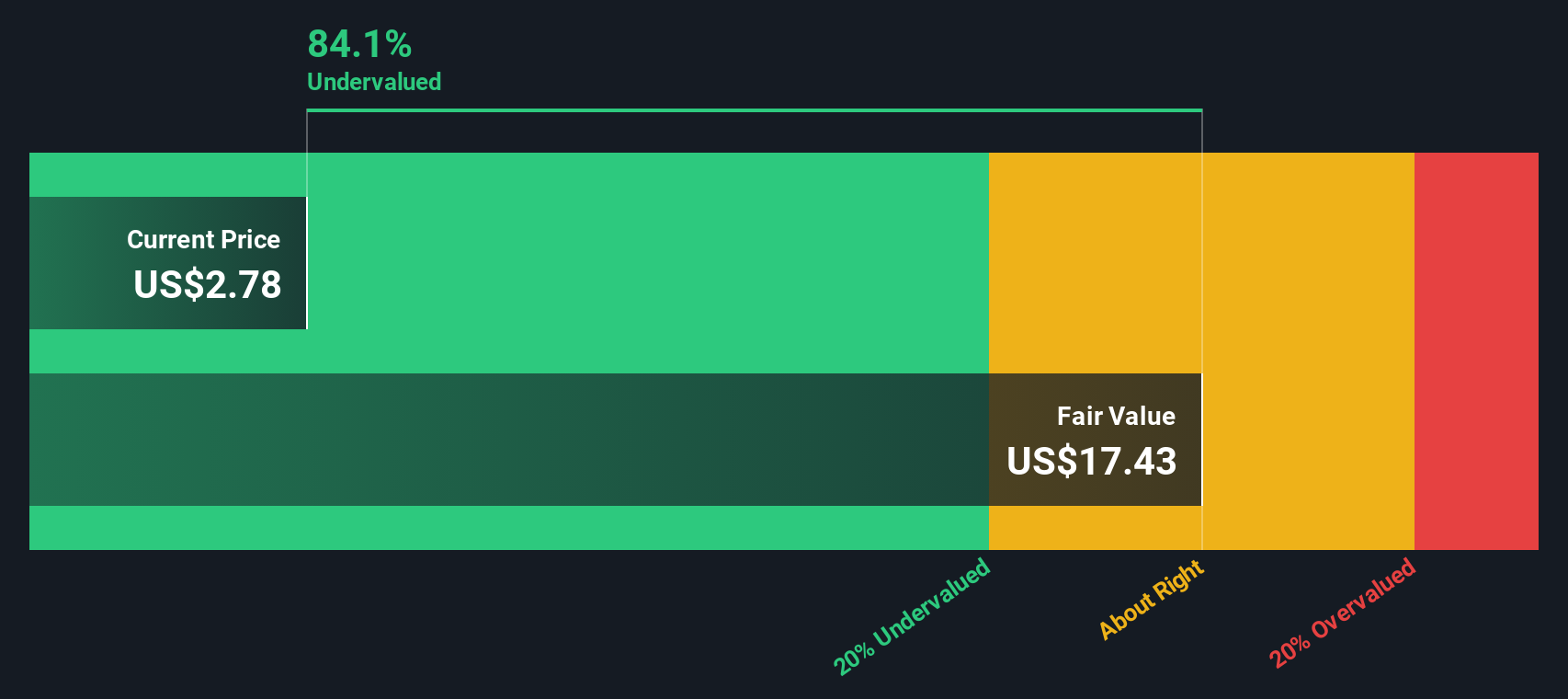

Taking a different approach, the SWS DCF model considers Kindly MD’s future cash flows instead of just market multiples. This method suggests a far less optimistic picture and points to significant undervaluation. Could the market have missed something, or is risk holding back the upside?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Kindly MD Narrative

If you think there’s more to the story, or want to run the numbers your own way, you can easily do so in just a few minutes by using Do it your way.

A great starting point for your Kindly MD research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Why stop at one opportunity when you could uncover even more potential winners? Take advantage of these handpicked strategies to sharpen your portfolio and capture what others might be missing.

- Spot tomorrow’s tech leaders early by searching for AI penny stocks that are powering innovation and disrupting entire industries with artificial intelligence breakthroughs.

- Strengthen your returns and boost your income with dividend stocks with yields > 3%. These go beyond just growth and target reliable companies delivering consistent yields above 3%.

- Uncover hidden gems trading below their worth by targeting undervalued stocks based on cash flows, which are primed for future gains based on attractive cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kindly MD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NAKA

Kindly MD

A healthcare and healthcare data company, provides direct health care services to patients integrating prescription medicine and behavioral health services.

Excellent balance sheet with moderate risk.

Market Insights

Community Narratives