- United States

- /

- Medical Equipment

- /

- NasdaqCM:MBOT

Evaluating Microbot Medical’s Valuation Following FDA Clearance of LIBERTY Endovascular Robotic System

Reviewed by Simply Wall St

Microbot Medical has grabbed the spotlight with news that could shift the company’s direction in a major way. After securing FDA 510(k) clearance for its LIBERTY Endovascular Robotic System, the first single-use, remotely operated device approved for peripheral endovascular procedures, the company is now cleared to commercialize this breakthrough technology in the U.S. market. By removing the typical hurdles of expensive capital equipment and specialized infrastructure, LIBERTY could give hospitals and clinics a fresh path toward adopting advanced robotics, and that’s catching the attention of both medical professionals and investors deciding what to do with Microbot Medical stock.

This regulatory milestone comes against a backdrop of strong momentum, with the stock surging 235% over the past month and nearly tripling in value over the last year. Microbot Medical’s journey hasn’t been a straight upward climb; longer-term performance has seen its challenges, but the recent rally stands out, especially after the clear clinical benefits demonstrated by LIBERTY, such as a 100% success rate in navigation and a game-changing reduction in radiation exposure. Alongside continued data collection and a presence at major investor conferences, it feels like the company is entering a new phase that has the market rethinking its growth potential.

With all this excitement and a dramatic move in the stock, is Microbot Medical undervalued at these levels, or are investors now paying up for future growth that’s already priced in?

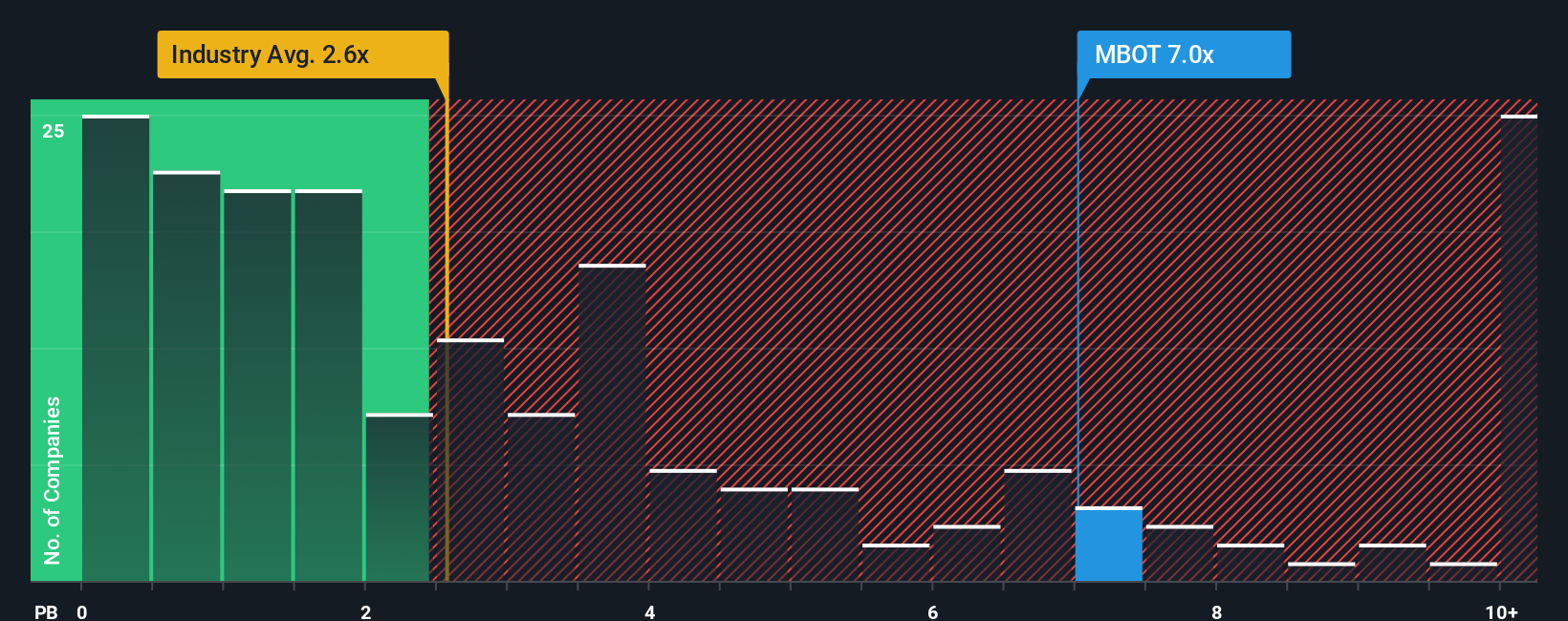

Price-to-Book of 5.4x: Is it justified?

Based on a price-to-book (P/B) ratio of 5.4x, Microbot Medical appears expensive compared to the broader US Medical Equipment industry, where the average is only 2.5x. This suggests that the company's shares trade at more than twice the book value premium typically seen in the sector.

The price-to-book multiple measures how much investors are willing to pay for each dollar of net assets on the balance sheet. For a medical technology company like Microbot, it reflects market expectations for future growth and the value placed on proprietary innovations, even when the company remains unprofitable.

This elevated P/B ratio indicates that the market is already pricing in significant future performance, significantly above the industry standard. Whether this is justified depends on Microbot delivering on projected revenue growth and successfully executing its commercial strategy following its recent FDA clearance.

Result: Fair Value of $3.57 (OVERVALUED)

See our latest analysis for Microbot Medical.However, ongoing losses and zero reported revenue raise concerns about whether Microbot Medical can sustain its momentum without significant progress in commercialization.

Find out about the key risks to this Microbot Medical narrative.Another Perspective: No Discounted Cash Flow View

There is no discounted cash flow (DCF) valuation available for Microbot Medical, so the earlier conclusion remains unchallenged. Without a DCF model to provide a different perspective, it raises the question of whether the current market price can be relied upon.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Microbot Medical Narrative

If you want a different angle or prefer building your own perspective from the financials, it takes just a few minutes to craft your own interpretation, and you can always Do it your way.

A great starting point for your Microbot Medical research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t miss powerful opportunities hiding in plain sight. Use our handpicked screeners and see what stands out. You could uncover the next standout performer before the crowd does.

- Accelerate your search for value by checking out stocks that may be overlooked but primed for growth with the help of undervalued stocks based on cash flows.

- Spot companies riding AI breakthroughs and seize your chance in transformative technology by exploring AI penny stocks.

- Boost your portfolio’s income with market-leading companies offering strong yields and resilience using dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:MBOT

Microbot Medical

A clinical-stage medical device company, engages in the research, design, and development of robotic endoluminal surgery devices targeting the minimally invasive surgery space in Israel and the United States.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives