- United States

- /

- Medical Equipment

- /

- NasdaqGS:MMSI

Merit Medical Systems (MMSI): Valuation Analysis Following WRAPSODY Reimbursement Decision Delay

Reviewed by Simply Wall St

Merit Medical Systems (MMSI) announced that the Centers for Medicare & Medicaid Services deferred a decision on transitional reimbursement for its WRAPSODY device. This delay pushes the earliest possible approval date to January 2027 and shifts near-term expectations for the product.

See our latest analysis for Merit Medical Systems.

News of the WRAPSODY reimbursement delay has added a layer of uncertainty. However, Merit Medical’s share price has managed a 5.9% climb over the past month as investors weighed this alongside broader sector moves. Despite a very strong 60.7% five-year total shareholder return, recent momentum is mixed and the one-year total return is down 15.8%. This reflects shifts in both growth expectations and risk perception.

If you’re looking to find other healthcare companies navigating similar challenges and opportunities, now’s a great chance to discover See the full list for free.

With Merit Medical’s shares trading at a notable discount to analyst targets, the question is whether current challenges have created a buying window for long-term investors, or if the market has already taken the company’s future growth prospects into account.

Most Popular Narrative: 15.4% Undervalued

With the most widely followed narrative assigning a fair value of $103.55 versus the last close of $87.60, the numbers set up a potential disconnect between market pricing and what is forecast if projections hold true. The underlying reasoning includes both ambitious growth drivers and important macro trends.

The expanding global prevalence of chronic diseases and an aging population are increasing the need for interventional, diagnostic, and therapeutic medical procedures. Merit’s strong growth in cardiovascular and endoscopy segments, robust new product development, and recent acquisitions (such as Biolife and EndoGastric) position the company to capture a larger share of this growing market and drive sustained long-term revenue growth.

What underpins this valuation? Imagine record-breaking margin targets and top-line growth assumptions that go beyond recent momentum. The real story is tucked away in bullish analyst forecasts and the advanced strategy behind the company’s product launches. Click to find out what could fuel the next big move.

Result: Fair Value of $103.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, reimbursement setbacks for WRAPSODY and continued weakness in international sales could challenge Merit Medical’s momentum if these issues are not addressed in the coming quarters.

Find out about the key risks to this Merit Medical Systems narrative.

Another View: Is the Market Already Pricing in Optimism?

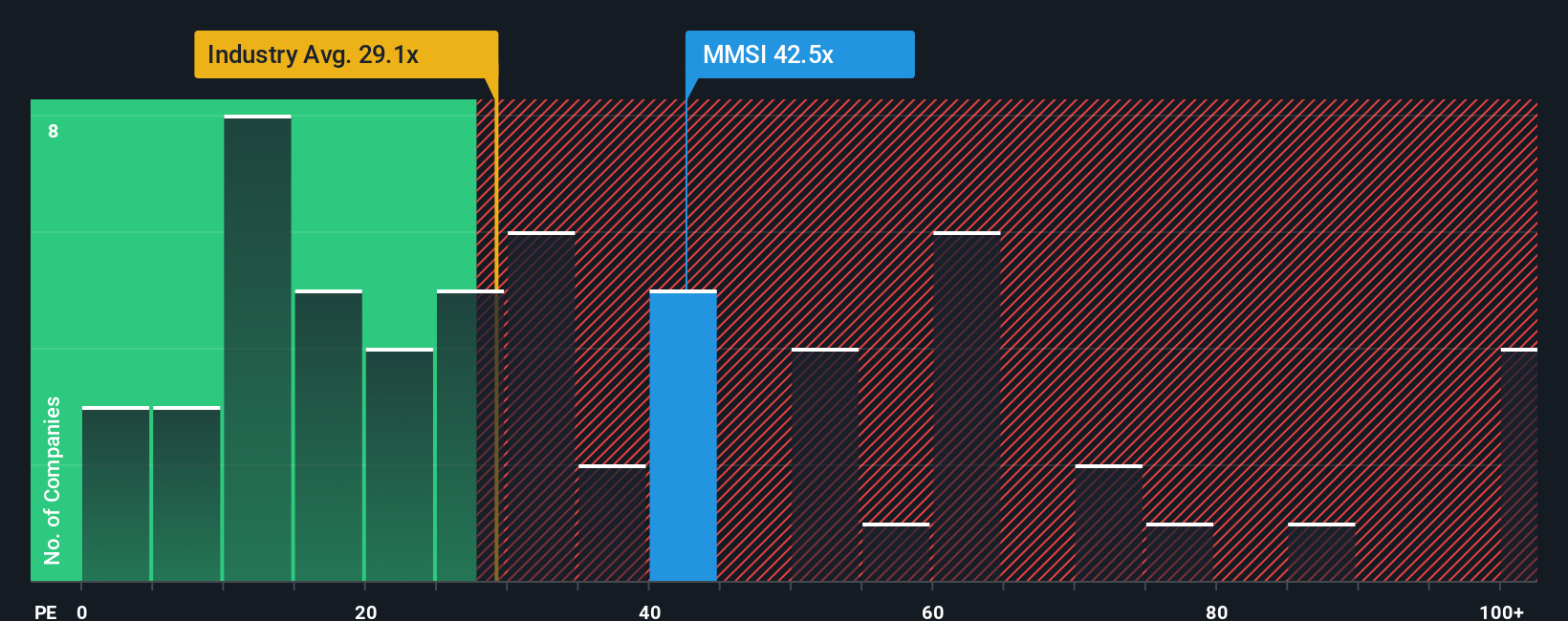

Shifting focus from analyst targets to what investors are actually paying, Merit Medical’s price-to-earnings ratio stands at 43.9x. This is meaningfully higher than both the US Medical Equipment industry average of 28.2x and its fair ratio of 23.4x. Such a premium suggests the current price incorporates a lot of growth, leaving little margin for error. What does this valuation risk mean for those considering a long-term entry?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Merit Medical Systems Narrative

If the consensus storyline does not align with your own perspective or you prefer to dig into the numbers yourself, you can craft your own narrative in just a few minutes. This approach offers a unique lens on the latest results. Do it your way.

A great starting point for your Merit Medical Systems research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Do not let the market’s best-kept secrets pass you by. Take your investing to the next level by finding companies with the factors you care about most.

- Boost your portfolio with reliable income by checking out these 14 dividend stocks with yields > 3%, which offers attractive yields above 3 percent and robust financials.

- Get ahead of tech trends by scanning these 26 AI penny stocks, which delivers innovations at the intersection of artificial intelligence and business profitability.

- Seize untapped value by reviewing these 924 undervalued stocks based on cash flows, packed with stocks trading below their estimated cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MMSI

Merit Medical Systems

Designs, develops, manufactures, and markets single-use medical products for interventional, diagnostic, and therapeutic procedures in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.