- United States

- /

- Medical Equipment

- /

- NasdaqGS:MMSI

A Look at Merit Medical Systems's Valuation Following SCOUT Technology Milestone and New Product Launch

Reviewed by Kshitija Bhandaru

Merit Medical Systems (MMSI) has hit a major milestone as its SCOUT Radar Localization technology has now been utilized in procedures for 750,000 patients worldwide. The achievement signals growing traction for the company’s breast cancer solutions.

See our latest analysis for Merit Medical Systems.

This milestone for SCOUT technology arrives against a backdrop of slowing share price momentum, with the latest price closing at $82.46. After a steep slide these past months, Merit Medical Systems posts a 1-year total shareholder return of -0.14%. The company keeps its long-term growth story alive, as its 3- and 5-year total shareholder returns of 40% and 75% underscore investors’ rewards for patience. Recent innovations and ongoing sector demand could help turn sentiment, especially as the company continues to roll out new solutions and deepen its global reach.

If breakthrough medical tech is on your radar, you might want to see which other healthcare stocks are making strides: See the full list for free.

Given these recent achievements and the stock’s discounted price compared to analyst targets, the key question is whether Merit Medical is currently undervalued or if the market has already factored in its promising growth outlook.

Most Popular Narrative: 20.4% Undervalued

With a narrative fair value target set at $103.55, shares of Merit Medical Systems have considerable upside compared to the latest close at $82.46. This valuation stems from expectations of robust revenue and profit margin improvement as the company continues to innovate and expand worldwide.

*Ongoing investments in operational efficiency, manufacturing automation, and product portfolio expansion through innovation and strategic M&A are driving improved gross and operating margins (evidenced by record 21% non-GAAP operating margin). These factors support higher cash flow and net earnings. Regulatory support for medical device innovation, including NTAP approval and ongoing CMS engagement for WRAPSODY CIE, along with successful cross-selling of new product lines into existing channels, establish strong long-term catalysts for above-peer revenue growth and margin expansion once reimbursement uncertainties resolve.*

Curious how high-performing margins and aggressive expansion come together in this fair value? There’s a surprising earnings leap and future profit benchmark behind this narrative. Dive in to uncover what powers these ambitious projections.

Result: Fair Value of $103.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks remain, including ongoing reimbursement delays for new products and global trade headwinds that could put pressure on Merit Medical’s growth outlook.

Find out about the key risks to this Merit Medical Systems narrative.

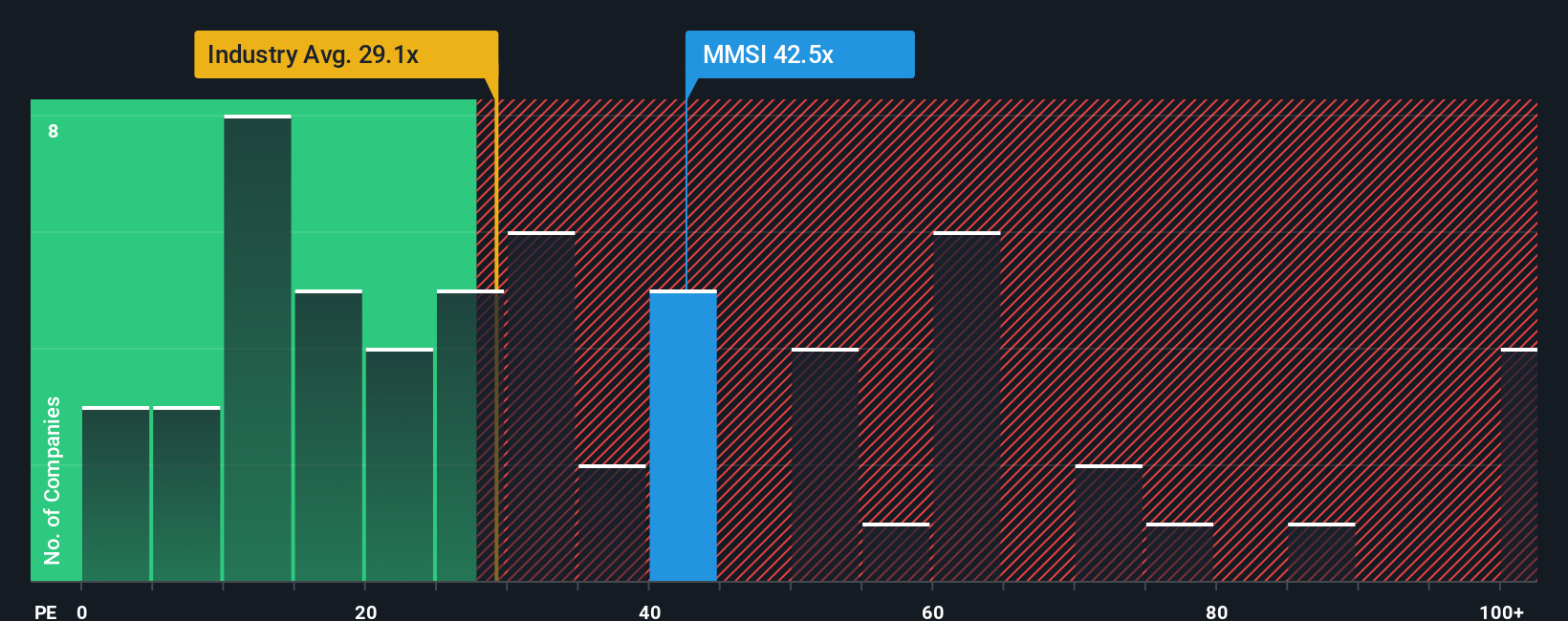

Another View: Valuation Through the Lens of Market Multiples

Looking beyond forecasts, Merit Medical’s share price trades at 41 times its earnings. That is roughly double the average for industry peers, and even further above its fair ratio of 21.8. This significant premium hints at high expectations and brings valuation risk into sharper focus for investors. Are those lofty hopes justified?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Merit Medical Systems Narrative

If you have alternative ideas on where Merit Medical is headed or want your own fresh perspective, you can assemble a personalized analysis in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Merit Medical Systems.

Looking for More Smart Investment Ideas?

Don’t let your portfolio miss out on tomorrow’s winners. Broaden your investment radar with handpicked stock opportunities tailored to your strategy and interests.

- Tap into the electric momentum of high-yield opportunities with these 19 dividend stocks with yields > 3% and start building passive income today.

- Supercharge your watchlist by spotting tomorrow’s tech pioneers among these 24 AI penny stocks to get ahead of the digital curve.

- Unlock the hidden value waiting in the market by checking out these 909 undervalued stocks based on cash flows to seize undervalued gems before the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MMSI

Merit Medical Systems

Designs, develops, manufactures, and markets single-use medical products for interventional, diagnostic, and therapeutic procedures in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives