- United States

- /

- Medical Equipment

- /

- NasdaqGS:MMSI

A Fresh Look at Merit Medical Systems (MMSI) Valuation Following Muted Share Price Moves

Reviewed by Simply Wall St

Merit Medical Systems (MMSI) has experienced modest shifts in its stock price over the past week. This reflects how investors are digesting recent company developments along with ongoing market trends. Assessing both shorter and longer-term performance helps frame expectations.

See our latest analysis for Merit Medical Systems.

While Merit Medical Systems' stock recouped some ground this week, momentum remains muted in the bigger picture. After some volatility earlier this year, the company’s 1-year total shareholder return sits at -12.95%, underscoring that recent buying has not reversed the broader slide since January. Over a longer period, shareholders have still enjoyed meaningful growth, with a solid 69.68% total return over the last five years. The stock’s movement suggests investors are weighing solid long-term performance against short-term headwinds and shifting risk sentiment.

If you’re interested in discovering other healthcare names with growth and resilience, now is a great time to check out the full See the full list for free..

With Merit Medical Systems’ shares still lagging their highs, the key question for investors now is whether the market is undervaluing its future prospects or if steady growth is already fully reflected in the price.

Most Popular Narrative: 19.6% Undervalued

Analysts think Merit Medical Systems deserves a much higher price than its recent $83.21 closing level, pointing to an almost 20% valuation gap as market uncertainty weighs on near-term momentum.

Ongoing investments in operational efficiency, manufacturing automation, and product portfolio expansion through innovation and strategic M&A are driving improved gross and operating margins (evidenced by record 21% non-GAAP operating margin). This is supporting higher cash flow and net earnings.

Want to see which aggressive growth assumptions are fueling this bold target? The narrative hinges on strong margin expansion and profitability forecasts that could make or break the current valuation debate. Brace yourself for unexpected numbers and the logic behind a premium profit multiple seldom seen in this industry.

Result: Fair Value of $103.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, delays in key product reimbursement and weaker international sales trends could quickly undermine these optimistic projections for Merit Medical Systems.

Find out about the key risks to this Merit Medical Systems narrative.

Another View: Is the Market Already Pricing in Growth?

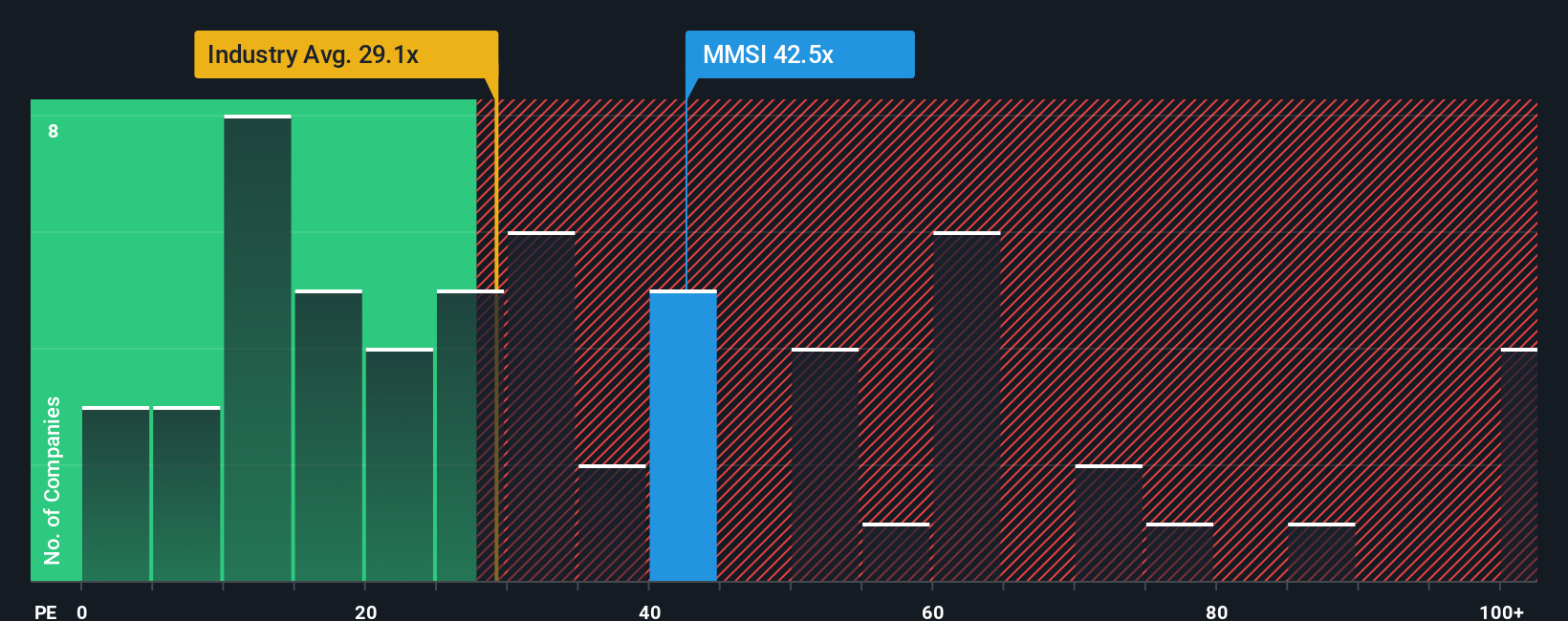

Looking at the widely-used price-to-earnings ratio provides a different take. Merit Medical trades at 41.4 times earnings, well above both the US Medical Equipment industry’s 29.8x average and its peer group’s 22x. The fair ratio, or what the market could revert to, is just 22.1x. This premium suggests investors may already be baking in high growth expectations, which presents valuation risk if those are not met. Is the optimism already reflected in the price, or is more upside ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Merit Medical Systems Narrative

If you have a different perspective or want to form your own conclusions, exploring the key financials yourself only takes a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Merit Medical Systems.

Ready for More Investment Opportunities?

Sharpen your portfolio with top picks hand-selected for real growth and resilience. Smart moves today could be the difference between missing out and building lasting wealth.

- Uncover companies with stable growth and hidden value by checking out these 874 undervalued stocks based on cash flows before the rest of the market catches on.

- Target strong, reliable income streams by starting with these 17 dividend stocks with yields > 3%. This screener features businesses that consistently deliver attractive yields above 3%.

- Capitalize on the next wave of healthcare breakthroughs by exploring these 33 healthcare AI stocks. Here, AI-driven innovation is transforming patient care and medical technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MMSI

Merit Medical Systems

Designs, develops, manufactures, and markets single-use medical products for interventional, diagnostic, and therapeutic procedures in the United States and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives