- United States

- /

- Medical Equipment

- /

- NasdaqGS:MMSI

Does SCOUT MD’s Milestone and Analyst Upgrades Reinforce the Growth Story for Merit Medical (MMSI)?

Reviewed by Sasha Jovanovic

- In recent news, Merit Medical Systems announced its SCOUT® Radar Localization technology has surpassed 750,000 patients treated worldwide, accompanied by the launch of the next-generation SCOUT MD™ system with enhanced surgical capabilities.

- This milestone highlights the company's growing role in improving breast cancer procedures, while recent analyst upgrades signal confidence in Merit Medical's value and long-term growth potential.

- We'll explore how the successful adoption of SCOUT MD and positive analyst sentiment influence Merit Medical Systems' investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Merit Medical Systems Investment Narrative Recap

To be a shareholder in Merit Medical Systems, you need to believe in the company’s ability to drive adoption of innovative medical technologies, like SCOUT MD, while managing trade and reimbursement uncertainties. The recent milestone in breast cancer treatment could heighten investor attention, but in the short term, the major catalyst remains successful resolution of the delayed WRAPSODY CIE reimbursement process, whereas tariffs and ongoing global trade tensions continue to be the biggest risk; the SCOUT news doesn’t materially change these priorities.

Among recent developments, the regulatory approval and launch of WRAPSODY CIE in Canada is directly linked to one of the company’s most important near-term catalysts. This supports Merit’s ambitions in growing its footprint and diversifying revenue, but ultimately reimbursement progress in larger markets will determine whether product launches translate to meaningful earnings acceleration.

However, investors should be aware that if WRAPSODY CIE reimbursement faces further delays or challenges...

Read the full narrative on Merit Medical Systems (it's free!)

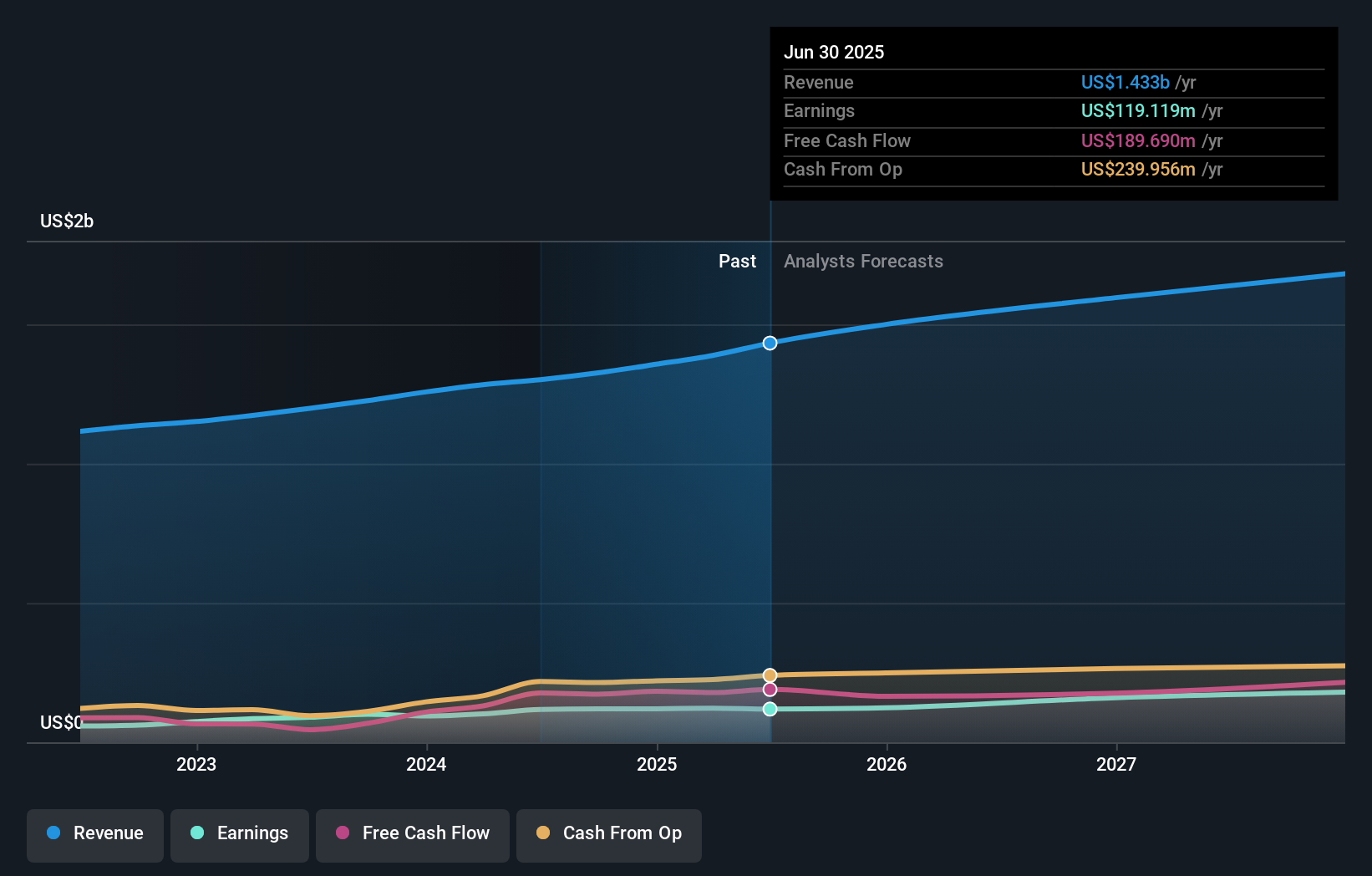

Merit Medical Systems is projected to reach $1.8 billion in revenue and $197.2 million in earnings by 2028. This outlook assumes a 7.0% annual revenue growth rate and represents a $78.1 million increase in earnings from the current $119.1 million.

Uncover how Merit Medical Systems' forecasts yield a $103.55 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have published fair value estimates for Merit Medical Systems ranging from US$80.52 to US$103.55, reflecting contrasting views from just two contributors. While opinions may vary, many are closely watching how ongoing reimbursement delays could impact the company’s path to stronger revenue and earnings growth.

Explore 2 other fair value estimates on Merit Medical Systems - why the stock might be worth just $80.52!

Build Your Own Merit Medical Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Merit Medical Systems research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Merit Medical Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Merit Medical Systems' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MMSI

Merit Medical Systems

Designs, develops, manufactures, and markets single-use medical products for interventional, diagnostic, and therapeutic procedures in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives