- United States

- /

- Medical Equipment

- /

- NasdaqGS:MASI

Did Broader FDA Clearance for O3 System Just Shift Masimo's (MASI) Investment Narrative?

Reviewed by Simply Wall St

- On August 18, 2025, Masimo announced that Board member William Jellison had resigned without disagreement, and the company received FDA 510(k) clearance for expanded indications of its O3 Regional Oximetry system, now authorized for use across all patient groups including pediatric and neonatal cases.

- This clearance allows Masimo’s O3 technology to be adopted more widely in both cerebral and somatic settings, potentially expanding its reach and clinical relevance within hospital monitoring applications.

- We'll look at how broader FDA clearance for Masimo's O3 monitoring could impact its growth outlook and current investment narrative.

AI is about to change healthcare. These 28 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Masimo Investment Narrative Recap

To be a shareholder in Masimo, you have to believe in the long-term adoption of innovative hospital monitoring technologies, especially as the company continues to develop and expand use cases for its platform. The recent FDA clearance expanding O3 Regional Oximetry’s indications supports Masimo’s growth outlook, but doesn’t materially impact the most immediate risk: ongoing headwinds from shifting hospital capital spending and delays in contract timing, which still weigh on near-term visibility.

Among recent announcements, the expanded O3 clearance is particularly relevant, as it strengthens Masimo’s position in brain and tissue monitoring for all patient groups, aligning with the company’s efforts to boost market share in early-stage segments. This could act as a catalyst for future contract wins, though success still depends on commercial execution and hospitals’ purchasing behaviors.

By contrast, investors should be especially aware of persistent uncertainty around large, lumpy hospital contracts and the unpredictability of...

Read the full narrative on Masimo (it's free!)

Masimo's narrative projects $1.8 billion in revenue and $293.5 million in earnings by 2028. This requires a 5.1% annual revenue decline and an earnings increase of $563.2 million from current earnings of $-269.7 million.

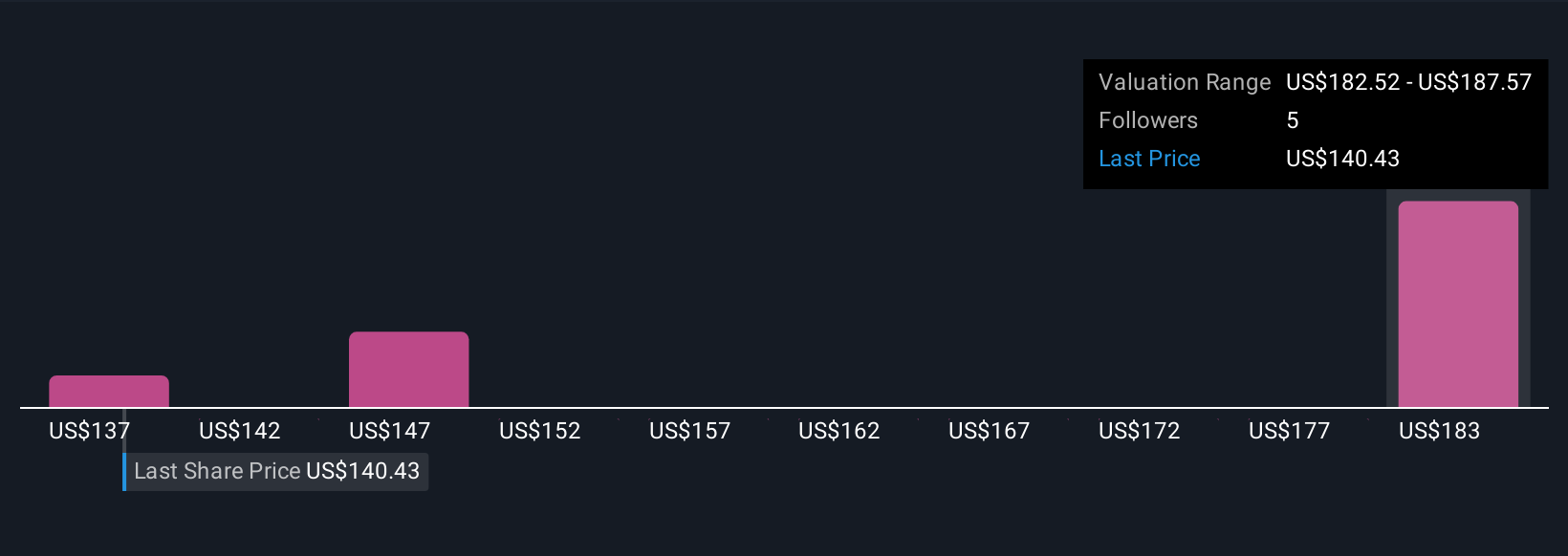

Uncover how Masimo's forecasts yield a $187.57 fair value, a 26% upside to its current price.

Exploring Other Perspectives

With three separate fair value estimates from the Simply Wall St Community ranging between US$137.02 and US$187.57, expectations vary for Masimo’s true worth. Uncertainty around hospital contract timing remains a central issue for many market participants considering the company’s forward potential.

Explore 3 other fair value estimates on Masimo - why the stock might be worth as much as 26% more than the current price!

Build Your Own Masimo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Masimo research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Masimo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Masimo's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MASI

Masimo

Develops, manufactures, and markets various patient monitoring technologies, and automation and connectivity solutions worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives