- United States

- /

- Medical Equipment

- /

- NasdaqGS:MASI

How Investors Are Reacting To Masimo (MASI) Analyst Upgrades and Renewed Earnings Growth Expectations

Reviewed by Sasha Jovanovic

- In the past week, several analysts have revised their earnings estimates upwards for Masimo, noting analyst optimism for strong earnings and sales growth in the upcoming year along with increased options market activity.

- Despite Masimo's prior challenges with mediocre long-term revenue growth and declining return on invested capital, the upbeat consensus among analysts highlights renewed expectations for performance improvement and cash flow expansion.

- We’ll now explore how the wave of recent upward earnings estimate revisions could reshape Masimo’s current investment narrative and outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Masimo Investment Narrative Recap

To be a Masimo shareholder today, you need to believe that the company’s recent upward earnings revisions and analyst optimism can overcome both its longer-term growth challenges and recent underperformance. The surge in positive earnings estimates, while a catalyst for near-term sentiment, does not materially change the biggest risk right now: the company’s heavy reliance on large, sometimes unpredictable, hospital contracts, which can result in lumpy revenues and uncertain growth if competition intensifies or key deals are delayed.

Among recent announcements, the renewal and expansion of Masimo’s partnership with Royal Philips stands out. This development directly supports Masimo’s most important catalyst: expanding market share in high-growth product categories through new specialty sales teams and integration with leading healthcare platforms, which could drive faster revenue and earnings momentum in the near term.

However, in contrast to this momentum, investors should be aware that any missed hospital contract renewals or heightened competition from lower-cost providers could limit visibility on...

Read the full narrative on Masimo (it's free!)

Masimo's narrative projects $1.8 billion revenue and $293.5 million earnings by 2028. This requires a 5.1% yearly revenue decline and a $563 million earnings increase from current earnings of -$269.7 million.

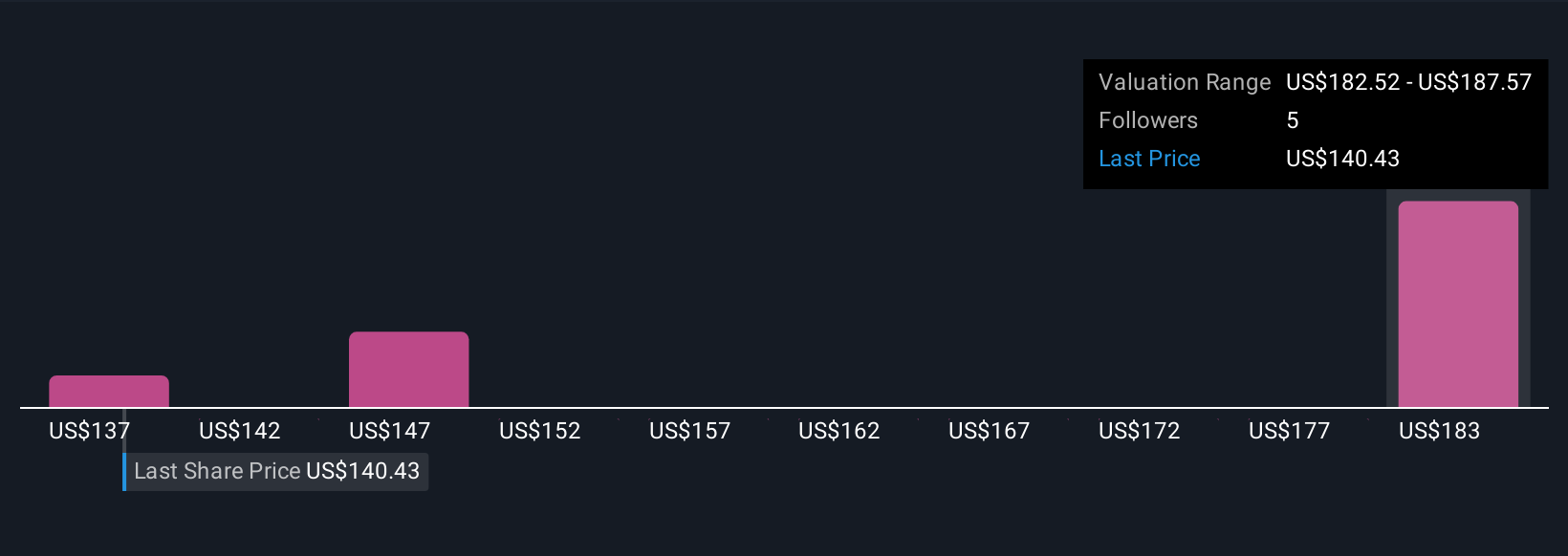

Uncover how Masimo's forecasts yield a $187.57 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members estimate Masimo’s fair value to range from US$137.02 to US$187.57 per share. While such a broad spread exists among community forecasts, many agree that the company’s earnings outlook could hinge on its ability to secure and expand hospital contracts as competition rises.

Explore 3 other fair value estimates on Masimo - why the stock might be worth 7% less than the current price!

Build Your Own Masimo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Masimo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Masimo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Masimo's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MASI

Masimo

Develops, manufactures, and markets various patient monitoring technologies, and automation and connectivity solutions worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives